- Loan Syndication

- Loan Syndication Contracts - Part 2

- Processing the Release of Payment Messages

- Forward Processing Browser

- Hold Transaction Processing

5.21.3.1 Hold Transaction Processing

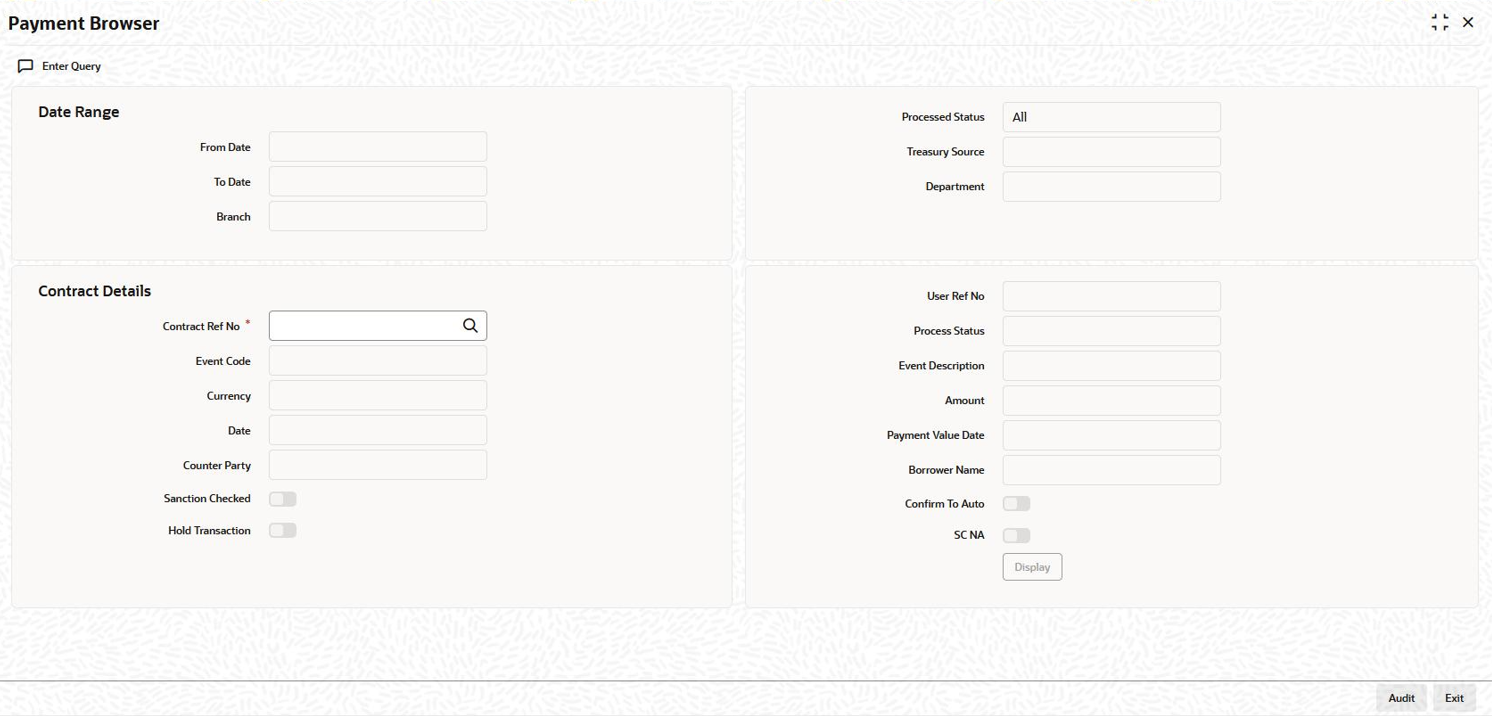

- On the homepage, type LBDFWDPR and click next

arrow.The Payment Browser screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields.Figure 5-86 Payment Browser

- By default, Hold Transaction check box is not selected

and you can select this check box for interest and principal payments You need

to query for the contract in the FP browser. You can click

Unlock and select the Hold

Transaction check box and save the record.Once the this check box is selected, systematically the Confirmed to Auto check box is cleared and disabled. Even though if the Confirmed to Auto check box is selected for a transaction before it is held, once you select Hold Transaction check box, the Confirmed to Auto check box is cleared and disabled systematically.

The system performs the below validations when you select Hold Transaction check box and save the record.

- The liquidation mode of the underlying drawdown contract should be Semi Auto.

- The payment message should have been generated for any of the below

events.

- Future dated rollover with increase (VAMI) where system has generated the payment message as part of PMSG event.

- Liquidation (LIQD) which can be either manual or auto liquidation. The payments can either be future dated or current dated and scheduled payments or prepayments.

- If the above validations are failed, appropriate error messages appears.

Once the record is saved and authorized, the payment message is put on hold and it is not released from the system. No changes is done as part of rollover processing/VAMI and rollovers are processed on the respective dates irrespective of whether the payments are held/un-held. All accounting entries are passed on the relevant value date and not when the payments are un-held/released.

Liquidation (LIQD) is not processed for the contracts during EOD batch on the schedule date if the payment message for the associated event is held. All accounting entries are passed on the relevant value date online if the current application date is lesser than the schedule date. If the current application date is greater than the schedule date, then the accounting entries are posted during the EOD batch on the schedule date.You are not allowed to hold messages generated for any other events than liquidation (LIQD), and future dated rollover with increase (VAMI). The Hold Transaction check box is enabled for current dated payments where the message generation has happened before the current date. If both the message and payment generation happened on the current date, the system does not allow you to hold such messages. Appropriate error messages are displayed.

If the payment messages generated for future dated VAMI/LIQD/rollover with increase is placed on hold,- System does not stop the processing of rollovers. Only the payment

message generation (either manual or batch) for rollovers is put on hold

systematically in the FP browser.

Note:

In case of future dated rollover with increase, VAMB/VAMI events are triggered on the value date and there are no blocks on these events. However, the payment message is generated as part of PMSG are blocked systematically. - System stops the processing of VAMI or any further manual or auto payments and the corresponding payment messages generation in the FP browser systematically.

Changes are done to stop the archival of the payment messages which are held in the FP browser. Archival is done on the EOD once the payment messages are un-held in the FP browser.

You are allowed to hold / un-hold the reverse MT103 payment messages generated as part of payment liquidation as well.

Parent topic: Forward Processing Browser