1.1 Rule Definitions

A rule definition helps identify the internal transaction entries and external statement entries to reconcile and the reconciliation rules to match the identified entries.

A formal way to understand a rule definition is as a function composed of the attributes of the internal and external entries with conditional and mathematical operators. The following are some of the entry attributes or methods used to identify the internal and external entries that should be reconciled:

- Internal Reference Number

- External Reference Number

- Value Date of a transaction

- Aggregation of internal and external entries

Note:

To view the list of all internal and external attributes and their descriptions, see Internal and External Entry Attributes.You can create any number of reconciliation rules according to your requirements using these internal and external transaction entry parameters.

Rule Definition Using the Value Date

- Values Date for the internal and external entries are the same.

- Values Date for the internal and external entries are within a threshold number of days.

Rule Definition Using Reference Number

- Matching references numbers of a transaction generated by the internal and external banking entities.

- Partially matching reference numbers of a transaction generated by the

internal and external banking entities.

Note:

A partially matching transaction reference number occurs when the external banking entity generates reference numbers that are differing in length. Reference numbers that are greater in length are truncated and then stored. In such a case a partial match is more useful than a full match.

Rule Definition using Amount Entries

- Amount in the internal and external entries are the same.

- Amount in the internal and external entries are within a tolerance limit.

- Aggregated amounts in the internal and external entries are the same.

- Aggregated amount in the internal and external entries are within a tolerance limit.

Example Rule Definitions

The following examples illustrate the combination of rules to form rule definitions for different scenarios.

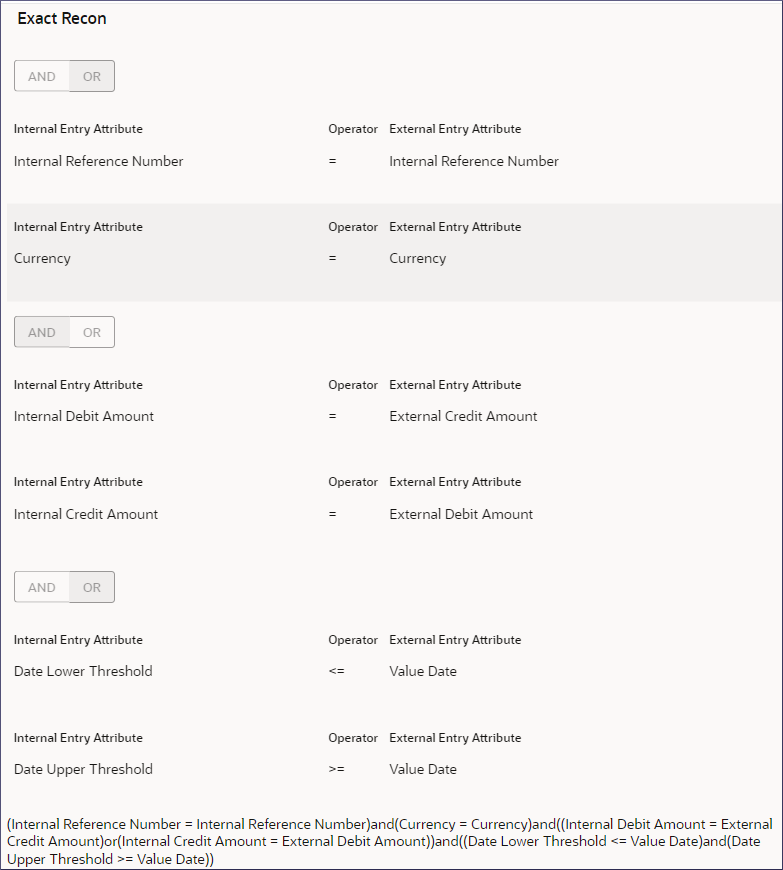

- Internal and external reference numbers are the same.

- Value date of the external entry should occur on or between the lower and upper threshold dates.

- Internal Debit amount should be equal to external Credit amount or the Internal Credit amount should be equal to the external Debit amount

(Internal Reference Number = Internal Reference Number)and(Currency = Currency)and((Internal

Debit Amount = External Credit Amount)or(Internal Credit Amount = External Debit

Amount))and((Date Lower Threshold <= Value Date)and(Date Upper Threshold >= Value

Date))- Internal and external reference numbers are the same.

- Internal and external value dates are the same.

- External Credit amount is between the upper and lower amount thresholds.

(Internal Reference Number = Internal Reference Number)and(Value Date = Value

Date)and(Currency = Currency)and((Amount Lower Threshold <= External Debit Amount)and((Amount

Upper Threshold >= External Debit Amount)))In this example rule definition the following rules are implemented.

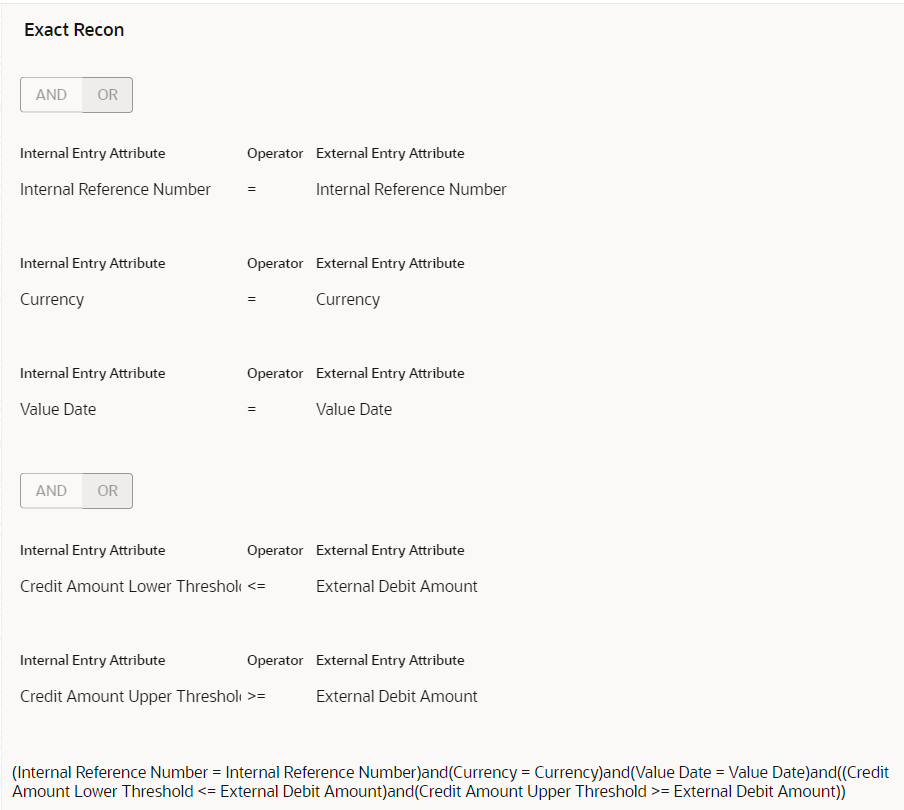

- Internal and external reference numbers are the same.

- Internal and external value dates are the same.

- External Debit amount is between the upper and lower internal credit amount thresholds.

(Internal Reference Number = Internal Reference Number)and(Value Date = Value

Date)and(Currency = Currency)and((Credit Amount Lower Threshold <= External Debit Amount)and((Credit Amount

Upper Threshold >= External Debit Amount)))In this example rule definition the following rules are implemented.

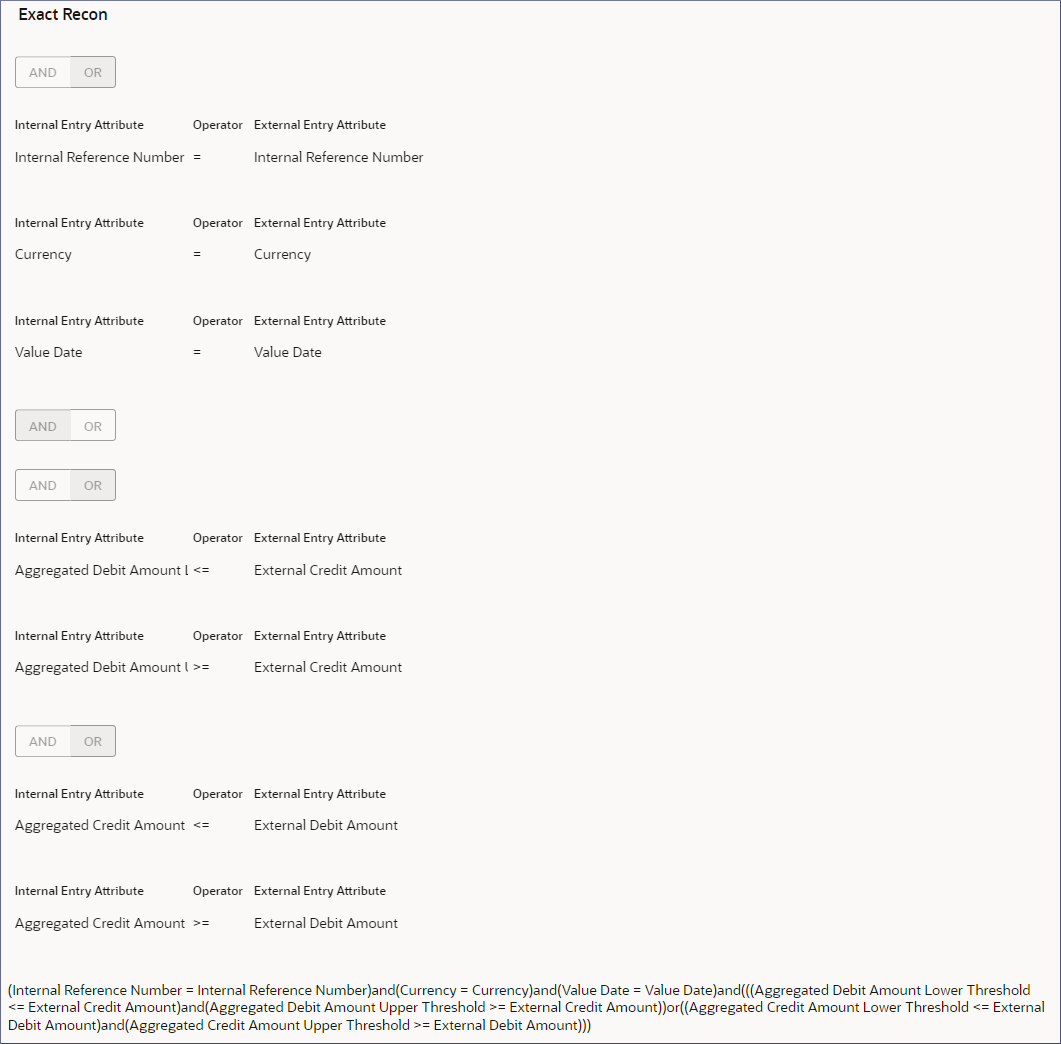

- Internal and external reference numbers are the same.

- Internal and external value dates are the same.

- Aggregated external credit amount is between the upper and lower aggregated internal debit amount threshold.

- Aggregated external debit amount is between the upper and lower aggregated internal credit amount threshold.

(Internal Reference Number = Internal Reference Number)and(Currency = Currency)and(Value Date

= Value Date)and(((Aggregated Debit Amount Lower Threshold <= External Credit

Amount)and(Aggregated Debit Amount Upper Threshold >= External Credit Amount))or((Aggregated

Credit Amount Lower Threshold <= External Debit Amount)and(Aggregated Credit Amount Upper

Threshold >= External Debit Amount)))Parent topic: Nostro Reconciliation Overview