- Loan Syndication

- Loan Syndication Contracts - Part 2

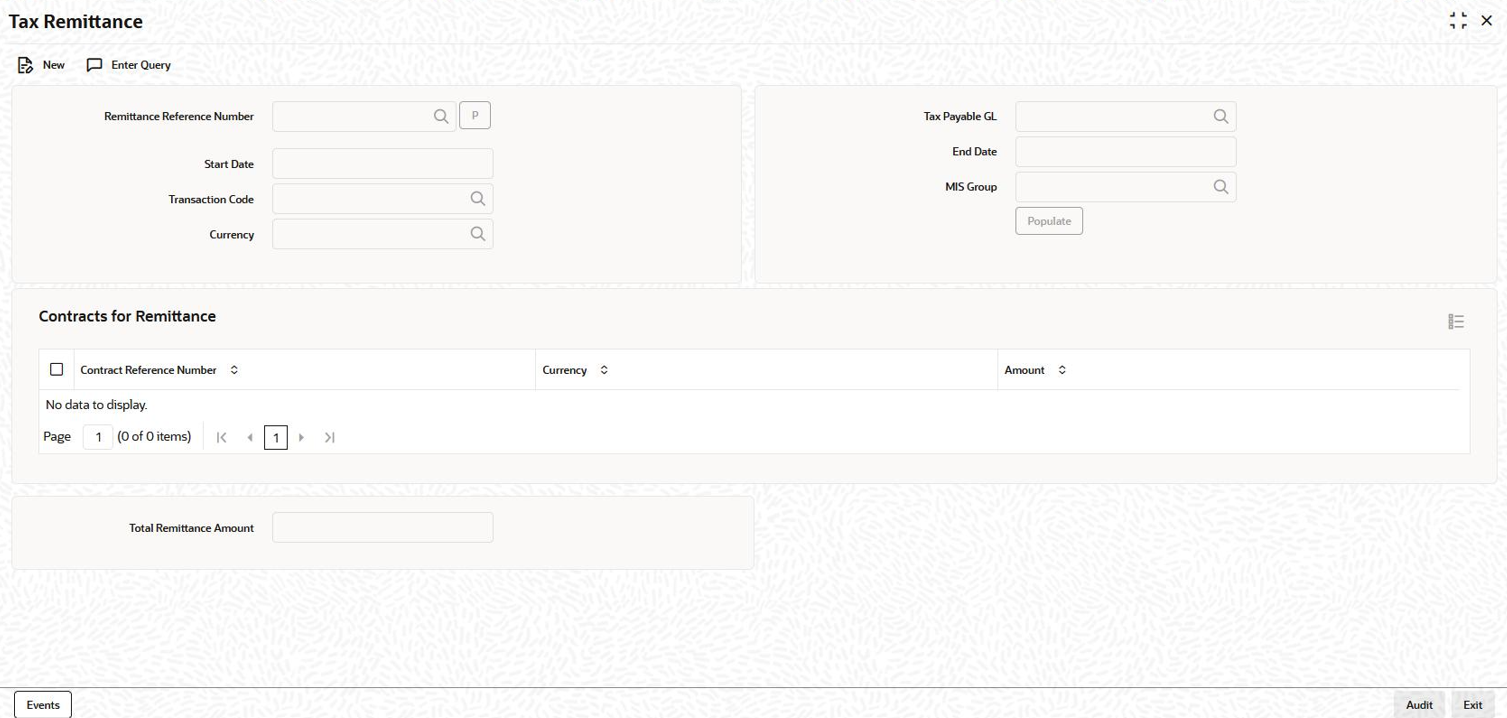

- Remitting Withheld Tax

5.13 Remitting Withheld Tax

- On the Homepage, type LBDTARMT and click next

arrow.The Tax Remittance screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - You can enter below details in this screen. For information on fields, refer to

the field description table.

Table 5-20 Tax Remittance

Fields Description Remittance Ref No For any remittance, you need to click New from menu. System generates a unique 16 digit reference number and populate the same here. For example, the format of the reference number will be as follows - CT4ZTRM043660065 where; - CT4 is the Branch Code

- ZTRM – fixed format for tax liquidation

- 04 – Year

- 366 – Julian Date

- 0065 – Sequence No.

Tax Payable GL The tax remitted amount will be credited into this GL account. The option list will display all internal GLs of the branch. Start Date Select the date from when you want to remit the tax withholdings. The drop-down list will display all the withholding tax have been booked from this date. End Date Select the date till when you want to remit the tax withholdings. The drop-down list displays all the withholding tax have been booked till this date. Transaction Code The transaction code you specify here is used to pass liquidation entries. The option list displays all transaction codes maintained in the Transaction Code Maintenance screen. For more details on transaction codes, refer the chapter Transaction Code Maintenance in the Core Services (CS) User Manual.

MIS Group Select the MIS Group from the list of values. The accounting entries are posted with MIS details associated with the MIS group. Currency This is the currency in which the tax that has been withheld needs to be remitted. Once you enter the above details, click the Populate button to view details under Contracts for Remittance. Here, system displays all the withheld tax entries for the specified period in the currency you have selected.Note:

System does not post accounting entries or fire events after remitting tax for any LB contract.If you change the Start Date, End Date or Currency, you will need to click the Populate button to update the details displayed under Contracts for Remittance.

Contract Ref No. The reference number of the facility, tranche and drawdown contracts against which the tax was withheld is displayed here. System displays the tax currency and the total tax amount that was withheld against the participants of the contract. Click Events to view the Event Log Details screen.

For more details on the Event Log Details screen, refer the section titled Viewing events for the facility in the Loan Syndication Contracts chapter of this User Manual.You can execute the following operations in the Tax Remittance screen:- Create

- Authorize

- Delete

- Query

Note:

- You cannot reverse a remittance.

- If the total amount for the specified period and currency is negative, system do not allow tax remittance for that transaction.

Parent topic: Loan Syndication Contracts - Part 2