- Loan Syndication

- Loan Syndication Contracts - Part 2

- Refunding Withheld Tax

5.14 Refunding Withheld Tax

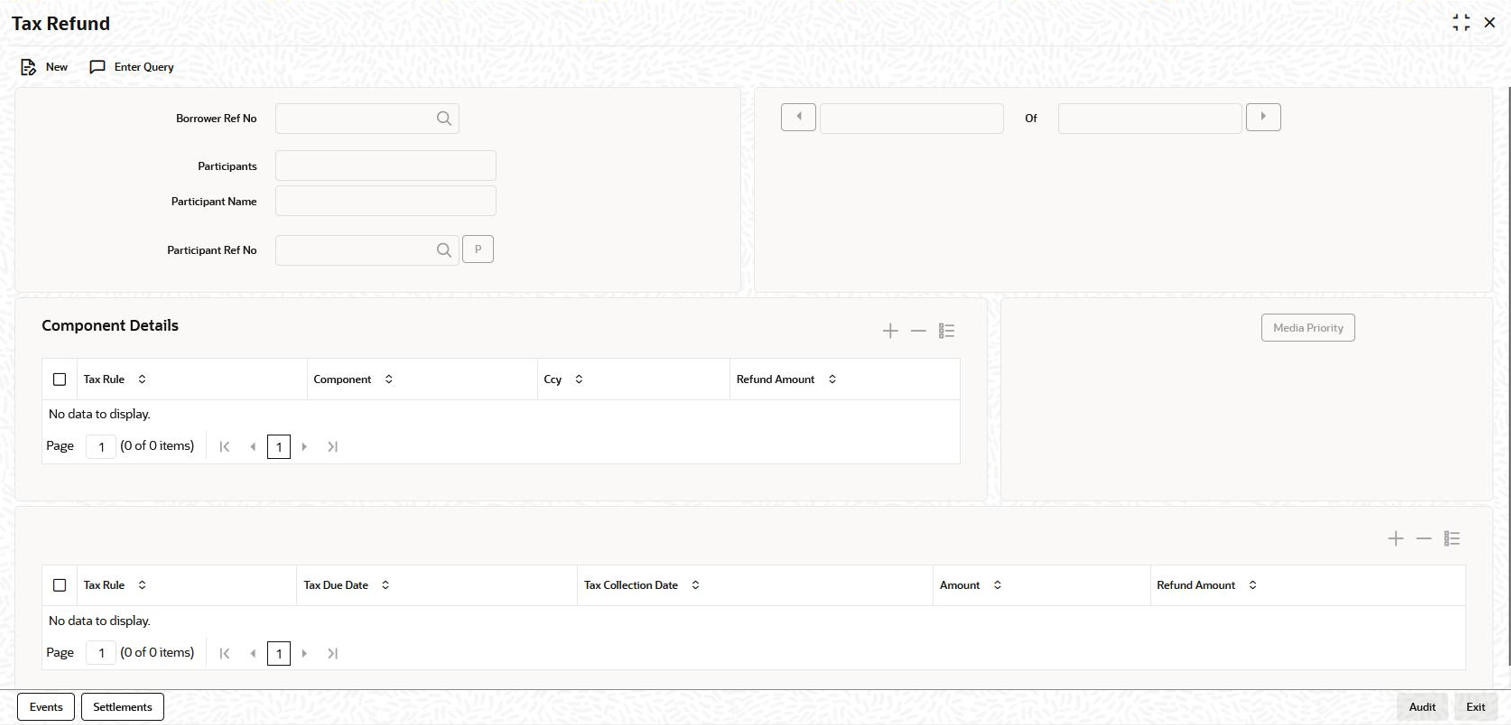

Tax is refunded to the participants using the Tax Refund screen.

- On the homepage, type LBDTXREF and click next

arrow.The Tax Refund screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - In the above screen, system displays all the withheld tax components. The

following details are displayed.System displays the schedule details of the components:

Table 5-21 Tax components

Fields Description Borrower Ref No. Specify the reference number of the borrower contract for which you want to refund the tax. Participant From the option list select the participant for whom you want to refund the tax. Participant Ref No. System displays the reference number of the participant. Tax Rule System displays the tax rule associated with the contract. Component System displays the component against which the tax rule is associated. Ccy This is the currency in which the Tax that has been withheld which needs to be remitted. Refund Amount This is the sum of all the Refund Amount specified under Schedule Details. Table 5-22 Schedules Details of Components

Fields Description Tax Rule This is defaulted from the Tax Rule under Component Details. Tax Due Date System displays the due date of the component with which the tax rule is associated. Tax Collection Date This is the date on which the component was liquidated. Amount This is the maximum tax amount that can be considered for the refund for a Tax rule, Due Date and collection date combinations for the given participant of an LB contract. System calculates this amount considering the impact of the past refunds and the remittances. Refund Amount You can specify the amount you wish to refund to the participant. You can choose to refund the tax withholdings in partial or full. The amount in the Amount field is defaulted here. You can, however, change the amount. If you specify zero, it indicates that you do not want to refund any amount. Click Settlements tab in the Tax Refund screen to invoke the Settlement screen. This screen displays the customer’s account where the refund amount is credited.

Click Events tab to invoke the Event screen. This screen displays the accounting entries posted with TXRF (Tax Refund) and TXRV (Reversal of refund) events.

Click Media Priority button to invoke the Media for Message Generation screen. You can specify the media for the message generation in this screen. This buttonis enabled only if the FpML Type option is deselected at the contract level and the Media Priority option is selected at the product level.

If this button is enabled, then the system displays an override message saying to view the Media for Message Generation screen. If not, the system handoffs the message as per the details maintained in the Customer Entity Maintenance screen.

For more information on Settlement Message Details screen, refer the Settlements User Manual.

For more details on the Event Log Details screen, refer the section titled Viewing events for the facility in the Loan Syndication Contracts chapter of this User Manual.

For more information on the Media for Message Generation screen, refer the section Specifying Media for Message Generation of this chapter.

You can execute the following operations in the Tax Refund screen:- Create

- Reverse

- Authorize

- Delete

Note:

- You can refund the amount even after a contract is liquidated.

- You can refund the amount only for components that have not been remitted.

- You can reverse the refund, if required.

- System does not refund the amount if the underlying contract for which refund is being made is not authorized.

- You cannot execute a transaction if the refund is unauthorized.

This topic contains the following sub-topics: