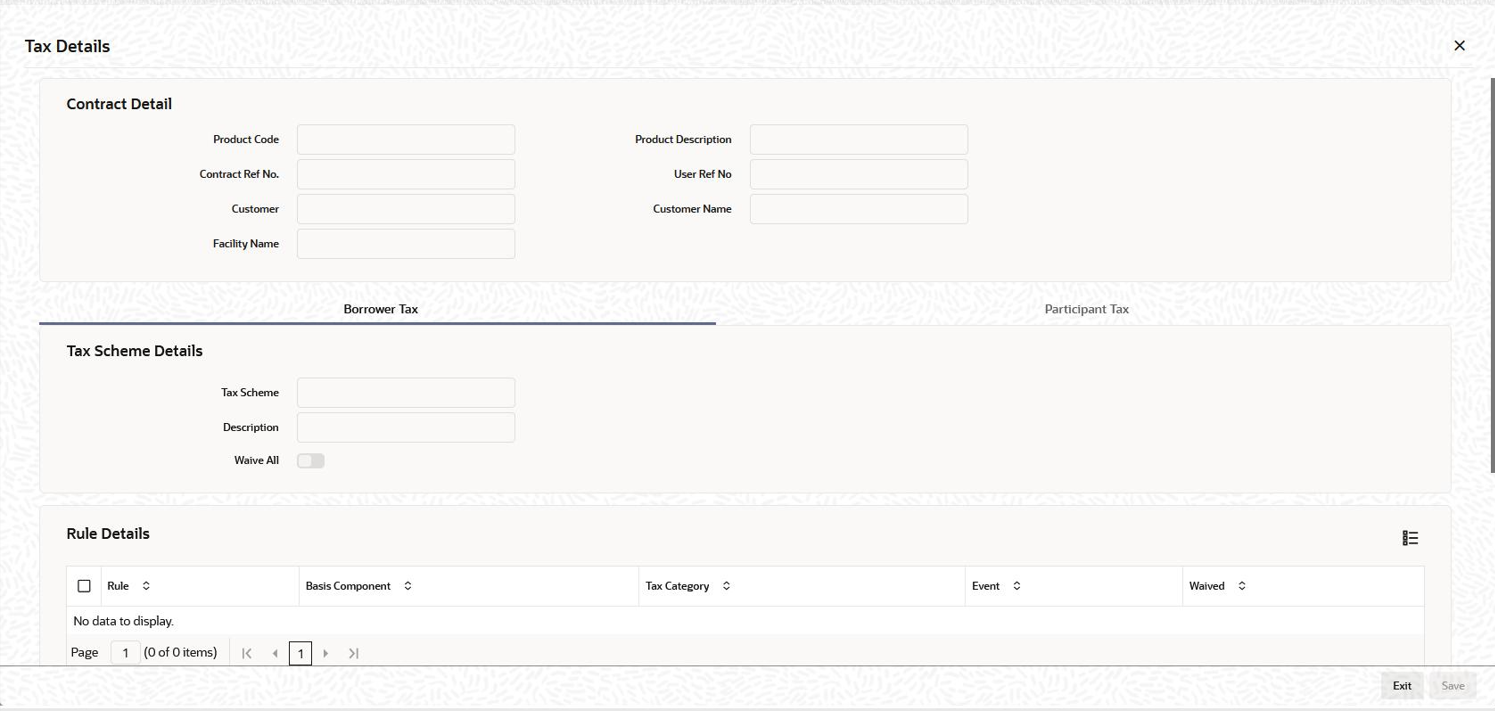

5.2.18 Tax Details

At the drawdown level, tax is applicable only on the interest and fee

component.

Specify the User ID and Password, login to Homepage.

From the Homepage, navigate to Drawdown Contract Detail screen.

Parent topic: Capturing Drawdown Details