Understanding Invoices

Please note the following with regard to invoicing:

Master Configuration

Ensure that you create master configuration settings in Purchasing Master Configuration and Financial Master Configuration to process invoicing transactions.

Default Approval Profile for Invoice Submission

-

Navigate to the user and click the Characteristics tab.

-

In the Characteristic Type of Invoice Approval Profile field, enter an approval profile for characteristic value.

To have the invoice go straight to approved status, select an approval profile based on a No Approval Required type of profile.

Invoice Total Cost Validation

-

Create a validation algorithm to make the Manually Entered Total field on the invoice required.

-

Create a copy of W1-CKINVCTTL and modify it so that it produces an error rather than a warning.

This will force the user to correct the invoice before the system allows it to be processed. Once this copy is created, you should inactivate W1-CKINVCTTL.

Automatic Invoicing

In order for the system to complete automatic invoicing against purchase orders, the vendor on the purchase order must be set as an “auto pay” vendor. When the purchase order is created, it must also be set as “auto pay”. After items are received against the purchase order, the system automatically creates an invoice with line items. When an invoice is automatically created, no additional line items can be added to the created invoice and none of the line items can be deleted. If the receipt included more items received than ordered, these invoice line items are placed in “Pending Resolution” status when the invoice is submitted for approval. An authorized user must then change the quantity on the purchase order before the invoice can be reprocessed successfully.

Note that when Require Receipt for Services is set to “No” in Purchasing Master Configuration, users cannot create a receipt against a purchase order which was created for services. This also affects automatic invoicing in that when this is set to "No", invoices for services must be created manually even when the vendor is set as an "Auto Pay" vendor.

A/P Interface

If WAM owns invoice in your implementation and you need to interface invoices to your A/P system, the base product provides support to batch your invoices. You need to define an algorithm based on the W1-ADENTRYGP algorithm type and plug this algorithm onto the appropriate status of the invoice header BO, e.g. ‘Posted’. This algorithm writes a record in F1_GEN_PROC table for that invoice with a batch code, which should be defined in the ‘Invoice A/P Extract’ parameter of the Purchase Master Configuration, and batch run number.

Please note that the base product doesn’t deliver the actual batch process that extracts and formats the data. It’s the implementation team’s responsibility to develop such batch process. You can use the base GL batch extract as a template. The batch control for the GL extract is ‘W1-GLDL’.

If invoice is owned by your ERP system, there is a productized integration to transfer WAM related invoices into WAM, please refer to the ERP integration documentation for more information.

Tax Rate Schedule Selection

A Tax Rate Schedule defines the various tax components for each type of tax (such as state, city, and local tax) that get applied to materials, labor, equipment, and other resource requirements at various instances in times. The tax components for each type of tax identifies the effective date, the sequence in which the tax component is applied, and the factor associated with the specific tax component. If taxes are paid directly to a taxing authority, a cost center and expense code should also be defined.

The actual tax rate depends on the taxing state or taxing city characteristics on the invoice line itself. If the invoice line's taxing state is California, then CA's taxing rate will be applied. But if the invoice line's "Taxing State" is blank, it means state tax is not applicable.

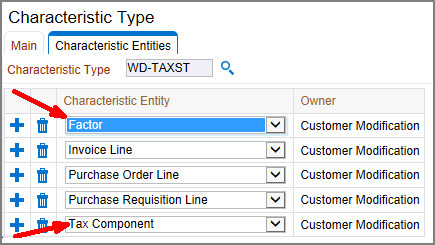

Configuring Tax Characteristics for Invoice Lines

-

For each required tax component, create one characteristic type with an entity flag of Tax Component and one characteristic type with an entity flag of Factor.

This ensures that the characteristic type will be included on the Factor Characteristic Types drop down on Factors.

-

Introduce a flattened characteristic element for the characteristic type in the Invoice Line business object.

In order to include these elements in the base business object, the corresponding Invoice Info data area included in the business object can be extended to add the characteristic element(s).

-

Configure a pre-processing algorithm for the BO to set default values for the tax characteristic element, if necessary.

-

Use the Retrieve Characteristic Value from Input Factor Characteristic List characteristic source algorithm for the factor that will be referenced for the tax component.

Cost Allocation

-

Freight:

-

Debit Freight Expense; cost center/expense code from Purchasing Master Configuration

-

Credit Payables Clearing; cost center/expense code from Financial Master Configuration

-

-

Extra Cost:

-

Debit Extra Cost Expense; cost center/expense code from Purchasing Master Configuration

-

Credit Payables Clearing; cost center/expense code from Financial Master Configuration

-

-

Discount:

-

Debit Payables Clearing; cost center/expense code from Financial Master Configuration

-

Credit Discount; cost center/expense code from Purchasing Master Configuration

-