1.4 Initiate Application Kick Off

This topic describes the product application process that you need to fill out to apply for the product.

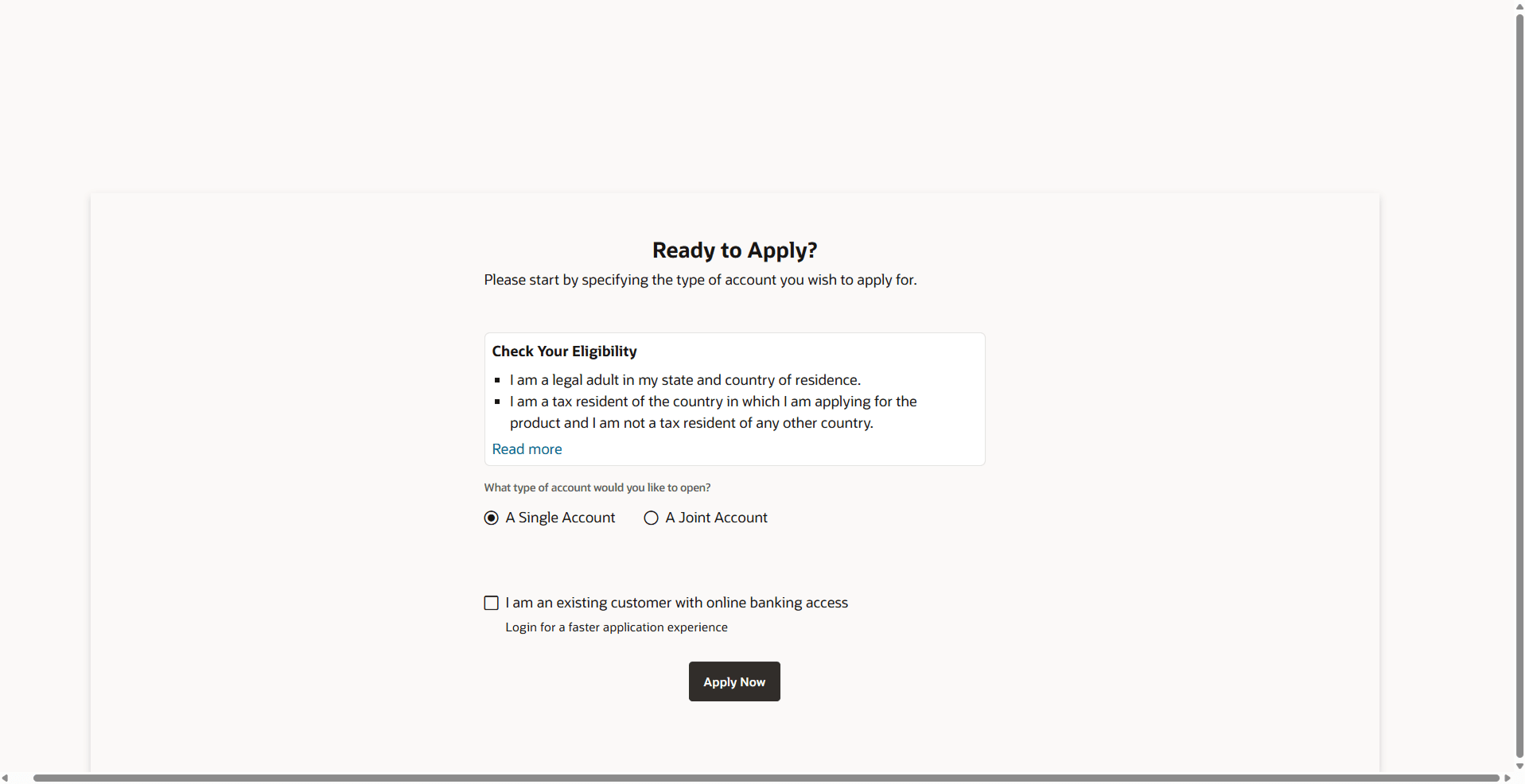

This page provides information pertaining to the application that you are required to fill out in order to apply for the product. The information will cover the eligibility criteria you are required to meet in order to apply for the product and the documents that can serve as various proofs including ID proof, address proof etc. This page also provides the means by way of which you can proceed with the application form – as an existing customer of the bank or as a guest who has no current relationship with the bank.

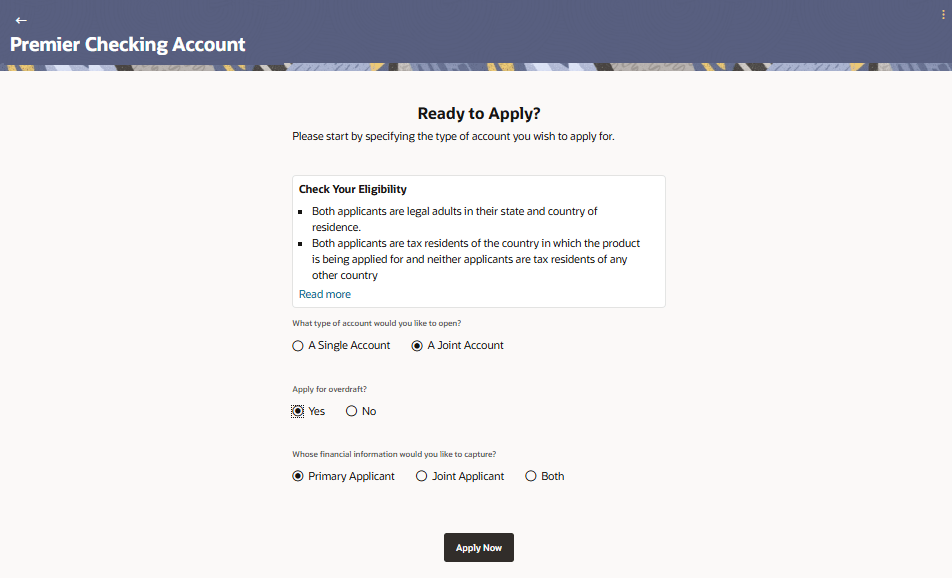

In case the product you have selected, allows for joint applications, this page will also provide the option by way of which you can choose to apply for a single account or joint account. In case you select the option to apply jointly, the eligibility criteria will reflect the conditions that both you, as the primary applicant, as well as the joint applicant, will need to meet in order to be able to apply for the account.

If you are an existing online banking customer of the bank, you can select the provided option and proceed to Login with your online banking credentials. In this case, you will be required to only specify information pertaining to the account. Information related to your personal details, etc will not be required to be entered as it is already available with the bank.

- In case of Joint Applications, OBDX only supports two applicants to apply i.e. the primary applicant along with one joint applicant.

- At present, joint online applications only support the case where both the primary and the joint applicants are prospects i.e. new to the bank.

Parent topic: Checking Account Application