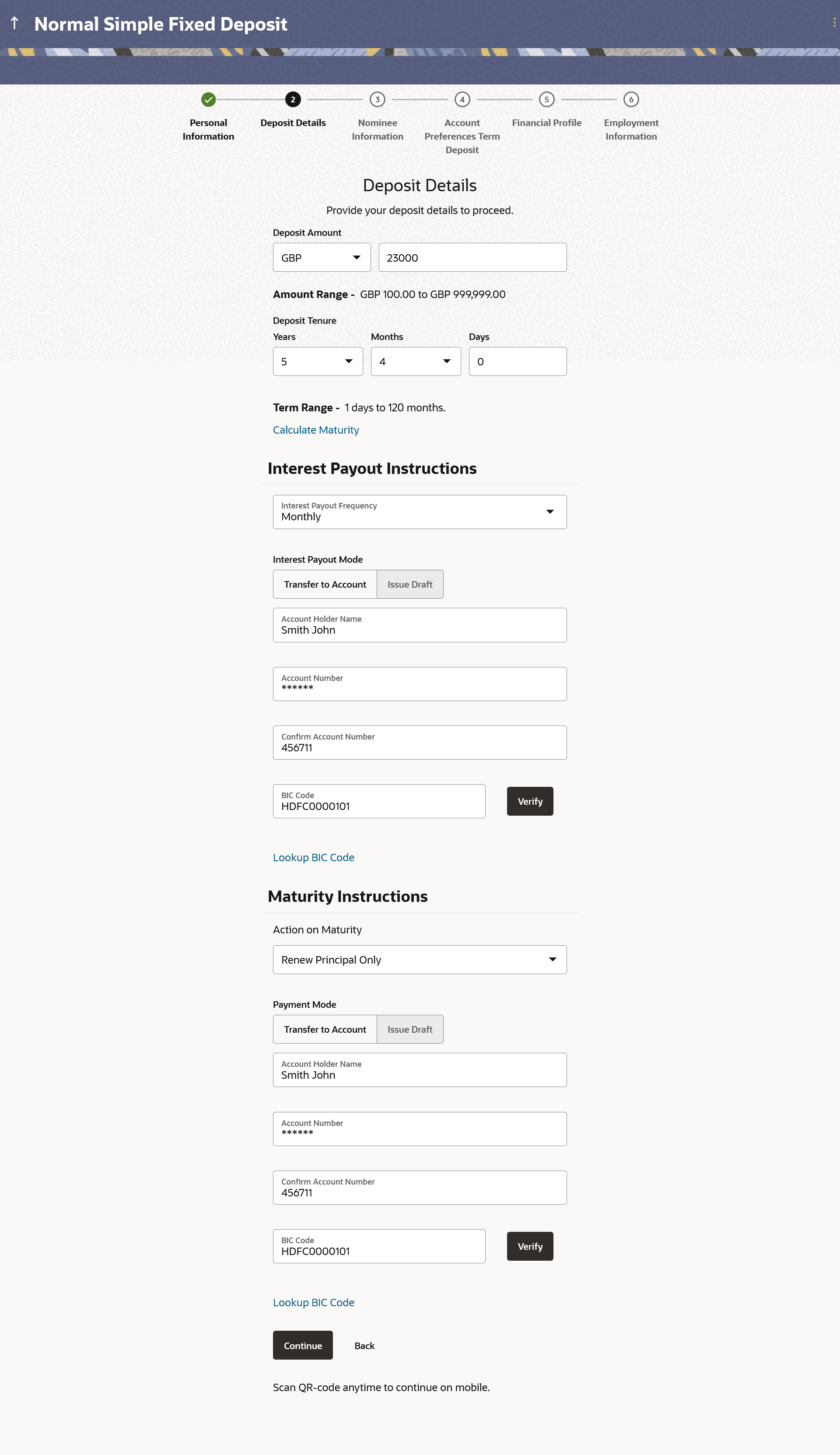

1.7 Deposit Details

This topic describes the section where you will specify details about the deposit account you wish to open.

These details will include the amount for which you wish to open the deposit, the deposit tenure and maturity instructions.

Figure 1-11 Deposit Details

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 1-10 Deposit Details - Field Description

| Field Name | Description |

|---|---|

| Deposit Amount | Specify the deposit amount and currency in which the Term Deposit is to be opened. |

| Amount Range | The allowed amount range within which the deposit can be opened is displayed. |

| Deposit Tenure | Specify the period in years, months or days for which the Term Deposit is to be opened. |

| Term Range | The allowed term range for the selected deposit product is displayed. |

| Calculate Maturity | Click on the Calculate Maturity link to view the estimated maturity amount of the deposit along with the specific interest amount that will be accrued at the specific interest rate. |

| Interest Rate | The interest rate in percentage as calculated by the system on the basis of the deposit amount and tenure. |

| Interest Amount | The interest amount as calculated by the system on the basis of the deposit amount and tenure. |

| Your Maturity Amount is | The value of the term deposit at the time of maturity will be displayed, as calculated by the system on the basis of the deposit amount and tenure. |

| Interest Payout Instructions |

This section will appear in case the deposit is a simple Term Deposit. |

| Interest Payout Frequency | The frequency at which Interest is to be paid out. |

| Interest Payout Mode |

The mode through which the interest is to be paid out on a regular basis as defined in the Interest Payout Frequency field. The options are:

|

| The following fields will be displayed if the applicant has selected the option Transfer to Account in the Interest Payout Mode field. | |

| Account Holder Name | The name of the account holder. |

| Account Number | The account number to which the interest amount is to be transferred on a regular basis. |

| Confirm Account Number | Re-enter the account number so as to confirm that it is correct. |

| BIC Code | The payment network code through which the transfer is to be made. |

| Verify | Click on the link to verify the Bank Identifier code (BIC) defined in the BIC Code field. |

| Lookup BIC Code |

The lookup for the Bank Identifier code (BIC) search. The following fields appear on a modal window if the Lookup BIC Code link is selected. |

| BIC Code | The facility to lookup bank details based on Bank Identifier code through which the transfer is to be made. |

| Bank Name | The facility to search for the BIC code based on the bank name. |

| City | The facility to search for the BIC code based on the city name. |

| Search Results | Based on search criteria or Bank Code (BIC), fetch bank details. |

| Bank Name | The name of the bank in which the account is held. |

| City | The city in which the bank is located. |

| State | The state in which the bank is located. |

| Maturity Instructions | |

| Action on Maturity |

The option to identify what should be done of the maturity proceeds once the deposit matures. The options can be:

The option Renew Principal and Interest will not appear in the Action on Maturity drop-down in case the product is a simple deposit. |

| Payment Mode |

The mode through which the maturity amount should be transferred. The options are:

This field will be displayed only if you have selected the Close on Maturity or Renew Principal only option in the Payment Mode field. |

| The following fields will be displayed if the applicant has selected the option Transfer to Account in the Payment Mode field. | |

| Account Holder Name | The name of the account holder. |

| Account Number | The account number to which the maturity amount is to be transferred once the Certificates of Deposit matures. |

| Confirm Account Number | Re-enter the account number so as to confirm that it is correct. |

| BIC Code | The payment network code through which the transfer is to be made. |

| Verify | Click on the link to verify the Bank Identifier code (BIC) defined in the BIC Code field. |

| Lookup BIC Code |

The lookup for the Bank Identifier code (BIC) search. The following fields appear on a modal window if the Lookup BIC Code link is selected. |

| BIC Code | The facility to lookup bank details based on Bank Identifier code through which the transfer is to be made. |

| Bank Name | The facility to search for the BIC code based on the bank name. |

| City | The facility to search for the BIC code based on the city name. |

| Search Results | Based on search criteria or Bank Code (BIC), fetch bank details. |

| Bank Name | The name of the bank in which the account is held. |

| City | The city in which the bank is located. |

| State | The state in which the bank is located. |

Parent topic: Term Deposits Application