- Teller User Guide

- Customer Transactions

- Cheque Withdrawal

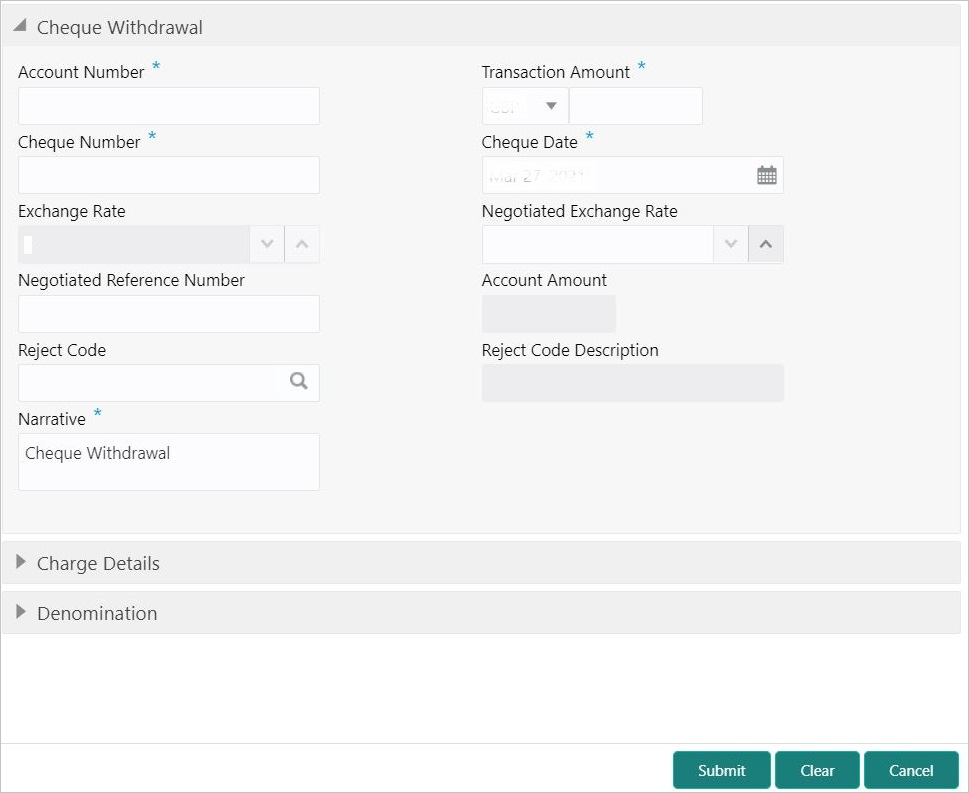

4.3 Cheque Withdrawal

The Cheque Withdrawal screen is used to withdraw cash from the CASA account of the customer against the in-house cheque.

The withdrawal is subject to the availability of a sufficient balance or available

credit limit. To verify the signature for the transactions, you can click

Verify button in the Customer Information

Widget. The signature verification is applicable for the

transactions, which have the Signature Verification Required option

selected as Y at the Function Code Preference level.

To withdraw cash through the in-house cheque:

- On the Homepage, from Teller mega menu, under

Customer Transaction, click Cheque

Withdrawal or specify Cheque Withdrawal

in the search icon bar and select the screen.The Cheque Withdrawal screen is displayed.

- On the Cheque Withdrawal screen, specify the fields. For more information on fields, refer to the field description

table.

Note:

The fields, which are marked with an asterisk, are mandatory.Table 4-4 Cheque Withdrawal - Field Description

Field Description Account Number

Specify a valid account number for the customer. Note:

When you press the Tab key, the corresponding account information will be displayed in the Customer Information widget.The system displays an override or error message on the tab out of Account Number based on the account dormancy parameters.

Transaction Amount

Displays the local currency of the branch. You can also select another currency from the drop-down list. Specify the transaction amount that needs to be debited from the customer account.

Cheque Number

Specify the cheque number of the customer account as provided by the Customer.

Note:

The system validates the status of the cheque and prompts an error message if incase of a Used or Stopped or Invalid cheque.Cheque Date

Select the date on which the cheque has been issued from the calendar option.

Negotiated Exchange Rate

Specify the negotiated exchange rate if it is needed to perform the transaction using negotiated value.Note:

This field is applicable only if the transaction involves cross currency. If this option is selected, the Negotiated Reference Number field will become mandatory.Negotiated Reference Number

Specify the reference number for the negotiated cost rate.Note:

This field is applicable only if the transaction involves cross currency.Reject Code

Select the reject code from the list of values, which are maintained in the Reject Code Maintenance screen.Note:

If the cheque withdrawal transaction needs to be rejected, you can reject it by specifying the appropriate reject code in this field. The transaction can be rejected for one of the following reasons:-

Insufficient funds

-

Signature mismatch

-

Stale cheque

Reject Code Description

Displays the description of the specified reject code.

Exchange Rate

Displays the exchange rate used to convert the transaction currency into account currency and it can be modified.Note:

If the transaction currency is the same as the account currency, the system displays the exchange rate as 1. This field is displayed only ifMulti-Currency Configurationat Function Code Indicator level is set as Y.Account Amount

Displays the transaction amount converted in terms of account amount based on the exchange rate.Note:

This field is displayed only ifMulti-Currency Configurationat Function Code Indicator level is set as Y.Narrative

Displays the default narrative as Cheque Withdrawal, and it can be modified.

-

- Specify the charge details. For information on the fields in the Charge Details segment, refer to Add Charge Details.

- Specify the denomination details. For information on the fields in the Denomination Details segment, refer to Add Denomination Details.

- Click Submit.A teller sequence number is generated, and the Transaction Completed Successfully information message is displayed.

Note:

The transaction is moved to authorization in case of any approval warning raised when the transaction saves. On transaction completion, the cash is withdrawn successfully against the customer cheque. For more information on transaction submission and validations, refer to Step 5 in Cash Deposit.

Parent topic: Customer Transactions