- Loan Syndication

- Loan Syndication Contracts - Part 2

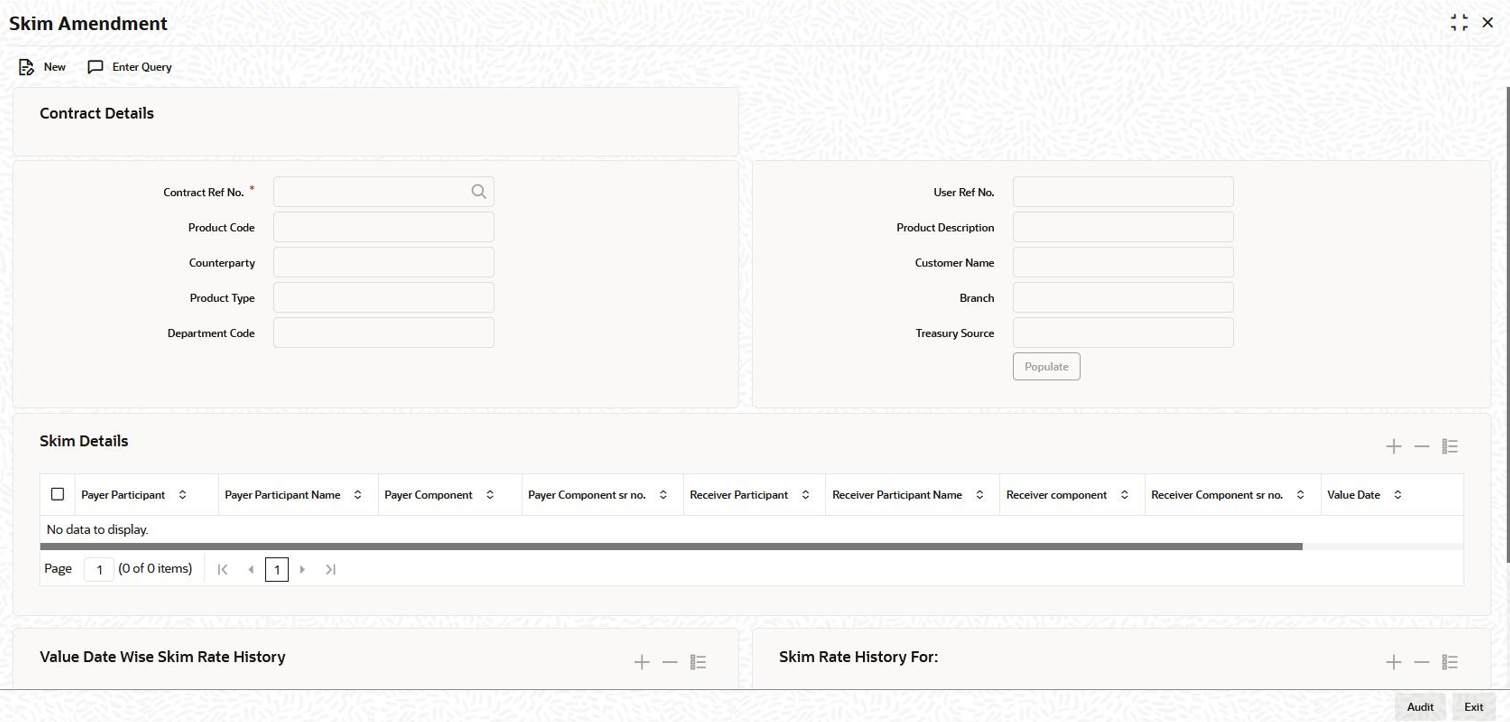

- Amending Drawdown SKIM Details

5.3 Amending Drawdown SKIM Details

You can amend the Skim details maintained for a drawdown in the Skim

Amendment screen.

For details on maintaining SKIM for a tranche, refer the section titled Defining SKIM details for tranche participants in this chapter.

Specify the User ID and

Password, login to Homepage.

- On the homepage, type LBDSKMAM and click next

arrow.The Skim Amendment screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - You can use the New option for amending the Skim details

for an authorized drawdown. The Unlock option is

available only if the drawdown is unauthorized.When you Unlock or select the New option, as the case may be, do the following as part of amendment:

Note:

During amendment:

- You cannot remove an existing combination of payer and receiver maintained for the drawdown. However, you can change the value date and skim rate for the combination.

- You can add a new combination and delete only a new combination added as part of Skim amendment

- Add a new combination of Payer and Receiver Participants. The option list displays the participants selected for the drawdown. When you select a Payer Participant or Receiver Participant, the corresponding name and component are also displayed. The system displays the number of times you select the participant for a combination. However, you cannot repeat a combination of Payer and Receiver.

- Specify the value date when the amendment should be applied to the drawdown. This date should not be earlier that the drawdown value date or later than the drawdown maturity date.

- Specify the Skim rate for the combinations maintained for the drawdown.

- The details get updated to the drawdown upon save of the amendment. You can view the same in the Skim Details – Drawdown sub-screen invoked from the Drawdown Contract Online screen. The drawdown status is Unauthorized after an amendment. The same gets updated to Authorized only after the amendment is authorized.

- Viewing the Skim Rate HistoryIn the Value Date Wise Skim History section of the Skim Amendment screen, you can view the history of modifications/amendments made till date for a payer and receiver combination. The following details are displayed here:

- Payer Participant and Receiver Participant

- Value Date

- Skim Rate

- Event Sequence Number: Indicates the number of modifications done till date

Following points are noteworthy here with reference to interest rate changes:The following points are noteworthy with respect to payable/ receivable tracking:- The interest receivable from a borrower on the schedule date can be more than the amount actually liquidated due to the interest rate increase. In such a case, the excess interest is receivable from the borrower and payable to the participants based on the participant sharing ratio for the associated business event (REVN).

- The interest receivable from borrower on the schedule date can be less than the amount actually liquidated due to the interest rate decrease. In such case, the excess interest is made payable to the borrower and made receivable from the participants based on the participant sharing ratio for the associated business event (REVN).

- The payable/receivable tracking is done only for normal/bearing interest type of contracts. It is not applicable for prime and competitive bidding contracts.

- Payable/Receivable tracking is not applicable for liquidated and rolled over contracts.

- The parent contract life cycle remains unaffected by the receivable and payable tracking. This means that the parent contract can move to the liquidated status on its maturity date, subject to all schedule payments, even though receivables/payables might be outstanding for the same.

- If the payable/receivable settlement is done after maturity date of the liquidated parent, the system fires the payable/receivable event (PRLQ) at the parent contract even after liquidation.

- If a parent contract is reversed before maturity, all receivables/payables get auto reversed by the system.

Note:

You can reverse a payment of a payable/receivable by clicking the Reverse option . This option is enabled only if you access the above screen directly from the Application Browser (to do this, you need to choose LB Operations and double-click on the Payment option under Receivable Payable).This topic contains following sub-topics: