The C&C Monitors

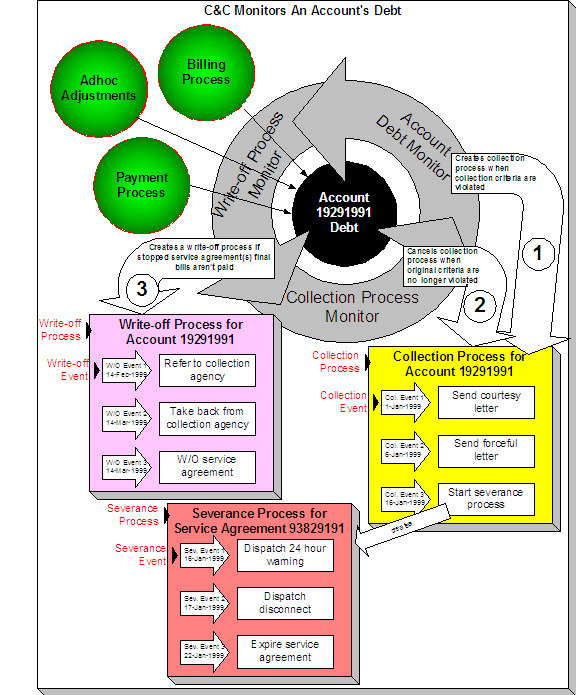

Your collection, severance and write-off criteria described in the previous section exist to support the processes that manage the collection activities. The following diagram illustrates, at a high level, the major processes that manage the collection of overdue debt:

There are many important concepts illustrated above:

|

Bills, payments and adjustments affect an account's debt |

An account's debt is the accumulation of all bills, payments and adjustments. |

|

The Account Debt Monitor creates a collection process when an account violates collection criteria |

Periodically, a background process referred to as the Account Debt Monitor determines if an account's debt violates your collection criteria. If so, a collection process is created using the violated criteria's collection process template. Refer to When Is An Account's Debt Monitored? for a description of when an account's debt is compared against collection criteria. |

|

A collection process contains one or more collection events |

The collection process contains a series of collection events. These events correspond with the collection event types associated with the collection process template. The initial collection events are typically letters. If payment is not received after several such communications, the last collection event typically starts a severance process for each service agreement in arrears. |

|

The Collection Process Monitor cancels a collection process when warranted |

The Collection Process Monitor cancels a collection process when its service agreements satisfy your cancellation criteria (e.g., when the service agreements have less than $10 of debt older than 20 days). Refer to How Are Collection Processes Cancelled for more information about the cancellation process. |

|

The last collection event starts one or more severance processes |

The last collection event typically starts one or more severance processes. A severance process contains the activities necessary to sever a service agreement. The service agreement(s) that are severed may be all SAs that are associated with the collection process. Alternatively, you can nominate a service agreement to act as the primary service to cut (you'd do this if you cut electricity when the customer doesn't pay for their gas). The algorithm on the collection event that starts severance will control which service agreement(s) are severed. Refer to How To Nominate A Single Service Agreement To Sever for more information. |

|

Each service agreement has its own severance process |

Every service agreement that is severed has a severance process. The type of process is dependent on the severance criteria linked to the service agreement's SA type. |

|

A severance process contains one or more severance events |

The severance process contains a series of severance events. The events correspond with the severance process template's severance events. |

|

The system cancels a severance process when warranted |

The system cancels a severance process when its service agreement satisfies your cancellation criteria (note, it is possible to set up the system so that all service agreements in the debt class must satisfy your cancellation criteria before a severance process is cancelled). It's important to note that the cancellation is real time (as opposed to the cancellation of collection processes, which happens in a background process). Refer to How Are Severance Events Canceled? for more information. |

|

The last severance event should expire the service agreement |

The last severance event typically expires its service agreement. When the last service agreement linked to an account is expired, the system will schedule the account for billing (outside of its normal bill cycle schedule). |

|

If you nominate a single SA to sever when multiple SAs are in arrears... |

Earlier we indicated that you can nominate a service agreement to act as the primary service to cut (you'd do this if you cut electricity when the customer doesn't pay for their gas). If you do this, you also need a severance event that will sever all other service agreements in the debt class if the severance of the nominated service agreement doesn't inspire payment. A severance event algorithm to do such is supplied with the base package. Refer to How To Nominate A Single Service Agreement To Sever for more information. |

|

The Write-Off Monitor creates a write off process to collect stopped, unpaid debt |

The Write-Off Monitor reviews stopped and reactivated service agreements after their closing bill's due date (plus grace period). The Write-Off Monitor attempts to reduce the service agreement's debt to zero using all of the following methods:

|

|

A write-off process contains one or more write-off events |

The write-off process contains a series of write-off events. These events correspond with the write-off event types associated with the write-off process template. The initial write-off events are typically collection agency referrals and/or letters. If payment is not received as a result of such efforts, the last write-off event typically writes off the customer's debt. |

|

The system cancels a write-off process when warranted |

The system cancels a write-off process when its service agreements no longer have debt (i.e., they become closed). |

|

Another write-off process will be created if a closed service agreement ever reactivates |

If a service agreement becomes reactivated (e.g., because the final payment bounces), the service agreement will be processed by the Write-Off Monitor and the whole write-off process starts again. |

Checkpoint. At this point, you should be familiar with the concept that a collection process will be created for an account that violates collection criteria. The collection process consists of a series of events that typically generate letters and / or To Do entries. If the customer doesn't respond, a severance process will be started for one or more service agreements. A severance process consists of a series of events that typically generate letters and/or disconnection field activities. If lack of service doesn't inspire payment, the last severance event expires the service agreement (and a final bill will be scheduled when the last service agreement is expired). If the customer doesn't pay the final bill, a write-off process will be created for each type of unpaid debt. The write-off process consists of a series of events that ultimately result in the write-off of the customer's debt. When debt is written-off, the system creates a write-off service agreement and transfers the outstanding debt to it. This means the debt stays with the account for life (because the write-off service agreement is linked to the account) and will have to be paid off if the customer ever returns.