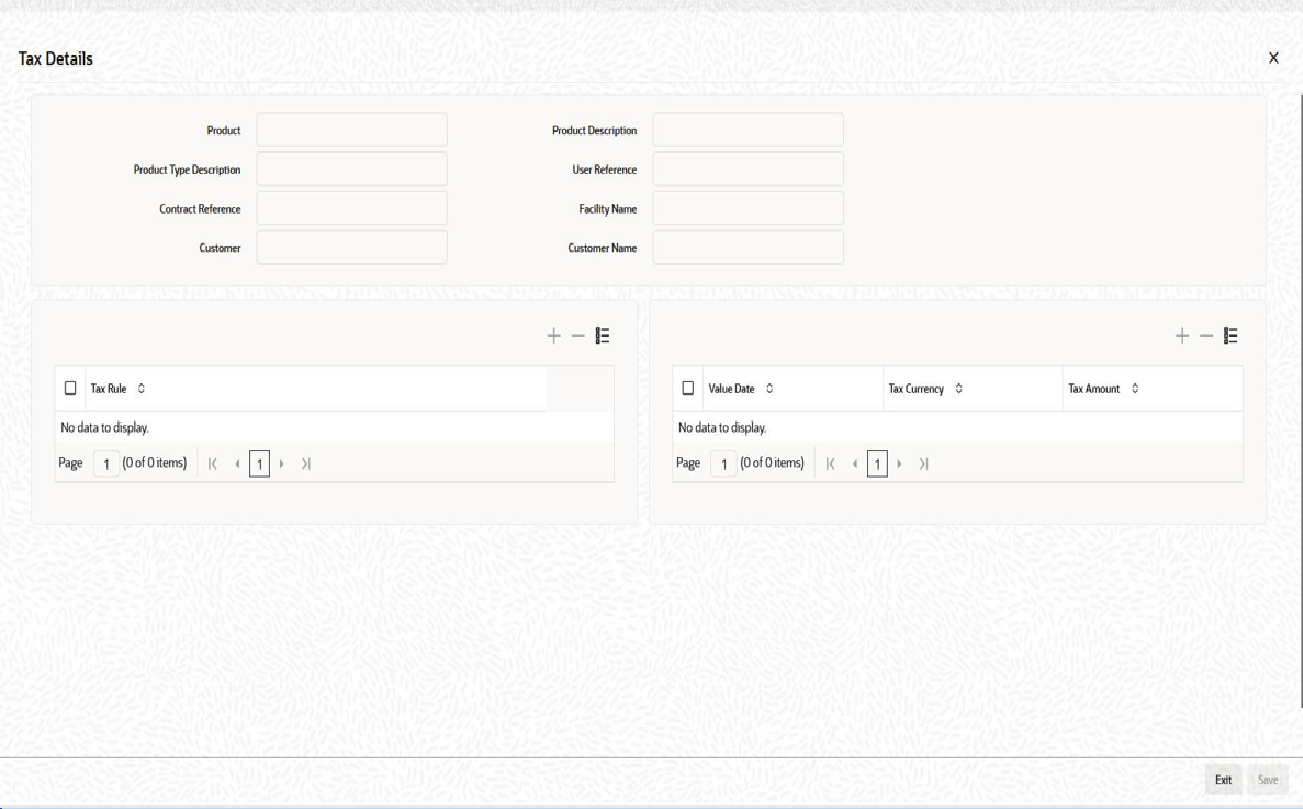

5.9.6 Viewing Participant Tax Details

You can collect withholding tax from participants on the interest and fee

components. If you have associated tax rules with the participant tranche/drawdown

product, the same is become applicable to the contract. You can view the tax details for

the contract in the Tax Details screen.

Specify the User ID and Password, login to Homepage.

From the Homepage, navigate to Participant Contract Input screen.

Parent topic: Loans Syndication – Participant Contract Online screen