- Interest User Guide

- Processing Interest

- Composite Rate for Loans

- Specifying limits for Interest Rate Application

1.5.2 Specifying limits for Interest Rate Application

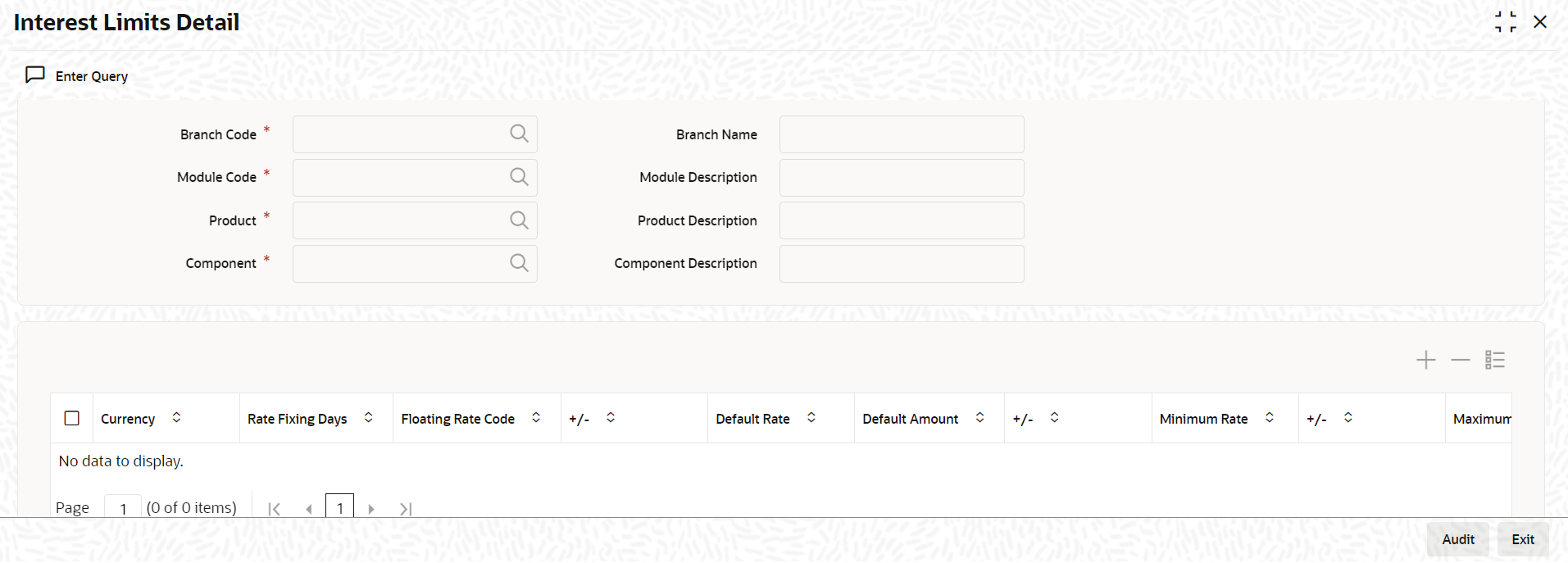

To capture details of interest limits details screen

Specify the User ID and Password, and login to Homepage.- On the Homepage, type OLDINTLM and click next

arrow.The Interest Limits Detail screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - When an interest class for which currency-wise interest limits have been

maintained is associated with a Loans product (in the Interest Class

Maintenance screen), the product inherits the limits, by

default. Such default limits can be modified if required, when the interest

limits for the product and branch combination are maintained, in the

Interest Limits Detail screen.This maintenance is applicable for all contracts for which:

- The interest component for which the limits have been maintained.

- The product used is the product for which the limits have been maintained.

- The contract branch is the branch for which the interest limits have been maintained.

- The contract currency is one of the currencies for which interest limits have been maintained, for the interest component, product, and branch combination.

- You can maintain the following information to set up the tenor-based,

currency-wise interest limits for a product, interest component, and branch

combination.

Table 1-11 Interest Limits Detail

Field Description Rate Fixing Days The rate fixing days gets defaulted from the Rate Fixing Days Maintenance screen. This is a numeric field. The system checks for the following: - Rate Fixing Days is greater than or equal to zero.

- Rate Fixing Days is supported for 2 digits (till 99 days)

- Rate fixing Days cannot be in negative

- Rate Fixing Days can be entered only for if Rate Fixing Required is set at the component level for the product in the Interest Class Maintenance screen.

- Rate Fixing Days can be entered only for Floating Rate Type components.

Floating Rate Code Floating rate code is applicable for floating products. You cannot use floating rate code for fixed rate type. If floating rate code are different in Interest Class Maintenance screen (LFDINTCL) and Bilateral Loans Product Definition screen (OLDPRMNT), then the system takes the floating rate code from the Bilateral Loans Product Definition screen. If you want to change the floating rate code, you can change in this screen. Default Amount or Default Rate for Late Payment Charge For components defined with Rate Type SPECIAL in Interest Class Maintenance screen, you can specify a default flat amount or a default rate at the interest limit level which is defaulted to the Interest Limits Details screen. Based on the value of Special Rate Type, you can either maintain the Default Rate or Default Amount for late payment charge applicable to the loan product.

If the value of Rate Type is SPECIAL and Special Rate Type is FIXED in the Interest Class Maintenance screen, then you can specify the default fixed rate to be applied as late payment charge to all loans created under this loan product.You can specify the default late payment charge (either fixed rate or flat) by selecting the loan product code and the late payment charge component. This component should already be linked to the loan product through the Interest Class Maintenance screen.

- For interest rate components, you can specify the minimum and maximum rate that

can be changed at the contract level.

Table 1-12 Interest Rate Product

Field Description Alternative Risk-Free Rates - If base rate + spread adjustment falls

below minimum rate, base rate is adjusted to bring

base rate + spread adj to minimum rate.

Example - If minimum rate is 2 and base rate received is 1 and spread adj is 0.5, 1+0.5 = 1.5 which is less than 2 so base rate is adjusted to 1.5, so that 1.5+0.5 = 2 (same as min rate)

- If base rate + spread adjustment falls

above maximum rate, base rate is adjusted to bring

base rate + spread adj to maximum rate.

Example - If maximum rate is 5 and base rate 4 and spread adj is 2, 4+2 = 6 which is more than 5 so that base rate is adjusted to 3, so that 3+2 = 5 (same as max rate)

Fixed Rate products - The standard rate that is applicable for contracts involving the product.

- The Minimum and Maximum interest rate that can be applied on a contract

By defining minimum and maximum rates for a fixed interest, you can ensure that your rates stay within the stipulated limits.

For penal interest components, you can specify the overdue tenor for which the penalty interest should be applied.Floating Rate Products For Floating Rate products, specify the Default, Minimum and Maximum spread that can be applied on the floating rate.Default gets assigned to the contract on booking, however you can amend.If the spread specified during contract processing is less than the value specified as the minimum spread, this value is picked up as the spread. Similarly, if the spread specified during contract processing is more than the value specified as maximum spread, this value is picked up as the spread. By defining minimum and maximum spread for floating interest, you can ensure that your spread stays within the stipulated limits.

The rate maintained for the maximum tenor is used if the Overdue days extend beyond the maximum tenor maintained.

The interest for each currency is calculated using the interest basis, which you select:- 30 Euro / 360

- 30 US / 360

- Actual / 360

- 30 Euro / 365

- 30 US / 365

- Actual / 365

- 30 Euro / Actual

- 30 US / Actual

- Actual / Actual

- 30(Euro)/365.25

- 30(US)/365.25

- Actual/365.25

- Working Days/252

- Working Days/360

- 30SPL/360

Interest period basis You can indicate how the system must consider the tenor basis upon which interest is computed over a schedule or interest period, in respect of the interest component for which the limits are being maintained, which is associated with the selected product. Currency-wise interest period bases may be maintained. This specification is inherited from the interest component class being chosen. You can choose any of the following options:For details about the four options, refer the topic Specifying the Interest Period Basis under the head Building Interest Classes, in this user manual.- Including the From Date

- Including the To Date

- Including both From and To Dates

- Excluding both From and To Dates

- If base rate + spread adjustment falls

below minimum rate, base rate is adjusted to bring

base rate + spread adj to minimum rate.

Parent topic: Composite Rate for Loans