5.2.14.4 Fixing Interest Rate for the Drawdown

Just as you fix the exchange rate for the drawdown currency, you can also fix the interest rate for a predefined period. The Interest rate fixing days refers to the number of business days before the value date of the drawdown or the new rate fix period. Interest rate fixing for the new drawdown or the new rate fix period is done on this day.

Note:

- You can fix interest rates ONLY if you have checked the Rate Fixing

Required option for the interest component at the drawdown

product level (in the Interest Definition screen).

Further, rate fixing is applicable for an interest component with the following

attributes:

- Rate Type: Fixed

- Fixed Rate type: User input

- If the UDF RATE-VARIANCE is maintained as a non-zero value for a tranche contract to which the drawdown is linked, dual authorization is required for rate changes for fixed rate contracts.

Note:

For main interest component if Rate Type is Fixed, then you can enter rate fixing details in Rate Fixing screen. In addition, you can enter the Spread and Margin Details.For more details regarding dual authorization, refer the heading titled Authorizing Overrides in the chapter titled Loan Syndication Contracts - Part 1 of this User Manual.

The system arrives at the Interest rate fixing date for the drawdown currency based on the Interest rate fixing days maintained at the tranche level and the holiday validation currencies specified for the drawdown currency.

For more details, refer the heading Specifying currency details for the tranche in this chapter.

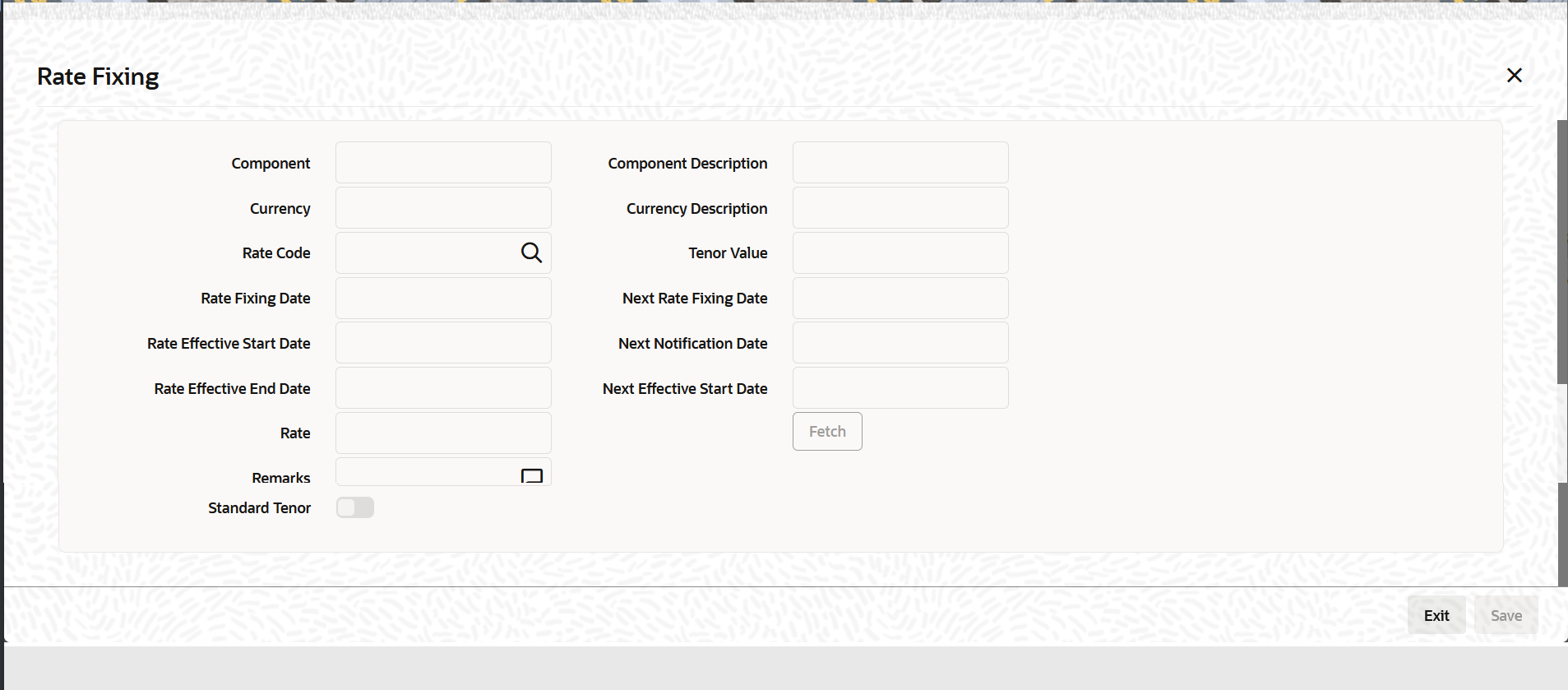

Rate Fixing Details screen

Specify the User ID and Password, login to Homepage.

From the Homepage, navigate to Drawdown Contract Detail screen.

- The ICCF Details screen is displayed.

- The Rate Fixing screen is displayed.

Table 5-10 Rate Fixing Details

| Fields | Description |

|---|---|

| Rate Code | You have to specify the floating rate code based on which you can specify the interest rate fixing tenor and the default fixing rate. |

| Tenor Value | You can specify the rate fixing period by specifying a

Tenor Value or the Rate

Effective End Date. If you are specifying a tenor,

you can select a value from the option list which displays the tenor

values associated with the rate code you select. This is based on

your maintenance in the Floating Rate Code

Definition screen. Upon choosing a value, the

following details are also displayed:

|

| Rate Effective End Date | If you do not want to specify a Tenor

Value, you have the option to capture the end date

of the rate fixing period. This date should not be less than or

equal to the Rate Effective Start Date. The

system displays the following after you specify the end date:

|

| Rate | The system defaults the interest rate based on the rate code and

the tenor value/effective end date you specify for the drawdown. You

can change the default rate, if required.

If the base rate is changed or new rate is added or the floating rate codes are changed, the system recalculates the interest. Note that it considers the margin rates maintained for the participants while recalculating the interest due for the participants. For more details on negative rate processing, refer the title Maintaining Loans Parameters Details in the chapter Bank Parameters in Core Services User Manual. |

| Remarks | You can also capture additional information, if required. This is

used only for information purposes.

Click the Ok button to save and exit the screen. |

Note:

- You have to fix the tenor and rate for the next tenor before the end of the current rate fix period. In case you fail to fix the rate for the next period, system applies zero interest rate for the rest of the period until rate fixing happens.

- Interest Rate fixing occurs on the Interest Rate Fixing date after considering the holiday preferences and the number of Interest Rate fixing days from the start of the new fixing period.

- For the first time, you can fix the interest rate as part of drawdown booking. Subsequent rate fixing should be performed through the LB Interest Rate Fixing screen.

Capturing the Value date

On click of unlock button you are allowed to capture the value date by altering the rate effective start date.Note:

- The IRAM event is registered individually for each amendment.

- After save, you are allowed to view the interest rate for both the periods, to verify the interest rate.

- You have to manually authorize both the IRAM events individually.

- If there is no value date (end date) captured or you can click the cancel button in the value date screen. The End date is disabled and you are allowed to amend only the interest rate.

- If user fixes interest rate for the new period from Interest Rate Fixing Screen, IRFX event is registered.

For details on the LB Interest Rate Fixing screen, refer the heading Fixing Interest Rate after drawdown booking in this chapter.

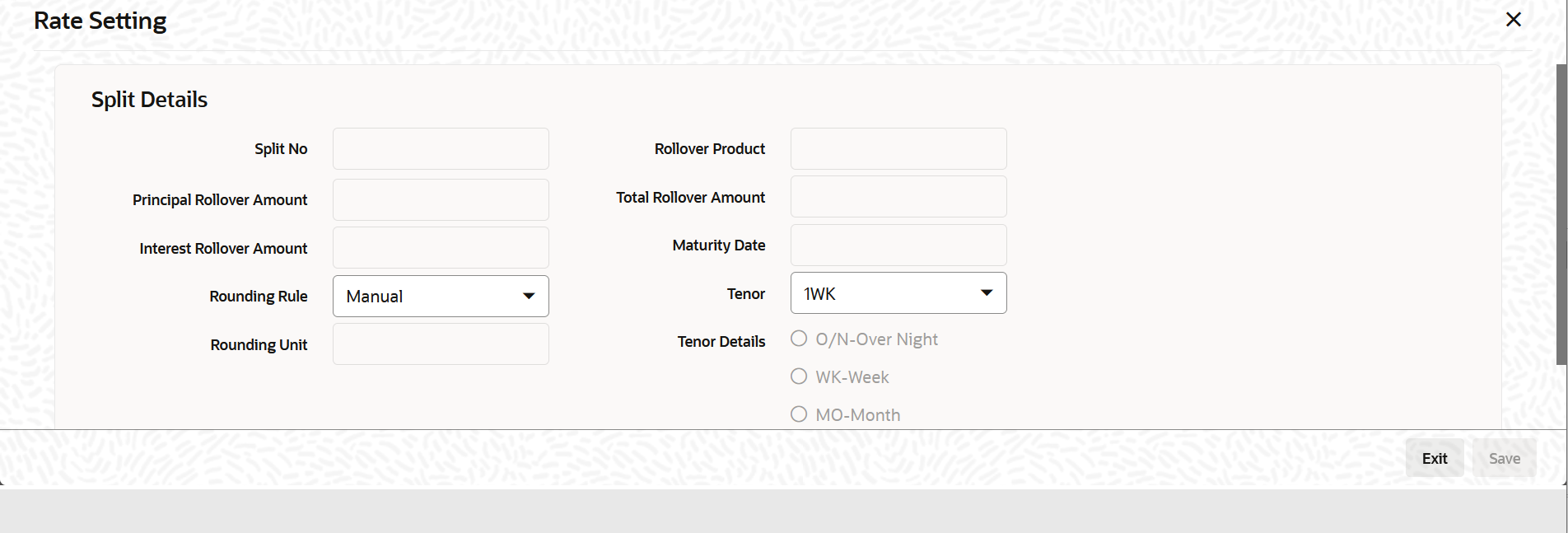

Rate Setting screen

Specify the User ID and Password, login to Homepage.

From the Homepage, navigate to Drawdown Contract Detail screen.

- The ICCF Details screen is displayed.

- The Rate Setting screen is displayed.

- Contract Details

Table 5-11 Contract Details

Fields Description Product code The system displays the product code. Contract Ref number The system displays the contract ref number. User ref number The system displays the user ref number. Customer The system displays the customer name. Facility name The system displays the facility name. - Split Details

Table 5-12 Split Details

Fields Description Split number The system displays the split number. Principal roll amount The system displays the principal roll amount.s Interest roll Amount The system displays the Interest roll amount. Roll Product The system displays the roll product. Total roll amount The system displays the total roll amount. Maturity date The system displays the maturity date. - Interest rate rounding rules

Table 5-13 Interest rate rounding rules

Fields Description Rounding rule Select the rounding rule from the adjoining drop down list. Select one of the options listed below: - Down

- Upto

- No rounding

- Manual

Rounding Unit The rounding unit enables only if the you have selected the rounding rule as Down and Upto. Interest rate period Select one of the interest rate periods from the options given. Once all the rate setting rules are maintained and when you come out of Rate Setting Rule screen by clicking OK button (Green tick), the following override messages are displayed.- If the Interest Rate Rounding Rule is Manual, then the message Rounding Rule is manual. Auto Rate Fixing will not be done is displayed.

- If Interest Rate Rounding Rule is not Manual, then the message Rounding Rule is maintained. Auto Rate Fixing will be done and rate will be defaulted is displayed. This message appears only for the future dated events / contracts.

- You are allowed to change the Rounding Rule by clicking Cancel button in the override message.

Rate Setting screen

Specify the User ID and Password, login to Homepage.

From the Homepage, navigate to Drawdown Contract Detail screen.

- The ICCF Details screen is displayed.

- The Rate Setting screen is displayed.

- Contract Details

Table 5-14 Contract Details

Fields Description Product code The system displays the product code. Contract Ref number The system displays the contract ref number. User ref number The system displays the user ref number. Customer The system displays the customer name. Facility name The system displays the facility name. - Split Details

Table 5-15 Split Details

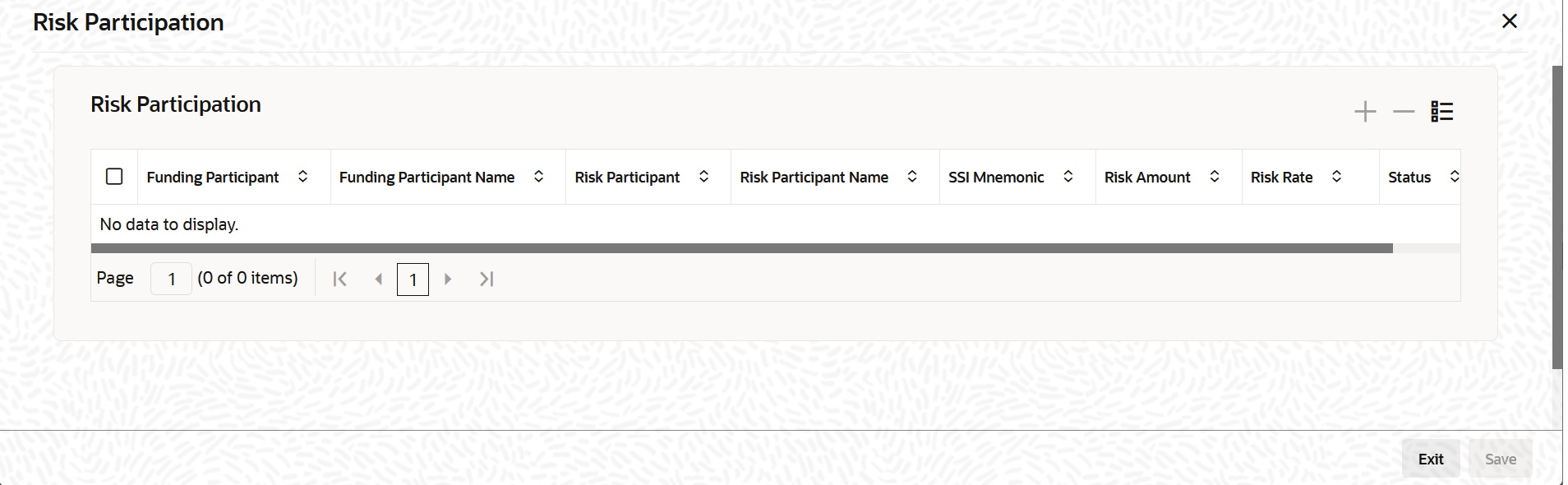

Fields Description Split number The system displays the split number. Principal roll amount The system displays the principal roll amount.s Interest roll Amount The system displays the Interest roll amount. Roll Product The system displays the roll product. Total roll amount The system displays the total roll amount. Maturity date The system displays the maturity date. - Risk ParticipationTo set the risk participation details for the borrowers drawdown, click the ‘Risk Participation’ in the ‘ICCF Details’ screen. The following details are provided in the ‘Risk Participation’ screen.

Table 5-16 Risk Participation

Fields Description Funding Participant Select the funding participant from the LOV. Funding Participant Name Based on the funding participant selected, the name automatically appears. Risk Participant Select the risk participant from the LOV. Risk Participant Name Based on the risk participant selected, the name automatically appears. SSI Mnemonic It is the settlement account for the risk participant. Risk Amount You can provide the risk compensation amount as agreed between the funding and risk participant banks. Risk Rate You can provide the risk rate as agreed between the funding and risk participant banks. The risk pay-outs are computed on this rate. The risk compensation pay-outs are defined in the form of schedules.

Status It indicates the risk participation status. It can be either Active or Cancelled (Active till cancelled)'. You can change the status from active to cancelled. Note:

Accrual computations and accounting for risk component for the self-participant portions are defined in the bilateral module.

Parent topic: Specifying Drawdown Interest Details