Disputing Items

Open-item customers may dispute FT's that they are not comfortable paying. For example, a customer who receives a bill with an anomalous charge may decide to dispute it.

When an open-item customer disputes a charge, a user creates a match event and links the disputed FT(s) to it. This match event will be in the open state (because it does not contain FT's that sum to zero). In addition, the match event's "disputed switch" is turned on.

Alerts. An alert is displayed on control central to highlight the existence of disputed match events (if the appropriate alert algorithm is plugged in). In addition, you can also set up a To Do entry to highlight the existence of disputed match events.

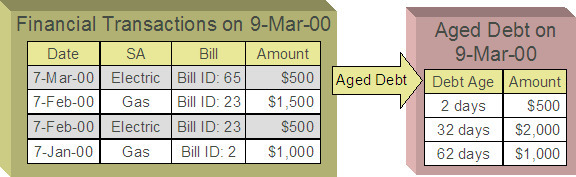

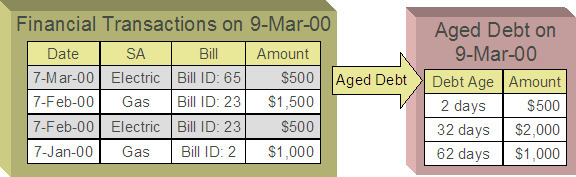

While the dispute is being researched, the disputed amount will not affect aged debt, but it still forms part of the customer's balance. For example, consider the following unpaid financial transactions that exist for an account:

If the customer disputes the two electric bill segments, the customer's aged debt will look as follows:

Notice how a new category of debt appears - Disputed. Also notice how the 2 day old debt disappears and the 32 day old debt is reduced by the disputed amount.

The system shows disputed debt on Control Central. In addition, in all places where aged debt appears in the system, disputed debt is shown as a separate debt category.

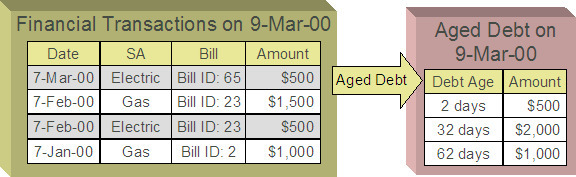

If the dispute goes in your company's favor, the disputed match event should be cancelled (thus allowing the FT's to again impact aged debt). For example, if we assume 3 days have passed and the dispute match event is cancelled, the customer's aged debt will look as follows:

If the dispute goes in the customer's favor:

- You may decide to issue a credit note to cancel the offending bill or bill segment(s). As described above, the system in this case will automatically create new match events that match the original FTs with their cancellation FTs and cancel the disputed match event when the last item is unlinked from it.

- You may decide to cancel the offending bill segment(s) / adjustment(s). As described above, these cancellations are going to be swept on to the next bill. The system therefore will not automatically cancel the disputed match event. Notice that the cancellation effect of the disputed items is carried over on to the next bill. This means that the previously disputed items still need to be paid.

Cancel / rebill. If you cancel / rebill an offending bill segment, both the cancel and the rebill will become open-items that will be matched when the next bill is paid.

- You may decide to issue an adjustment to counter the effect of the disputed FT's. In this situation, you would simply link the adjustment FT to the disputed FT's (thus allowing the match event to become balanced ). It is important to use in this case an adjustment that does not show on bill.