1 Nostro Reconciliation Overview

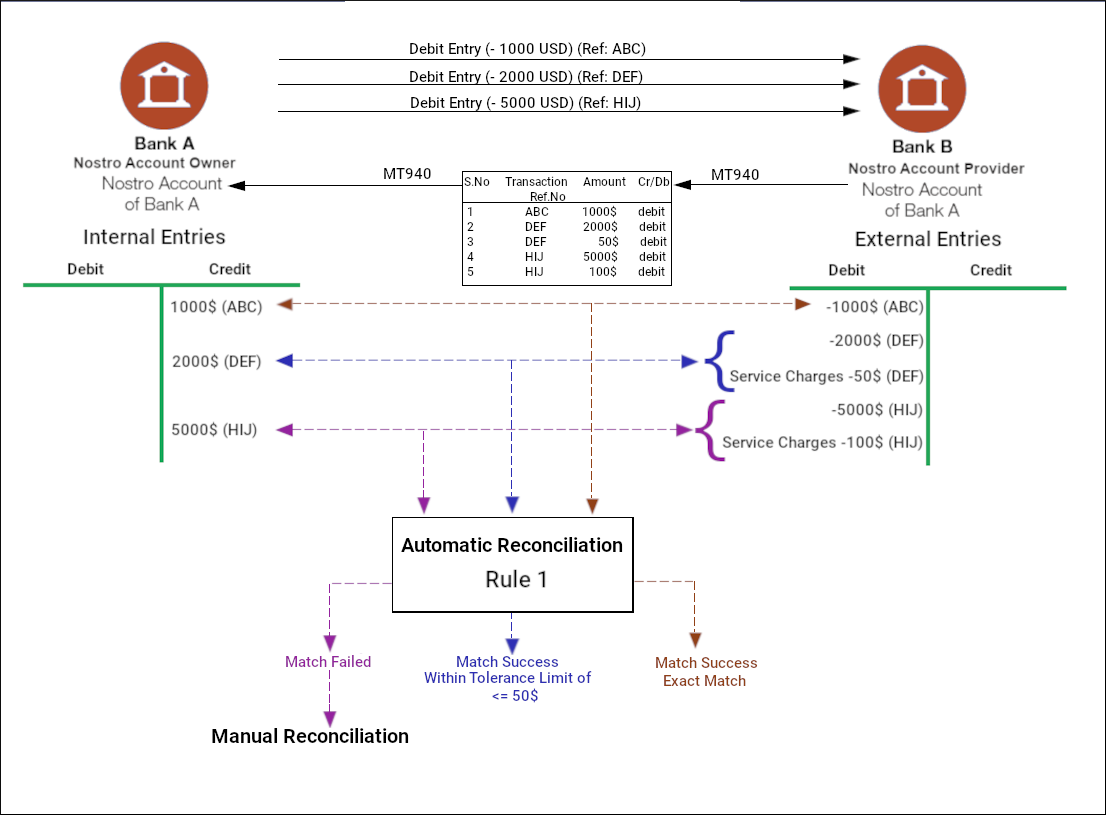

The Nostro Reconciliation module provided as part of the Oracle Banking Corporate Accounts allows the collection, management, and reconciliation of external and internal credit and debit transactions.

- Capture debit and credit entries of internal and external transactions.

- Reconcile and match the corresponding entries of internal and external transactions.

Note:

The reconciliation module also allows manual reconciliation of the transaction entries.Benefits of the Nostro Reconciliation Module

The reconciliation module helps prevent overfunding of Nostro accounts or excessive use of credit lines for payments settled in a different time zone by providing visibility and predictability on IN and OUT transactions on a day-to-day basis.

- Reduces costs by enabling liquidity optimization.

- Provides enhanced ability to release payments early while reducing recalls and liquidity risks.

- Identifies potential pending or unexpected transactions.

- Provides manual resolution to reduce the following:

- Investigations related to post-settlement.

- Investigations of unreconciled or unconfirmed entries.

- Reduce expensive claims when invoicing payment processing fees monthly.

Nostro Reconciliation Workflow

Reconciliation Requirements

To automatically reconcile internal and external entries, the system needs to determine the type of reconciliation and the method to perform the reconciliation. How to perform a reconciliation is provided by a rule definition. As there can be many rules that apply to different transaction scenarios, a rule decision suggests the appropriate rule definition. The following Nostro entities capture the above information and faciliatate automatic reconciliation.

- Reconciliation Product - Determines the reconciliation type to be applied and the tolerance limits for different currencies. The reconciliation types are Mirroring and Replication.

- Rule Definition - Specifies how to match and reconcile internal and external entries.

- Rule Decision - Considers the transaction details and applies the appropriate rule.

- Rule Definitions

A rule definition helps identify the internal transaction entries and external statement entries to reconcile and the reconciliation rules to match the identified entries.