- Teller User Guide

- Customer Transactions

- F24 Tax Payment By Account

- Add Standard Details

4.15.1 Add Standard Details

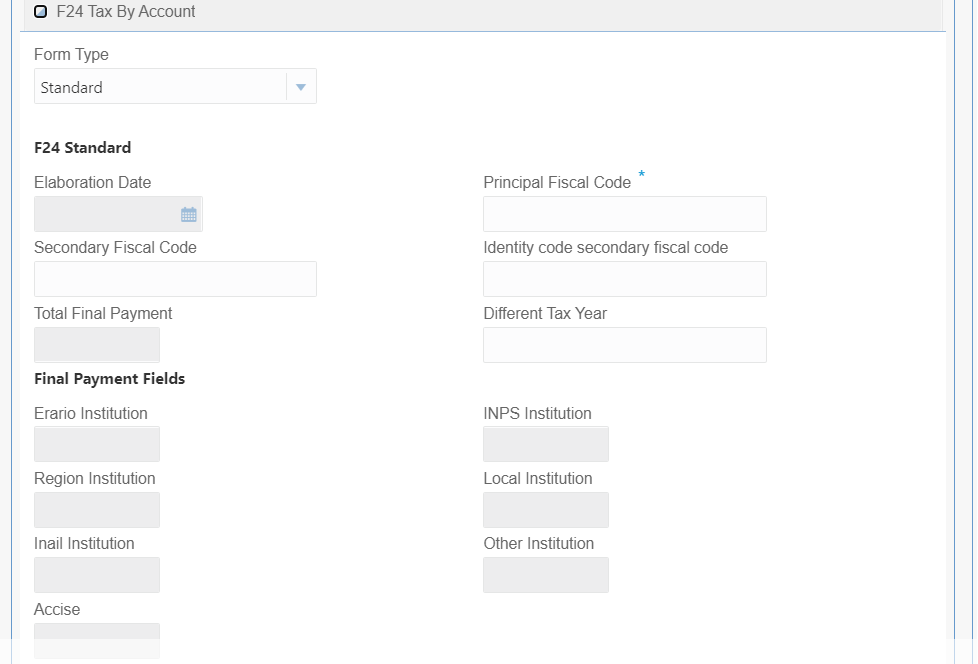

You can add the F24 standard details in the F24 Tax By Account data segment.

Figure 4-36 F24 Tax By Account - F24 Standard

- On the F24 Tax By Account data segment, specify the

fields. For more information on fields, refer to the field description

table.

Note:

The fields, which are marked with an asterisk, are mandatory.Table 4-48 F24 Standard - Field Description

Field Description Form Type

Select the Standard tax category from the drop-down list.

F24 Standard

Specify the fields.

Elaboration Date

Displays the elaboration date.

Principal Fiscal Code

Specify the debtor fiscal code.Note:

For Individual customers, the allowed principal fiscal code is 16 characters and for non-individual customers, this will be an 11-character VAT number.Secondary Fiscal Code

Specify the secondary fiscal code.Note:

For Individual customers, the allowed secondary fiscal code is 16 characters and for non-individual customers, this will be an 11-character VAT number.Identity Code Secondary Fiscal Code

Specify the Identity code secondary fiscal code.

Total Final Payment

Specify the total amount to be paid.

Different Tax Year

Specify if the tax being paid is related to the current year or not.

Final Payment Fields

The system displays the total amount of each segment:

-

Tax Institution

-

INPS Institution

-

Region Institution

-

Local Institution

-

Insurance Institution

-

Other Institution

-

Excise

-

- Specify the tax details. For information on the fields in the Tax Details, refer to Add Tax Details.

- Specify the INPS details. For information on the fields in the INPS, refer to Add INPS Details.

- Specify the region details. For information on the fields in the Region, refer to Add Region Details.

- Specify the details of the IMU and other local taxes. For information on the fields in the IMU and Other Local Taxes, refer to Add IMU and Other Local Taxes.

- Specify the insurance details. For information on the fields in the Insurance Details, refer to Add Insurance Details.

- Specify the details of the other bodies. For information on the fields in the Other Bodies, refer to Add Other Bodies.

- Specify the excise details. For information on the fields in the Excise, refer to Add Excise Details.

Parent topic: F24 Tax Payment By Account