Examples of Partial Payments Using Accounting Priority

The examples below assume a customer has the financial history described above and attempts to illustrate the financial effect when a payment is made.

• Example 1 - Customer Pays In Full

• Example 2 - Customer Makes a Partial Payment

• Example 3 - Customer Makes a Partial Payment

Example 1 - Customer Pays In Full

Assume the customer makes a payment in the amount of 287. This amount is sufficient to satisfy all holding amounts, so the payment will have the following financial effect:

Event | GL Accounting | SA's Payoff Balance | Holding Balances | |||||

HLD-LPC | HLD-RGEN | HLD-RDIS | HLD-RTRN | HLD-THRD | HLD-VAT | |||

Payment received | Cash 287 A/R <287> HLD-LPC 10 R-MISC <10> HLD-RGEN 30 R-GEN <30> HLD- RDIS 40 R-DIST <40> HLD- RTRN 100 R-TRAN <100> HLD- THRD 65 R-THRD <65> HLD-VAT 42 A/P-VAT <42> | 0 | 0 | 0 | 0 | 0 | 0 | 0 |

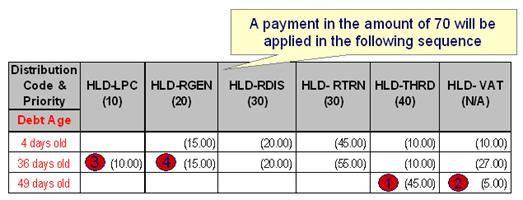

Example 2 - Customer Makes a Partial Payment

Assume the same financial history described above for a customer and a partial payment in the amount of 70 is made. This amount is not sufficient to satisfy the total holding amounts of 287, so the system will start settling held amounts starting with distribution codes with the oldest debt first from highest priority until the payment amount is exhausted.

The following describes how the holding amounts will be booked as a result of this partial payment:

• Settle oldest debt first (49 days old), i.e. 3rd Party Charges (HLD-THRD) and VAT (HLD-VAT). Note that even though these holding accounts have the lower accounting priorities, they are booked first because they have the oldest debt. An amount of 20 now remains on the partial payment.

• Next, we'll settle the 36 days old debt from the highest priority:

◦ Late Payment Charge (HLD-LPC) in the amount of 10. An amount of 10 now remains on the partial payment

◦ Revenue - Generation Charge (HLD-RGEN) gets the remaining payment amount of 10

• So, this partial payment in the amount of 70 will result in the following financial effect:

Event | GL Accounting | SA Balance | Holding Balances | |||||

HLD-LPC | HLD-RGEN | HLD-RDIS | HLD-RTRN | HLD-THRD | HLD-VAT | |||

Payment received | Cash 70 A/R <70> HLD-LPC 10 R-MISC <10> HLD-RGEN 10 R-GEN <10> HLD- THRD 45 R-THRD <45> HLD-VAT 5 A/P-VAT <5> | 217 | 0 | (20) | (40) | (100) | (20) | (37) |

Example 3 - Customer Makes a Partial Payment

Assume the same financial history described above for a customer and a partial payment in the amount of 220 is made. This amount is not sufficient to satisfy the total holding amounts of 287, so the system will start settling held amounts starting with distribution codes with the oldest debt first from highest priority until the payment amount is exhausted.

The following describes how the holding amounts will be booked as a result of this partial payment:

• Settle oldest debt first (49 days old), i.e. 3rd Party Charges (HLD-THRD) and VAT (HLD-VAT). Note that even though these holding accounts have the lower accounting priorities they are booked first because they have the oldest debt. An amount of 170 now remains on the partial payment.

• Next, we'll settle the 36 days old debt from the highest priority, i.e. Late Payment Charge (HLD-LPC), Revenue - Generation Charge (HLD-RGEN), Revenue - Distribution Charge (HLD-RDIS), Revenue - Transmission Charge (HLD-RTRN), 3rd Party Charges (HLD-THRD) and VAT (HLD-VAT). An amount of 33 now remains on the partial payment.

• Next we'll settle the 4 day old debt from the highest priority:

◦ Revenue - Generation Charge (HLD-RGEN) in the amount of 15. An amount of 18 now remains on the partial payment

◦ The two holding accounts at the next priority have an outstanding amount of 65. Since the remainder of the payment is not enough to satisfy this amount, the remainder of the payment is prorated amongst HLD-RDIS and HLD-RTRN as follows:

▪ (Remaining Pay Amount / Total Outstanding Holding Amount) * Holding Account Amount

▪ So for the Revenue - Distribution Charge (HLD-RDIS) holding account the amount booked will be (18/65 * 20) = 5.54

• So, this partial payment in the amount of 220 will result in the following financial effect:

Event | GL Accounting | SA Balance | Holding Balances | |||||

HLD-LPC | HLD-RGEN | HLD-RDIS | HLD-RTRN | HLD-THRD | HLD-VAT | |||

Payment received | Cash 220 A/R <220> HLD-LPC 10 R-MISC <10> HLD-RGEN 30 R-GEN <30> HLD- RDIS 25.54 R-DIST <25.54> HLD- RTRN 67.46 R-TRAN <67.46> HLD- THRD 55 R-THRD <55> HLD-VAT32 A/P-VAT <32> | 67 | 0 | 0 | (14.46) | (32.54) | (10) | (10) |

Parent topic