9.6.2 Modifying Interest Rate

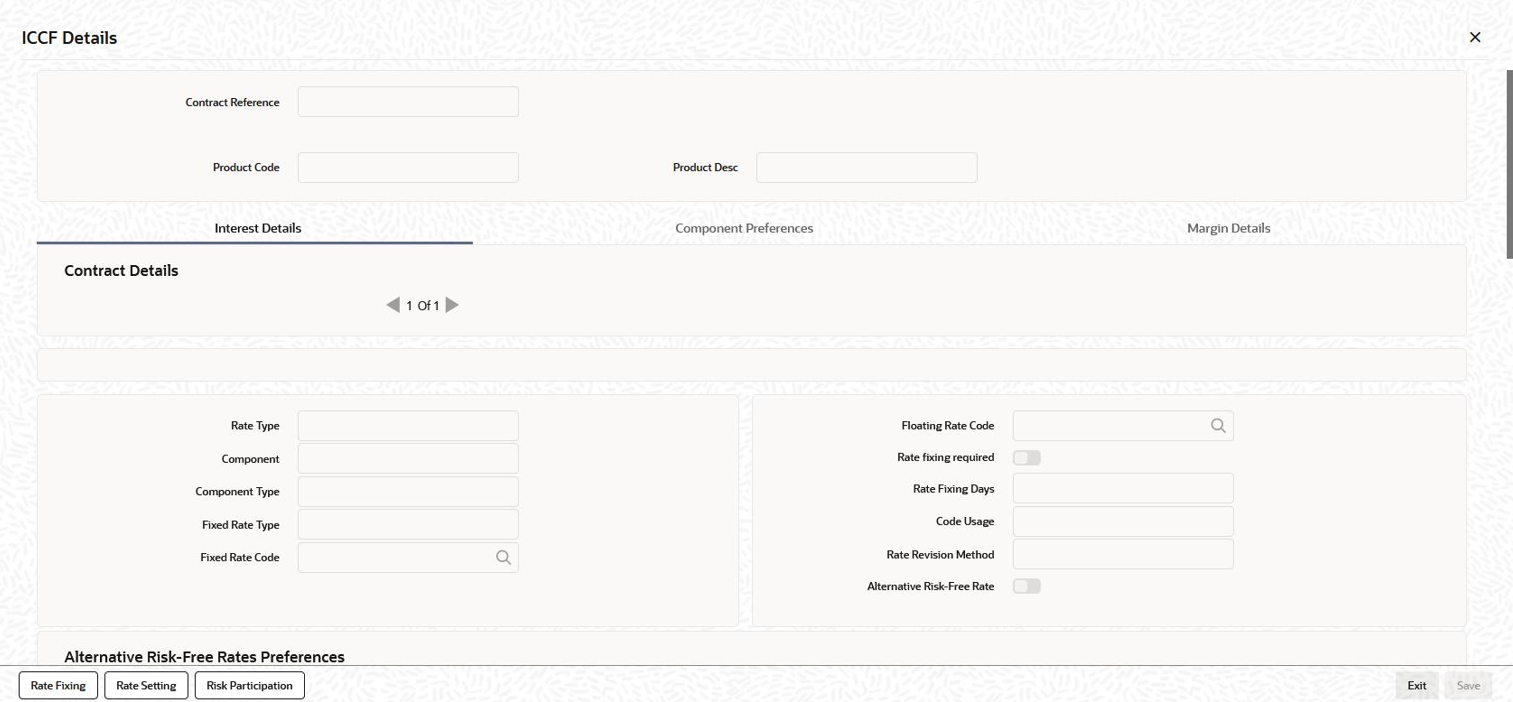

You can modify the interest for fixed or floating rate type of drawdowns in

ICCF Details screen (Interest button

is available only if you are performing value dated amendment for a drawdown).

Specify the User ID and Password, and login to Homepage.

From the Homepage, navigate to Value Dated Amendment screen.

Parent topic: Making Value Date Amendments for a Drawdown