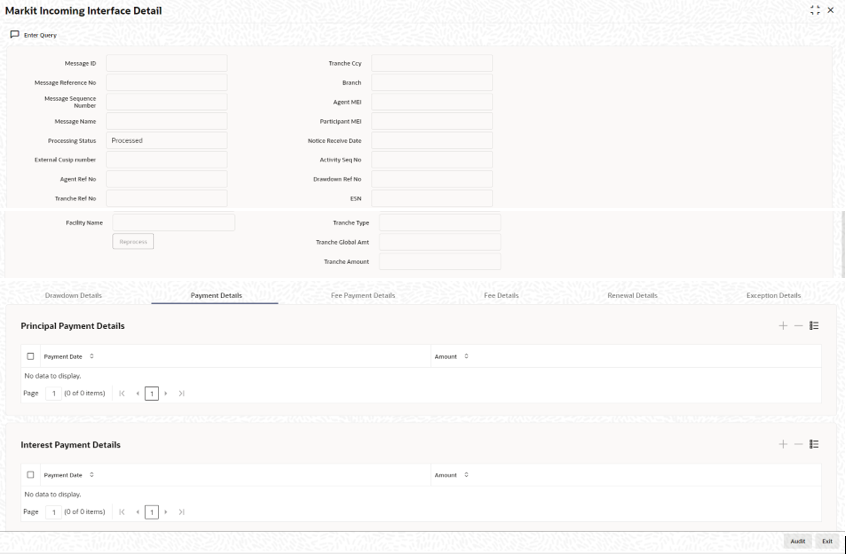

15.17.8 Interest Payment Notice (Scheduled / Unscheduled)

Incoming messages with Message Name as Interest Payment Notice is placed in the Incoming Browser with Processing Status as Pending. You can view and process it by clicking Interest Payment Details button against the message.

Based on the Agent Ref No., the system identify the drawdown for which Interest payment needs to be processed. Once the drawdown is identified, the system compares the notice date with application date to decide whether it is an intent payment / actual payment.

If the notice date is the same as application date and payment date is later than application date where Payment Date matches a defined schedule date and Liquidate Interest on Prepayment option is selected as No, then the system triggers a future value dated payment event (BLIQ) and change the Processing Status of the incoming message as Processed. The actual payment event is automatically triggered on the effective date and payment related accounting entries are posted with value date as the Payment date.

- If the Liquidate Interest on Prepayment option is

selected as No then system does the following:

- System compares the difference with the amount maintained in the field FPML Interest/Fee Payment variance which is newly introduced in the existing Loan Parameter screen.

- If the difference between the amounts is within the variance then system processes the incoming message.

- LIQD event is triggered at borrower and participant contracts to liquidate interest where the amount is as per the schedule amount due in Oracle Banking Corporate Lending.

- An override message saying difference amount is within the variance is flagged during processing and the payment message attached for LIQD event is generated.

- If the difference between the amounts is greater than the maintained variance then system marks Processing Status as Failed and log an exception difference is greater than the variance.

- If the Liquidate Interest on Prepayment option is

selected as Yes at the drawdown contract, then the system

does the following:

- System picks the message for reprocessing and marks the Processing Status as WIP with exception message saying waiting for message clipping. System then wait for the corresponding Principal Repayment Notice and once it is received system proceeds with processing after clipping both the messages. (BLIQ/LIQD may be fired based on Payment date).

If payment date does not match any defined schedule date for the interest component, then the payment is considered as unscheduled and the system checks if there are any pending schedules. If so, the system gets the earliest pending schedule date and settle this schedule only, based on the Oracle Banking Corporate Lending amount provided it is within the defined variance for interest payment. If not, the message is not processed.

- Borrower MEI not found (Borrower MEI code in the message does not match the MEI Code of the Borrower at the drawdown level).

- Payment date falling on holiday.

- If the Agent Ref No. In the incoming message does not match any active drawdown in the system, it marks the Processing Status as Failed by logging an exception Drawdown is not available.

- If the difference between schedule amount and amount in the message is greater than the FPML Interest/Fee Payment variance then system marks Processing Status as Failed and log an exception as Difference is greater the variance.

If the notice date is later than the application date and Message Name is Interest Payment Notice, the system considers the message as an Intent message and updates the Processing Status as Hold. It retains the message in the Incoming Browser till the event date and on event date during batch system updates the Processing Status as Pending so that the job picks up the incoming message for re-processing.

If the notice date and payment date are on application date, then system checks if the Liquidate Interest on Prepayment flag is Yes at the drawdown contract. For messages where the Processing Status is WIP (as mentioned above)if The Principal Repayment Notice for message clipping is not received till the end of the day then system marks the Processing Status as Failed by logging an exception saying clipping message is not received.

If the interest payment message is present in queue with Processing Status as Failed, and if the message is resent by the Agent with the same Message ID, the system picks the latter message for processing. Once the message is processed in the system, the payment cannot be amended.

Parent topic: Viewing the Markit Agency Interface Browser