- Core User Manual

- Reports

- FATCA & CRS Declaration Report

- FATCA & CRS Declaration - Adhoc Report

61.9.1 FATCA & CRS Declaration - Adhoc Report

To generate the FATCA & CRS Declaration Adhoc report:

- Navigate to the above path.The Report Generation screen appears.

- Click the Adhoc tab.

- From the Report Name list, select the appropriate report

to be generated.The respective report generation screen appears.

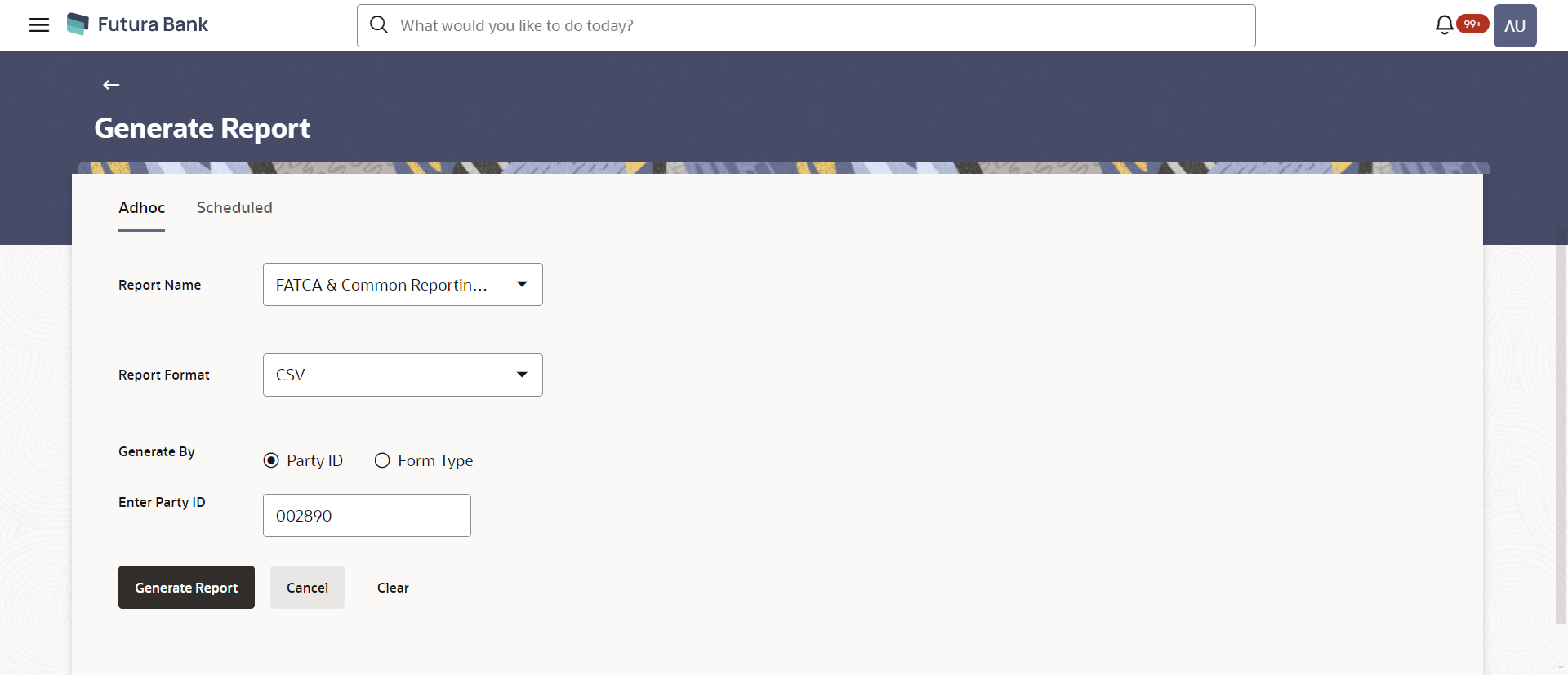

Figure 61-27 FATCA & CRS Declaration - Adhoc Report

Table 61-25 Field Description

Field Name Description Report Name Select the type of report to be generated. Report Format Select the format in which the report is to be generated. The FATCA & CRS Declaration report can be generated in format CSV only.

Generate By Specify whether the report is to be generated on the basis of party ID or form type as Individual or Entity. The options are:- Party ID

- Form Type

Enter Party ID Specify the party ID of the user for whom report is to be generated. This field appears if you have selected Party ID in the Generate By field.

Form Type Select whether you want to generate the report for the FATCA & CRS forms of entities or individuals. The options are:- FATCA & CRS - Entity

- FATCA & CRS - Individual

This field appears if you have selected Form Type in the Generate By field.

Duration Specify the period for which the report is to be generated. - From – The date from which you want to generate the report.

- To – The date until which you want to generate the report.

- From the Report Format list, select the format in which the report is to be generated.

- In the Generate By field, select the option of

choice.

- If you have selected the option Party ID, enter the party ID of the user for whom the report is to be generated in the Enter Party ID field.

- If you have selected the option Form Type,

select the required form type from the Form Type

list.From the Duration - From and Duration - To list, select the desired duration.

- Click Generate Report to generate the report.OR

Click Cancel to cancel the transaction.

OR

Click Clear to reset the search parameters.

- The success message along with the reference number, status and

Report Request Id appears.Click Ok to close the screen and navigate to the dashboard.

OR

Click on the View Reports link to download the report.

The user is directed to the My Reports screen. The list of reports appears.

OR

Click Generate another report to generate another report.

- In the My Reports screen, click on desired

Report Sub ID to view and download the generated

report.A report will be generated in the format specified at the time of scheduling or generating an adhoc report.

Note:

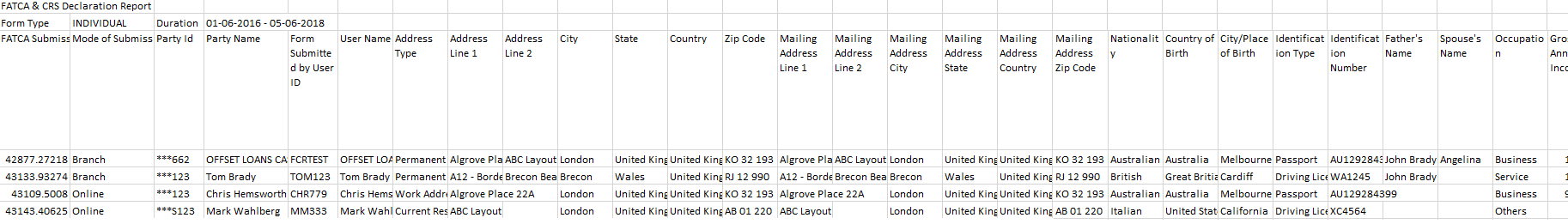

You can also download the requested report from Administrator Dashboard, click Toggle Menu, then click Reports and then click My Reports.Figure 61-28 For reference, a specimen of the report generated is given below:

Table 61-26 Field Description

Field Name Description FATCA & CRS Declaration report for Individuals The following four fields comprise of the criteria on the basis of which the report has been generated. Party ID The party ID of the user who has submitted the form. This field is displayed only if at the time of report generation, the administrator chose to generate the report by specifying a party ID.

Form Type The type of FATCA & CRS form for which the report is being generated. The form types are:- Entity

- Individual

Duration The period for which the report is generated. This field is displayed only if at the time of report generation, the administrator chose to generate the report on the basis of form type. The following fields comprise of the main body of the report. FATCA Submission Date & Time The date at time at which the form was submitted by the user. Mode of Submission The mode through which the form was submitted e.g. online, branch. Party ID The party ID of the user who submitted the form. Party Name The party name of the user who submitted the form. Form Submitted by User ID The user ID of the user who has filled and submitted the FATCA and CRS form. User Name The name of the user who has filled and submitted the FATCA and CRS form. Address Line 1-2 The address details of the user, as entered in the form. City The name of the city, as entered in the form. State The state, as entered in the form. Country The country, as entered in the form. Zip Code The zip code of the user, as entered in the form. Mailing Address Line 1-2 The mailing address of the user, as entered in the form. Mailing Address City The city of the user’s mailing address, as entered in the form. Mailing Address State The state of the user’s mailing address, as entered in the form. Mailing Address Country The country of the mailing address of the user. Mailing Address Zip Code The zip code of the mailing address of the user. Nationality The nationality of the user, as entered in the form. Country of Birth The country of birth of the user, as entered in the form. City/ Place of Birth The city of birth of the user, as entered in the form. Identification Type The identification document that serves as proof of identity. Identification Number The identification number corresponding to the identification type. Father's Name The name of the user’s father, as entered in the form. Spouse's Name The name of the user’s spouse, as entered in the form. Occupation The employment type of the user, as entered in the form. The occupation type could be any of the following:- Service

- Business

- Others

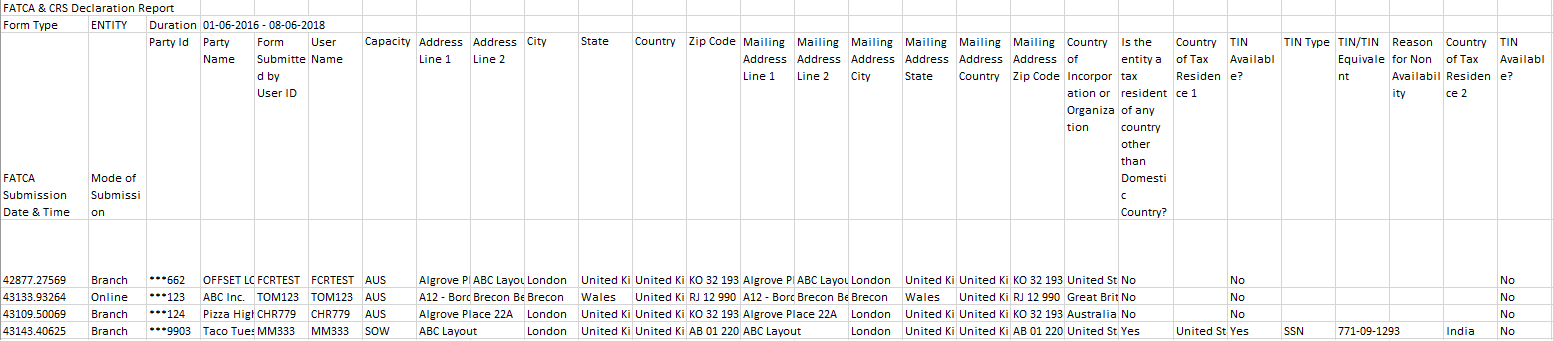

Gross Annual Income The gross annual income that the user enters, as entered in the form. Politically Exposed Person(PEP) Status The political status of the user. Was the Entity established in a country other than <country name>? The value in this field will identify whether the entity was established in the country in which the bank accounts are held. This field is applicable to sole proprietors only. Are you a tax resident of any country other than <country name>? Whether the user is a tax resident of any country other than the country in which the bank accounts are held. Country of Tax Residence The name of the country in which the user is a tax resident. A value will be displayed against this field only if the value against the field ‘Are you a tax resident of any country other than <country name>’is Yes. TIN Available Whether the user's taxpayer identification number of the country in which he is a tax resident, is available or not. A value will be displayed against this field only if the value against the field ‘Are you a tax resident of any country other than <country name>’is Yes. Tax Identification Type The tax identification type of the user. A value will be displayed against this field only if the value against the field ‘Are you a tax resident of any country other than <country name>’is Yes and if the value displayed against ‘TIN Available’ is Yes. TIN / TIN Equivalent The user’s taxpayer identification number or equivalent. A value will be displayed against this field only if the value against the field ‘Are you a tax resident of any country other than <country name>’is Yes and if the value displayed against ‘TIN Available’ is Yes. Reason for Non Availability The reason for which the user’s taxpayer identification number is not available. The user’s taxpayer identification number or equivalent. A value will be displayed against this field only if the value against the field ‘Are you a tax resident of any country other than <country name>’is Yes and if the value displayed against ‘TIN Available’ is No. Are you a citizen of United States of America Whether the user has a citizenship of the United States of America. Do you meet the Substantial Presence Test? Whether the user meets the Substantial Presence Test criteria. Do you have a green card? Whether the user holds a United States green card. For reference, a specimen of the report generated for FATCA & CRS forms for Entities is displayed below:

Table 61-27 Field Description

Field Name Description FATCA & CRS Declaration report for Entity The following four fields comprise of the criteria on the basis of which the report has been generated. Party ID The party ID of the user who has submitted the form. This field is displayed only if at the time of report generation, the administrator chose to generate the report by specifying a party ID.

Form Type The type of FATCA & CRS form for which the report is being generated. The form types are:- Entity

- Individual

Duration The period for which the report is generated. This field is displayed only if at the time of report generation, the administrator chose to generate the report on the basis of form type. The following fields comprise of the main body of the report. FATCA Submission Date & Time The date at time at which the form was submitted by the user. Mode of Submission The mode through which the form was submitted e.g. online, branch. Party ID The party ID of the organization on behalf of which the form was submitted. Party Name The party name of the organization on behalf of which the form was submitted. Form Submitted by User ID The user id of the user who has filled and submitted the FATCA and CRS form on the behalf of the organization. User Name The name of the user who has filled and submitted the FATCA and CRS form on behalf of the organization. Capacity The capacity in which the user has submitted the form on behalf of the organization. The values that can be displayed under this column are TRU for trustee, AUS for Authorized Signatory or SOW for Single Ownership. Address Line 1-2 The address details of the organization. City The city name of the organization. State The state of the organization. Country The country of the organization. Zip Code The zip code of the organization. Mailing Address Line 1-2 The mailing address of the organization. Mailing Address City The city of the mailing address of the organization. Mailing Address State The state of the of the organization’s mailing address. Mailing Address Country The country of the mailing address of the organization. Mailing Address Zip Code The zip code of the mailing address of the organization. Country of Incorporation or Organization The country in which the organization was incorporated. Is the Entity a tax resident of any country other than <country name>? Whether the entity is a tax resident of country other than country in which the entity’s accounts are held within the bank. Country of Tax Residence The name of the country in which the organization is a tax resident. A value will be displayed against this field only if the value against the field ‘Is the Entity a tax resident of any country other than <country name>?’is Yes. TIN Available Whether the organization's taxpayer identification number of the country of which it is a tax resident, is available or not. A value will be displayed against this field only if the value against the field ‘Is the Entity a tax resident of any country other than <country name>?’is Yes. Tax Identification Type The tax identification type of the organization. A value will be displayed against this field only if the value against the field ‘Is the Entity a tax resident of any country other than <country name>?’is Yes and if the value displayed against ‘TIN Available’ is Yes. TIN / TIN Equivalent The taxpayer identification number or equivalent. A value will be displayed against this field only if the value against the field ‘Is the Entity a tax resident of any country other than <country name>?’is Yes and if the value displayed against ‘TIN Available’ is Yes. Reason for Non Availability The reason for which the entity’s taxpayer identification number is not available. A value will be displayed against this field only if the value against the field ‘Is the Entity a tax resident of any country other than <country name>?’is Yes and if the value displayed against ‘TIN Available’ is No. Entity incorporated in the United States of America? Whether the entity was incorporated in the United States of America or not. Entity has any ultimate beneficial owners who are tax residents of countries other than <country name>? Whether any of the beneficial owners including the controlling persons of the entity/ organization is a tax resident of any country other than the country in which the entity’s accounts are held within the bank. Entity Category The category to which the entity belongs. The categories are: Financial Institution and Non- Financial Institution.

An Investment Entity located in a Non-Participating Jurisdiction and managed by another Financial Institution Whether the entity is an investment entity located in a Non-Participating Jurisdiction and managed by another Financial Institution. The value against this field will be Yes or No if the entity is a Financial Institution and an Investment Entity. If the entity is a non-financial institution or a financial institution that is a Depository Institution, Custodial Institution or Specified Insurance Company the value will be NA. Other Investment Entity Whether the entity is a type of investment entity that is different from that of an investment entity located in a Non-Participating Jurisdiction and managed by another Financial Institution. The value against this field will be Yes or No if the entity is a Financial Institution and an Investment Entity. If the entity is a non-financial institution or a financial institution that is a Depository Institution, Custodial Institution or Specified Insurance Company the value will be NA. Depository Institution, Custodial Institution or Specified Insurance Company Whether the entity is a depository institution, custodial institution or an insurance company. The value against this field will be Yes or No if the entity is a Financial Institution. If the entity is a non-financial institution, the value will be NA. GIIN Available Whether the entity's Global Intermediary Identification Number, is available or not. The value against this field will be Yes or No if the entity is a Financial Institution. If the entity is a non-financial institution, the value will be NA. GIIN The entity's Global Intermediary Identification Number. The value against this field will be defined if the entity is a Financial Institution and if the value against GIIN Available is Yes. If the entity is a non-financial institution, the value will be NA. Reason for Non Availability The reason for which the entity’s GIIN is not available. The value against this field will be defined if the entity is a Financial Institution and if the value against GIIN Available is No. If the entity is a non-financial institution, the value will be NA. Active NFE - A corporation, the stock of which is regularly traded on an established securities market

Whether the entity is an active NFE and the entity’s stock is regularly traded on an established securities market. The value against this field will be Yes or No if the entity is an Active Non-Financial Institution. If the entity is a financial institution, the value will be NA. Name of the established securities market on which the corporation is regularly traded The name of securities market on which the entity trades regularly. The value against this field will be defined if the entity is an Active Non-Financial Institution and is a corporation, the stock of which is regularly traded on an established securities market. The value displayed against this field will be NA if the entity is a financial institution or is any type of non-financial institution other than Active NFE – whose the stock of which is regularly traded on an established securities market. Active NFE - Entity is related to a corporation whose stock is regularly traded on an established securities market Whether the entity is an active non-financial entity and is related to a corporation whose stock is regularly traded on an established securities market. The value against this field will be Yes or No if the entity is an Active Non-Financial Institution. If the entity is a financial institution, the value will be NA. Name of the related corporation whose stock is traded The name of securities market on which the entity’s stock is traded regularly. The value against this field will be defined if the entity is an Active Non-Financial Institution and is related to a corporation whose stock is regularly traded on an established securities market. The value displayed against this field will be NA if the entity is a financial institution or is any type of non-financial institution other than Active NFE and is related to a corporation whose stock is regularly traded on an established securities market. Nature of relation The relation that the entity has with the company whose stock is traded. The value against this field will be defined if the entity is an Active Non-Financial Institution and is related to a corporation whose stock is regularly traded on an established securities market. The value displayed against this field will be NA if the entity is a financial institution or is any type of non-financial institution other than Active NFE and is related to a corporation whose stock is regularly traded on an established securities market. The value displayed can be any one of the following:- Subsidiary of the listed company

- Controlled by a listed company

- Common control as a listed company

Name of the established securities market on which the stock of the related corporation is regularly traded The name of security market in which the stock of the related corporation is traded regularly. The value against this field will be defined if the entity is an Active Non-Financial Institution and is related to a corporation whose stock is regularly traded on an established securities market. The value displayed against this field will be NA if the entity is a financial institution or is any type of non-financial institution other than Active NFE and is related to a corporation whose stock is regularly traded on an established securities market. Active NFE - A Governmental Entity or Central Bank Whether the entity is an active non-financial Governmental Entity or Central Bank. The value against this field will be Yes or No if the entity is an Active Non-Financial Institution. If the entity is a financial institution, the value will be NA. Active NFE - An International Organization Whether the entity is an active non-financial international organization. The value against this field will be Yes or No if the entity is an Active Non-Financial Institution. If the entity is a financial institution, the value will be NA. Active NFE - Other - e.g. a start-up NFE or a non-profit NFE Whether the entity is any other type of active non-financial organization e.g. a start-up NFE or a non-profit NFE. The value against this field will be Yes or No if the entity is an Active Non-Financial Institution. If the entity is a financial institution, the value will be NA. Sub-Category of Active NFE The sub-category of the active non- financial entity. The value against this field will be defined if the entity is an Active Non-Financial Institution and is either a government entity or central bank, an international organization or any other type of active NFE. If the entity is a financial institution, the value will be NA. Passive Non-Financial Entity (NFE) Specify Whether the entity is a passive non-financial entity. The value against this field will be Yes or No if the entity is a Non-Financial Institution. If the entity is a financial institution, the value will be NA.

Parent topic: FATCA & CRS Declaration Report