- Loan Syndication

- Reference Information for Loan Syndication

- Indicating Branch Parameters for Loan Syndication

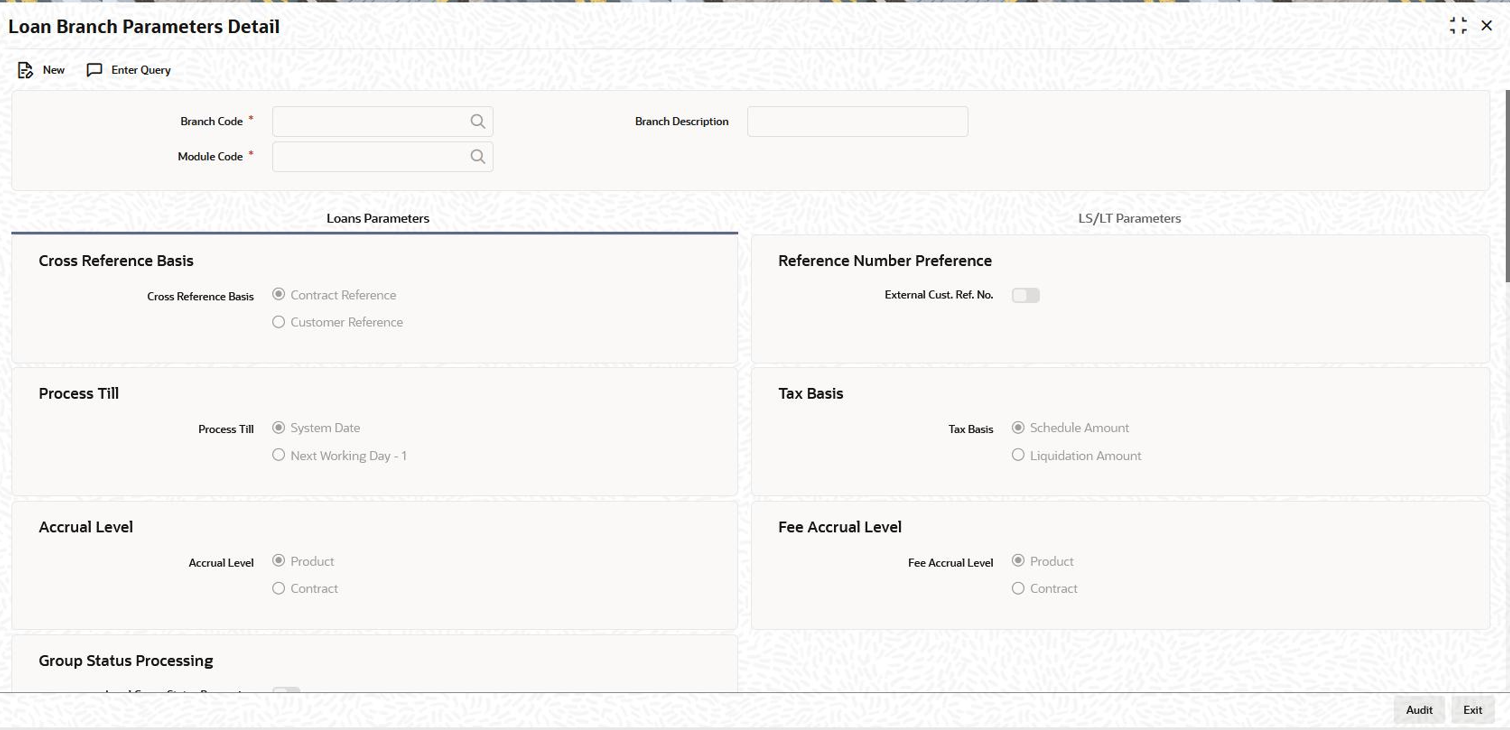

2.9 Indicating Branch Parameters for Loan Syndication

You can also indicate the participant to whom the rounding difference between amounts collected and amounts disbursed, must be routed.

- On the homepage, type OLDBRPRM and click next

arrow.The Loan Branch Parameters Detail screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - You can specify below details in this screen. For information on fields, refer

to the field description table.

Table 2-8 Loan Branch Parameters Detail

Fields Description Branch code Indicates the alphanumeric 3 characters to identify the branch of the bank. Module Code Indicate the module code for which the branch maintenance is done. Branch Description Indicates the brief description of the branch. - You can specify below details in Loans Parameters tab of

Loan Branch Parameters Detail screen. For information

on fields, refer to the field description table.

Table 2-9 Loan Parameter Tab

Fields Description Process Till Specify till which date the automatic processes of your branch should be executed if they fall due on holidays. The options available are: - System Date: If you specify that processing of automatic events should be done upto the System Date, automatic events scheduled till (inclusive of) the current system date will be processed.

- Next Working Day-1: This specification means that events scheduled for a holiday should be processed on the last working day before the holiday. If you indicate this, all the events that fall on a day between the current system date and the next working day are processed.

Example

Case 1: System Date

Assume today is 20th October 2005, and 21st October 2005 and 22nd October 2005 are holidays. If you select System Date, during the Automatic Batch Update function run for your branch, only the events scheduled for 20th October 2005 are processed.

The events scheduled for the holidays, that is, 21st October 2005 and 22nd October 2005 are processed during the Automatic Batch Update function run during beginning of day operations on 23rd October 2005.Case 2: Next Working Date -1

Assume that today is 20th October 2005, and 21st October 2005 and 22nd October 2005 are holidays. If you click this field, during the Automatic Batch Update function run at EOD on 20th October 2005, all the events scheduled that are scheduled for 21st and 22nd October 2005 are also processed.FTI Handoff Required Select this check box to indicate that the FTI handoff is required. The system handoff all the payment messages in branch local currency to FTI system through MQ only if this check box is selected. Chinese Characters in Payment Select this check box to indicate that Chinese character should be allowed during payment. The system allows you to enter Chinese characters in the field 57, 59 and 70 of the Settlement Instructions screen only if this check box is selected. FT Offset GL FT offset GL can be used to select FT contracts for settling the net amount to be transferred to the buyer/seller with the same or different counter parties of a CUSIP in which Borrower has made the interest payment. An incoming and an outgoing FT products are maintained as the default products as internal parameters for the actual settlement. Based on the net settlement amount (either Payable or receivable) for the counter party, Branch and Currency combinations, system picks up the appropriate Outgoing/ Incoming FT products from the internal parameters and use this product for the settlement.

- You can specify below details in LS/LT Parameters tab of

Loan Branch Parameters Detail screen. For information

on fields, refer to the field description table.

Table 2-10 LS/LT Parameters

Fields Description Reporting Currency Specify the currency that is displayed in the syndication contracts. This is the currency in which the principal contract amount outstanding balance of tranches and drawdowns is expressed. Reporting Rate Type This is the exchange rate type, which is used to convert the principal amount and outstanding balance in case the syndication contract currency is different from the reporting currency that you have specified in the previous field. Choose the exchange rate type from the option list given.

Rounding Participant The system creates a new participant contract to route the rounding difference amount that was created due to rounding difference between the amount collected and the amount disbursed. When the amount collected from the borrower is disbursed to the participants, you could encounter rounding differences. You need to choose the rounding participant from the option list to indicate that the participant to whom the rounding difference is to be routed.

Netting Suspense GL If on the maturity date of a drawdown, a borrower books another drawdown, you have the option of netting the payment. This netting of payment can be done for the principal, interest, tax, charge, and fee components associated with the drawdown. Select the Netting Suspense GL into which the accounting entries during netting are posted. Table 2-11 Sighting Funds Parameters

Fields Description Sighting Funds Applicable Select this field to indicate that sighting funds is applicable for the branch. On selecting this field, you can capture the fields described as follows. Sighting Funds suspense GL Specify a valid GL as the suspense GL for sighting funds. You can choose the appropriate one from the option list as well. Sighting Funds GL Specify a valid GL as the GL for sighting funds. You can choose the appropriate one from the option list as well. PNL Account Specify a valid account as the PNL Account for sighting funds. You can choose the appropriate one from the option list as well. Table 2-12 Collateral Customers

Fields Description Col Settlement Customer Specify the collateral settlement customer number for collateral settlement contract. The adjoining option list displays all valid collateral settlement numbers that are maintained in the system. You can select the appropriate one. Col Online Customer Specify the collateral online customer number for collateral online contract. The adjoining option list displays all valid collateral online numbers that are maintained in the system. You can select the appropriate one. Collateral Min Tranche Bal Specify the minimum tranche balance amount for the collateral. The amount maintained here are validated in Tranche currency. Collateral Max Drawdown Bal Specify the maximum drawdown balance amount for the collateral. The amount maintained here is validated in drawdown currency. New Availability Amount for collateral is computed by the system based on the following formula:- New Availability Amount = (Least of Net Available Collateral Amount for the Drawdown Value Date and Tranche Amount) – (Total Outstanding))

On saving the details, an override message is displayed and the transaction requires dual authorization.

An e-mail is sent to the participants of the tranche whenever the override message is displayed. The message is as follows:- If the new availability amount is less than the

specified collateral minimum tranche balance

amount, the following message is

displayed:

Tranche Availability is less than -collateral Min Tranche balance amount

- If the new drawdown amount exceeds the specified

collateral maximum drawdown balance amount, the

following message is displayed:

Drawdown amount is greater than - Collateral Max drawdown balance

Capturing Forward Event Processing Details

You can process transactions before the scheduled date, but hold back the messages till the Spot Date or Value Date. This is known as Forward Processing.Table 2-13 Forward Event Processing Details

Fields Description Limit Days The number you enter here, is the number of days after the System Date for which events marked for forward processing are shown in the Forward Processing Queue. Example

The System Date is 30th August 2005. The Limit Days you enter is 7. Any event marked for forward processing, occurring within the next seven days, are in the Forward Processing Queue.Archive Days When a payment message is sent out for an event marked for forward processing, the event can be archived. The archive days are the number of the days before the System Date prior to which any event confirmed for forward processing are archived. Example

The System Date is 30th August 2005. The Archive Days you enter is 7. Any event confirmed for forward processing, having occurred more than seven days before the System Date, are archived.For details on forward processing, refer the heading titled Forward processing of events in the Loan Syndication Contracts chapter of this User Manual.

Parent topic: Reference Information for Loan Syndication