Interval Values Can Be Used For More Than Just Interval Prices

The interval value transaction can be used for more than recording interval prices. One such purpose is to record rolling average prices. Let's use an example to make the point. Assume the following:

- You operate in a deregulated environment and part of the price charged to your customers is based on the spot-market price.

- Your customers don't have interval meters. Rather, they simply have meters that are read once a month. When you calculate a customer's bill, you must determine the single price to be applied to the total amount of consumption for the month.

- The price applied to a customer's bill is based on the number of weeks of consumption and the end date of the bill period. For example, a customer whose bill ends on 12-Sept-2001 with 3 weeks of consumption would probably have a different price than a customer whose bill ends on the same date but has 6 weeks of consumption. Why? Because the spot market price varies during the different billing periods.

- Different prices may be calculated based on the customer's load profile. This would mean that a residential customer whose bill ends on 12-Sept-2001 with 3 weeks of consumption would have a different price than a commercial customer whose 3 week bill ends on the same date. Why? Because residential customers tend to consume in different time periods than do commercial customers (and therefore different spot market prices were in effect).

If you assume the above, then you'd need the ability to record different prices based on:

- The bill end date

- The number of weeks / days in the billing period

- The customer's load profile

You can use the interval pricing objects to record this information. You do this as follows:

- Create a characteristic type called LOADPROF. Associate with it characteristic values of RESID and COMMERCIAL.

- Create a bill factor called WAP and have it reference the LOADPROF characteristic type.

- Enter an interval pricing value set for each bill end week cutoff date. And for each interval pricing value set, add an interval value for each bill start week cutoff date.

The following table will help visualize an interval pricing value set for the bills ending the week of 17-Sept-2001:

|

Bill Factor: WAP - Weighted Average Price Char Value: RESID - Residential Load Profile Interval Value Date / Time: Bills ending the week of 17-Sept-2001 |

||

|

Bill Period |

Bill Start Date |

Weight Avg Price |

|

4 Week Weighted Average PX Price |

19-Aug-2001 |

0.03432 |

|

5 Week Weighted Average PX Price |

12-Aug-2001 |

0.04594 |

|

6 Week Weighted Average PX Price |

5-Aug-2001 |

0.02302 |

|

7 Week Weighted Average PX Price |

29-July-2001 |

0.06039 |

|

8 Week Weighted Average PX Price |

22-July-2001 |

0.02981 |

|

9 Week Weighted Average PX Price |

15-July-2001 |

0.01921 |

|

10 Week Weighted Average PX Price |

8-July-2001 |

0.05010 |

|

11 Week Weighted Average PX Price |

1-July-2001 |

0.060929 |

|

12 Week Weighted Average PX Price |

24-June-2001 |

0.03939 |

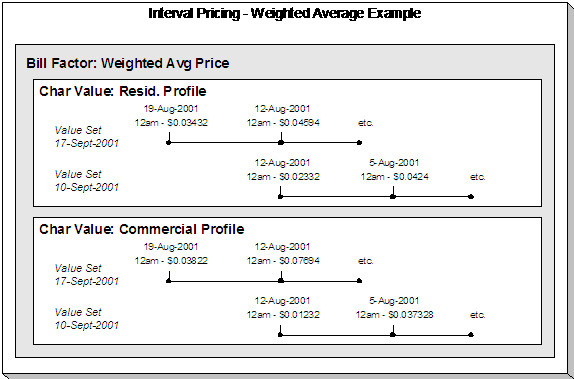

Below, we've illustrated how interval pricing information might look for a bill factor that holds the weighted average prices.

Refer to Pricing Non-Interval Consumption Using a Weighted Average Price for how a rate component value algorithm makes use of the above information when a bill is calculated for a customer.