- Loan Syndication

- Loan Syndication Contracts - Part 2

- Processing the Release of Payment Messages

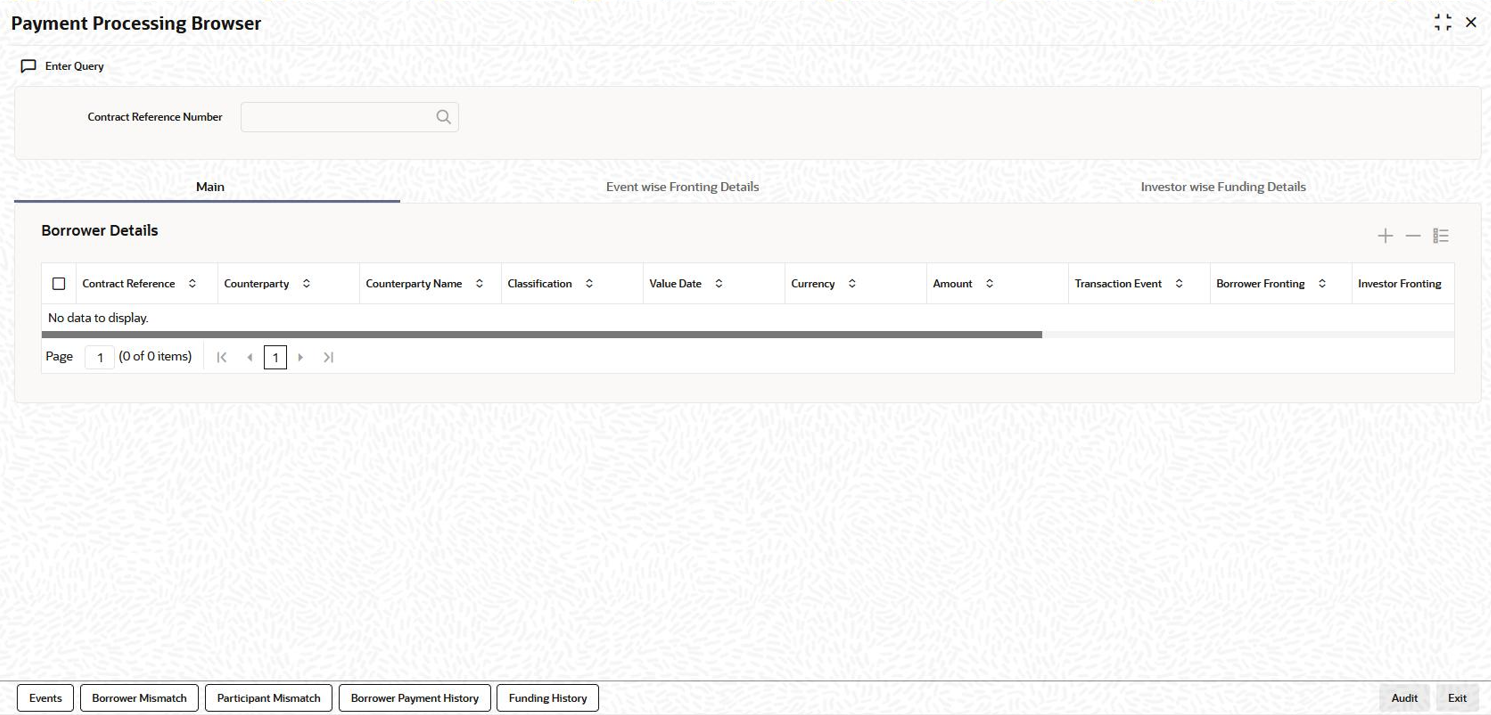

5.21 Processing the Release of Payment Messages

On the booking date of the contract, Oracle Banking Corporate Lending queues up

payments due for the value date and then you can release payment messages based on

approvals and /or funds received in the system using Payment Processing

Browser screen.

Specify the User ID and Password, and

login to Homepage.

- On the Hompage, type LBDMTPRC and click next

arrow.The Payment Processing Browser screen is displayed.

- You can specify the following fields in this screen. For information on fields,

refer to field description table.The following fields are displayed in this screen.

Table 5-23 Payment Processing Browser

Fields Description Contract Reference Number Specify the borrower contract reference number to capture the fronting/funding details for the disbursement/payment activities of the contract. The system displays the event wise borrower details for the disbursement and payment events in the Borrower Details frame of this screen.

Borrower Fronting Select the fronting for the borrower, in case of payment activities, from the following options. - Fronting

- No fronting

Investor Fronting Select the fronting for the investor, in case of disbursement activities, from the following options. - Fronting All

- No fronting

- Fronting Partial

Actual Receipt Date The date on which the borrower is funding for the payment is displayed in this field; however, you can choose to modify this date. Note:

- You can change the fronting options before the value date of the event.

- If bank is fronting or if the fund is sighted without bank fronting, the current application date is defaulted to the Payment sent date.

Funds Sighted Select Yes if the fund is sighted for the borrower repayment; otherwise, select No. - Borrower Details

- Contract Reference Number - Borrower contract ref number

- Counterparty - Borrower ID

- Counterparty Name - Borrower Name

- Classification - Borrower Classification

- Value Date - Value date of the event

- Amount - Event Amount

- Currency - Contract Currency

- Transaction Event - Event code (BOOK/VAMB/LIQD)

- Payment Date - Date on which the payment is made to the investors (in case of actual funding by the borrower or fronting by bank for the payment)

- Funds Sighted - Indicates if the fund is sighted for the borrower payments, Yes for Fronting All, No for No Fronting and NA for Partial Fronting

- Event Wise Fronting Details

You can capture the investor fronting details for each event in this frame.

The following fields are displayed in this frame:Table 5-24 Event Wise Fronting Details

Fields Description Default Investor Fronting Select any of the following options to indicate the type of participant fronting. - Fronting

- No Fronting

- Seek Approval

Fronting Select the fronting for the investor, for the disbursement event, from the following options. - Fronting All

- No fronting

- Seek Approval

Note:

- You can change the fronting options before the

value date of the event.

- Seek approval can be changed to Fronting or No Fronting Options before the value date of the disbursement event.

- Seek approval can be changed only to No Fronting Option on or after the value date of the disbursement event.

- By default, Seek approval is considered as No fronting.

- If there is a mismatch between the fronting option specified in the browser and the ORR maintained at the customer level for the respective investor, the system throws an override while saving the respective Payment browser activity

- For the investors who are funding, payment date is defaulted from the Investor wise Funding Details tab and is not allowed to change. This date is used for the interest computation for the borrowers.

- For the fronted investors, the payment date is updated internally as the application date on the payment date and interest is calculated accordingly.

Actual Receipt Date The actual receipt date is defaulted from Investor wise Funding Details Tab for each Investor; however, you can modify this date. The system uses this date for the interest computation for the investors. Recall Date In case of Recall for the fronted portion, specify the recall date for Fronted investors for the respective disbursement events. Note:

- You can specify the recall date for the latest disbursement event only, the system updates the same recall date for all the previous disbursements. It validates if the Recall date is greater than or equal to the latest disbursement event value Date.

- Recall Date is used in Interest Calculation for the borrower and investor. For the borrower, the total recall amount is treated as unfunded from the recall date. For the investor, the amount is treated as unfunded from the value date of the contract itself.

- Contract Reference Number - Participant contract reference number

- Counterparty - Participant ID

- Counter Party Name - Participant Name

- Classification - Participant Classification

- Pro Rata Share - Pro Rata share of the investor for an event.

- Payment Sent - Indicate if the payment message is sent to the investors in case of payments.

- Payment Date - Date on which the payment is made to the borrower (in case of actual funding by the participant or fronting by bank for the disbursement).

- Funding Status - Indicates the funding status of the investor (funded, unfunded or fronted).

- Investorwise Funding DetailsThe following fields are displayed in this screen:

Table 5-25 Investorwise Funding Details

Fields Description Funds Sighted Select Yes to Indicate if the fund is sighted for the Investor for the disbursements. Payment Date Specify the date on which the amount is disbursed to the borrower. Actual Receipt Date Specify the date on which the investor is funding the amount. - Contract Reference Number - Participant contract reference number

- Counterparty - Participant ID

- Counter Party name - Participant Name

- Unfunded Amount - Total unfunded amount across the disbursement events for the investor

- Fronting - This is defaulted from the fronting option chosen for the latest disbursement event for the investor in the Event wise Fronting Details tab.

- Funding Amount - Total unfunded amount across the disbursement events for the investor will be defaulted here as the investor is expected to fund the complete amount at a time

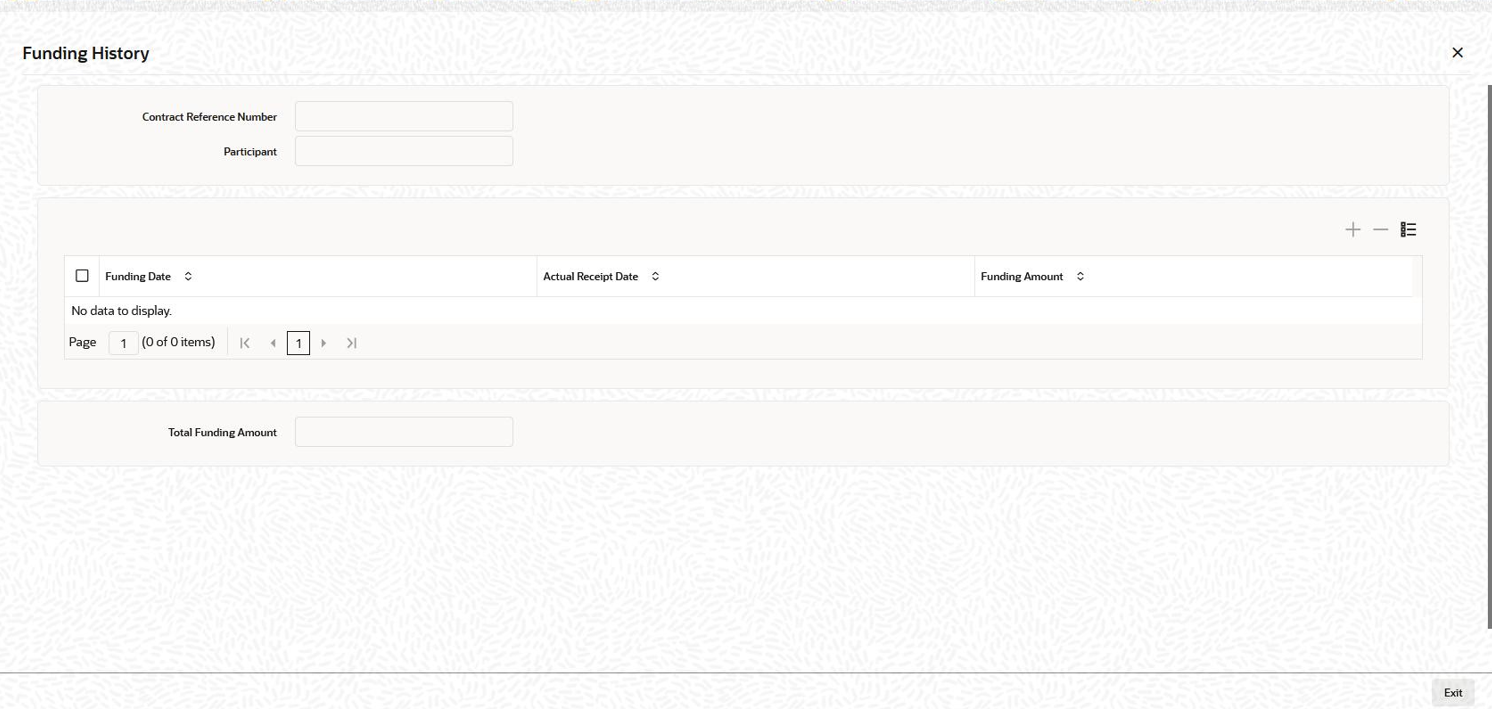

- From the Payment Processing Browser screen, click

Funding History.The Funding History screen is displayed.

- The following fields are displayed in Funding History

screen:

- Contract Reference Number

- Participant

- Funding date

- Actual Receipt Date

- Funding Amount

- Total Funding Amount

- Participant Transfer with existing participant(s) - following details

are updated based on the latest ratio.

- Pro-rata share amount of participants in Event-wise Fronting Details tab

- Unfunded amount in Investor-wise Funding Details tab

- Participant Transfer with new participant(s) - the new participant(s)

are added to the existing list of participants in the screen. All the

other relevant details for the new participant is populated. Fronting

value for such participants are defaulted as

- Fronting - If Investor Fronting captured at Borrower details is Fronting All and funding_status is populated as Fronted

- No Fronting – If Investor Fronting captured at Borrower details is not Fronting All and funding_status is populated as UnFunded.

- Payment processing browser is populated with the new child contracts

which are created as part of renewal of Drawdowns during Batch or

Online, as per the current functionality.

- Existing funded investors are populated as Funded with the latest amount and new investors are treated as Unfunded.

- User has to capture the funding details for such investors from the Payment Processing browser.

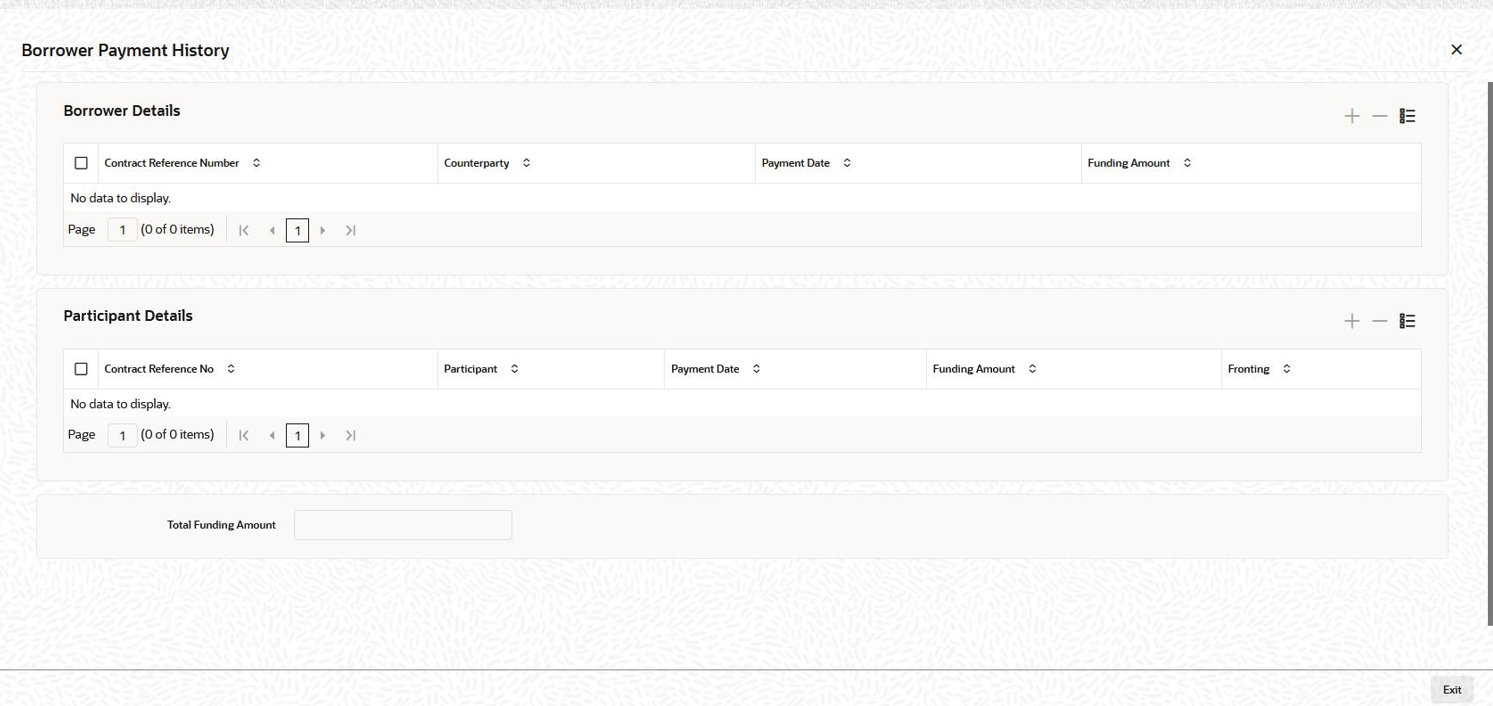

- From the Payment Processing Browser screen, click

Borrower Payment History.The Borrower Payment History screen is displayed.

- The following fields are displayed in Borrower Payment

History screen.

- Borrower Details

- Contract Reference Number

- Counterparty

- Payment Date

- Funding Amount

- Participant Details

- Contract Reference Number

- Participant

- Payment Date

- Funding Amount

- Fronting

- Total Funding Amount

This topic contains the following sub-topics: - Borrower Details