15.17.9 Principal Repayment Notice (Scheduled / Unscheduled)

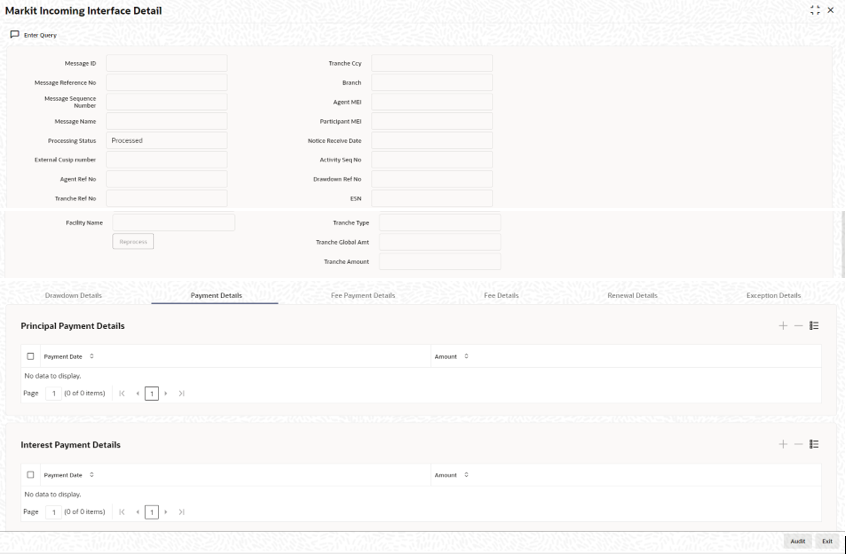

Incoming messages with Message Name as Repayment Notice is placed in the Incoming Browser with Processing Status as Pending. You can view and process it by clicking Details button against the message. The Interest & Principal Payment Details screen is displayed as shown below.

Based on the Agent Ref No system identifies the drawdown for which principal payment needs to be processed. Once the drawdown is identified, system compares the event date with application Date to decide whether it is an intent payment / actual payment.

If the notice date is earlier than application date, the system does not process the event in the system and marks the Processing Status of the Incoming Message as Pending Authentication. You can change the Processing Status to Pending or Processed.

If the notice date is later than application date, the system considers the message as an intent message and update the Processing Status as Hold. It retains the message in the incoming browser till the event date and on event date during batch, system updates the Processing Status as Pending so that the job picks up the incoming message for processing.

If the notice date is the same as application date and payment date is later than application date and Liquidate Interest on Prepayment is No then the system triggers a future value dated payment event (BLIQ) and change the Processing Status of the incoming message as Processed. The actual payment event is automatically triggered on the effective date and payment related accounting entries are posted with the value date as Payment date.

- System compares the difference if any with the amount maintained in the field FPML Principal Payment variance of Loans Parameter screen.

- If the difference is within the variance maintained then system processes the incoming message.

- LIQD event is triggered at borrower and participant contracts to liquidate Principal where the amount is as per the amount due in the system. An override messagedifference amount is within variance is flagged during processing.

- In case of full payment, the system does not mark the contract as Liquidated and it will be possible for you to use the Mark Liquidated screen to change the contract status to Liquidated.

- If the difference between the amounts is greater than variance then system marks Processing Status as Failed and log an exception Difference amount is greater than the variance.

- System picks the message for reprocessing and marks the Processing Status as WIP with exception message saying waiting for message clipping. System then wait for the corresponding Interest Repayment Notice and once it is received system l proceeds with processing after clipping both the messages. (BLIQ/LIQD may be fired based on Payment date).

- System compares the principal and interest amount for the schedule in the system with the corresponding amounts in the incoming message and processes the messages if the difference is within the threshold variance for principal and for interest. (In case of Principal prepayment, interest amount will be recalculated and this amount is compared with the interest amount in the message to check the variance).

- In case of full payment, system does not mark the contract as Liquidated and it is possible for user to use the existing Mark Liquidated screen to change the contract status to Liquidated.

If the drawdown is in currency other than USD then the variance amount is compared with the equivalent of variance for interest and principal using the latest exchange rate between the currencies.

If the payment date does not match with any defined schedule date for the Principal component, then the payment is considered as unscheduled and the system will check if there are any pending schedules. If so, the system gets the earliest pending schedule date and will settle this schedule, provided it is within the defined variance for principal payment. (BLIQ/LIQD may be triggered based on payment date). If not and if payment due date is on / after the application date system proceeds with processing the message.

- Borrower MEI not found (Borrower arrived based on the MEI code received is not matching the borrower at the drawdown level).

- Payment date falling on holiday.

- If the Agent Ref No. In the incoming message does not match with any active drawdown in the system, it marks the Processing Status as Failed by logging an exception Drawdown is not available.

- If the difference between the scheduled amount and the amount in the message is greater than Principal Payment Variance then the system marks Processing Status as Failed and log an exception Difference is greater the variance.

- On receiving a message for a Message ID that has already been marked as Processed, system marks the Msg.Seq. No as 2 and the Processing Status as Failed by logging the following exception- Message has been processed already. Payment cannot be amended.

- If the Interest Repayment Notice for message clipping is not received till the end of day, then system marks the Processing Status as Failed by logging an exception as clipping message is not received.

- If the payment date/ due date does not match any defined schedule date for the principal component, then the payment is considered as an unscheduled payment.

- System identifies the earliest pending schedule and it liquidates the schedule provided all the other validations are successful.

- If subsequent validations are unsuccessful, system updates the Processing Status as Failed by logging the relevant exception.

- If the Principal payment message is present in queue with Processing Status as Failed, and if the message is resent by the Agent with the same Message ID, the system picks the latter message for processing. Once the message is processed in the system, the payment cannot be amended

Parent topic: Viewing the Markit Agency Interface Browser