- Loan Syndication

- Defining Products for Loan Syndication

- Creating a Borrower Tranche/Drawdown Product

- Specifying Fee Components for a Borrower Product

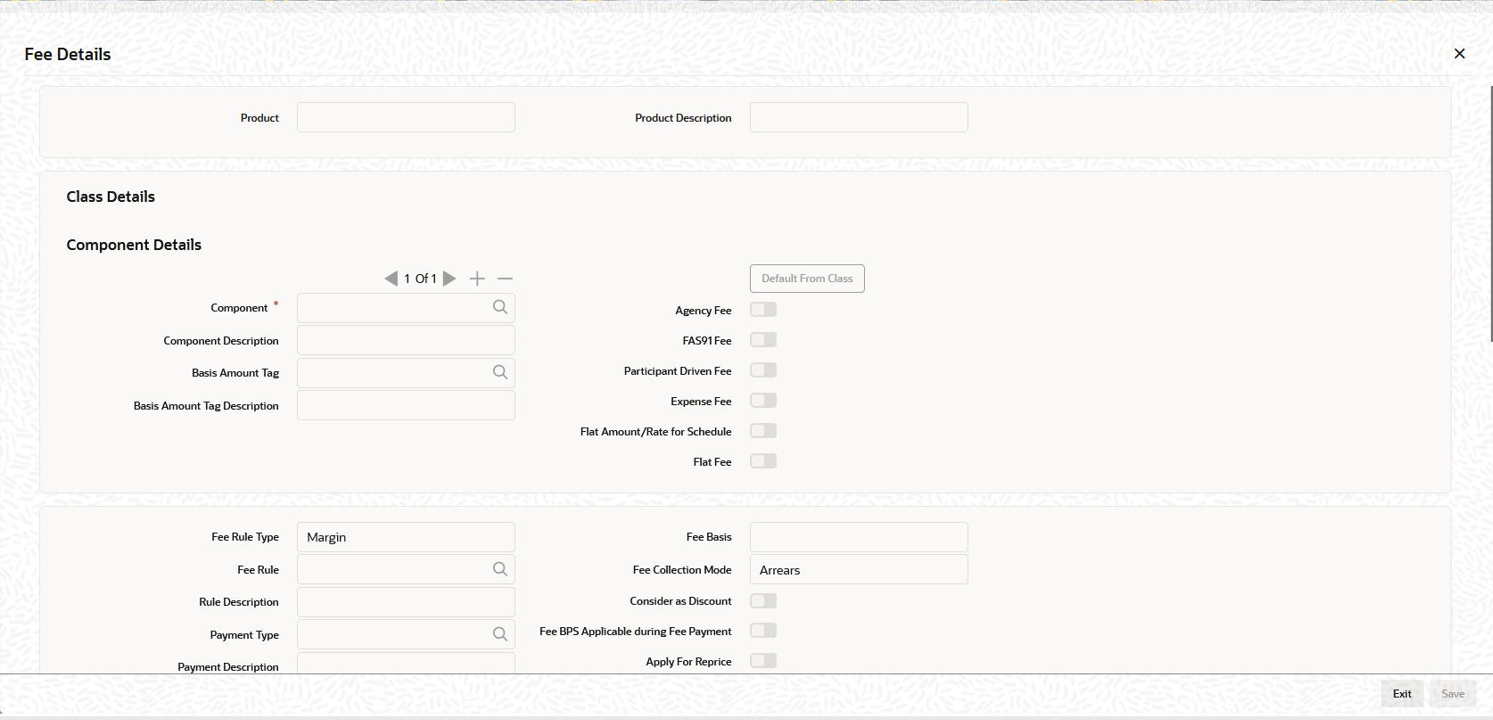

3.3.6 Specifying Fee Components for a Borrower Product

Specify the User ID and Password, and login to Homepage.

From the Homepage, navigate to Loan Syndication - Borrower Product Definition screen.

- From the Loan Syndication - Borrower Product Definition

screen, click Fee.The Fee Details screen is displayed.

Note:

The fields which are marked in asterisk red are mandatory fields. - You have the option of associating a Fee Class to the components, in which

case, the attributes of the class is defaulted to the component. To do the same,

click the Default From Class button.The fee details maintained for the fee class in Fee Class Maintenance (LFDFEECL) screen gets defaulted.

System defaults the parameters of the selected fee component. However, you can change the parameters according to your requirements.

In this screen, you associate fee components applicable for the product you are defining. Specify the following in this screen:Following are the Accounting Roles and Amount Tags when the fee is collected in advance:Table 3-8 Fee Details

Fields Description Component Enter the fee component you are maintaining details for. Description Enter a description for the fee component. Basis Amount Tag When defining fees, you can select the applicable amount tag on which the fee is to be calculated from the option list given. The following amount tags are available for a Tranche product:The following example illustrates the difference between utilized and unutilized basis amount tags with reference to Revolving and Non-Revolving tranches:- User Input – adhoc fee

- Outstanding – to collect fee on the outstanding portion of the tranche.

- COMMERCIAL_LCOS – to collect fee as a percentage of the outstanding amount of all the Commercial LC type of drawdowns linked to the tranche.

- STANDBY_LCOS - to collect fee as a percentage of the outstanding amount of all the Standby LC type of drawdowns linked to the tranche.

- ISSUER1_LCOS up to ISSUER10_LCOS – to compute fee on the outstanding amount of all the LC drawdowns for a given issuer. This fee, referred to as the issuance fee, is paid only to the bank that issues the LC. You have to define an LC Issuance Fee component to be associated with each of these ten basis amount tags.

Note:

Since issuance fee is not distributed across all the participants, the same is not displayed in the Participant Ratio Details screen. The participant who is identified as the issuer of the LC is entitled to 100% of this fee.- Utilized – to collect fee on the utilized portion of the tranche

- Unutil – to collect fee on the unutilized portion of the tranche

Example

Non-Revolving Tranche

In the case of a non-revolving tranche, the unutilized amount does not take into consideration the repayments made by the customer under any of the draw-downs under the tranche.A customer has three draw-downs of USD 100,000 each, under a tranche of USD 500,000 of which:- Draw-down 1 has been repaid

- Draw-down 2 has a total outstanding of USD 72,500

- Draw-down 3 has no repayments

- Outstanding amount : USD 172,500 (DD2-72500; DD3-100,000)

- Utilization amount: USD 300,000

- Non-utilization amount : USD 200,000

Revolving Tranche

In the case of a revolving tranche, the utilization or non-utilization amount takes into consideration the repayments made by the customer under any of the draw-downs under the tranche.Considering the same example as above, in this case:- Outstanding amount is : USD 172,500 (DD2-72500; DD3-100,000)

- Utilization amount is: USD 172,500

- Non-Utilization amount is: USD 327,500 (500,000 – 172,500)

Agency Fee If, for the fee component that you have selected, you have selected the box Agency Fee, the income on the component is meant for the leading agent alone. It does not get propagated to the participants. Note:

If you select the check box Agency Fee, the box Participant Propagation Required is disabled.FAS91 Fee Select this check box to perform FAS91 computations. The system validates if: - The Agency Fee check box is selected.

- The Basis Amount Tag is maintained as USER INPUT.

- The Fee Collection Mode is ADVANCE.

- The Accrual Required box is checked

Participant Driven Fee If you select this check box, the system allows you to define an individual fee amount for each participant. Note:

- If you check this option, you are not allowed to select the Agency Fee option.

- System performs the following validations on

checking the Participant Driven

Fee box:

- The Basis Amount Tag is maintained as USER INPUT.

- The Fee Collection Mode is ADVANCE.

- It is mandatory to check the Participant Propagation check box at the product level.

- The Accrual Parameters are disabled.

Expense Fee Select this check box to enable the expense fees. The fees can be accrued or amortized. The expenses may be flat amounts (such as Legal Fee) or rate based on a specific basis amount (such as fee paid to credit guarantor)

These are expenses incurred against a contract which the bank does not directly recover from the borrower. These expenses can be one-time expenses or periodic expenses or paid in advance or in arrears. They may be incurred at the Facility/Tranche/ Drawdown levels.In expense the fee calculation happens only within the schedule period of the contract whereas in normal arrears the fee calculation happens from the start of the contract till the schedule end date and for advance from the start of the schedule till the end of the maturity date.

For more information refer, to Expense Fee section in this User Manual.Fee Rule Type Select the Fee Rule Type applicable from the option list. You have the options ICCF and Margin. The rules are applicable depending on the rule type you select. Fee Rule Select the rule applicable from the option list given. The option list includes Fee Rules that you have defined in the Fee Rule Maintenance screen. Fee Basis The Fee Basis indicates the method in which a given fee schedule amount has to be calculated. The values in the drop-down list are: - 30(Euro)/360

- 30(US)/360

- Actual/360

- 30(Euro)/365

- 30(US)/365

- Actual/365

- 30(Euro)/Actual

- 30(US)/Actual

- Actual/Actual

- 30(Euro)/365.25

- 30(US)/365.25

- Actual/365.25

- Working Days/252

- Working Days/360

- 30/360

Fee Collection Mode While defining fees, you can specify whether the fee is to be collected in advance or in arrears. Payment Type The system displays the payment type. Fee BPS Rate Applicable Select this check box to indicate that BPS rate is applicable to the payment type. Note:

Payment Type and Fee BPS Rate Applicable options are enabled only if Basis Amount Tag is USERINPUT.- At Fee Collection (FLIQ)

- Dr/Cr Accounting Role Amount tag Amount As of the Fee Inception Date (FLIQ) Dr Customer <COMPONENT>_ LIQD (Advance fee component)

Balance for the fee basis amount tag* Fee Rate * Accrual Basis * No. of. Days Cr Fee In Advance <COMPONENT>_ LIQD (Advance fee component)

Balance for the fee basis amount tag * Fee Rate * Accrual Basis * No. of. Days - At Fee Accrual (FACR)

- Dr/Cr Accounting Role Amount tag Amount Daily Accrual (FACR) Dr Fee In Advance <COMPONENT>_ ACCR Liquidated Fee Amount / No.of. Days Cr Income <COMPONENT>_ ACCR (Advance fee component)

Liquidated Fee Amount / No.of. Days - Description of the Amount Tags

The following table gives the description of the amount tags:

Amount Tag Description CUSTOMER Borrower <COMPONENT>_LIQD Advance Fee Component Liquidated <COMPONENT>_ ACCR Advance Fee Component Accrued

- At Fee Accrual (FACR):

Accounting Role Dr. / Cr. Amount Tag Component_REC Dr. Component_FACR Component_INC Cr. Component_FACR - At Fee Collection (FLIQ):

Accounting Role Dr. / Cr. Amount Tag CUSTOMER Dr. Component_LIQD Component_REC Cr. Component_LIQD - Description of the amount tags

The following table gives the description of the amount tags.

Amount Tag Description Component_REC Fee Component Receivable Component_INC Fee Component Income CUSTOMER Borrower Component_LIQD Fee Component Liquidated Component_FACR Fee Component Accrued

This topic contains following sub-topics: