10 FATCA and CRS Form

This topic describes the information about FATCA and CRS Form feature.

The Foreign Account Tax Compliance Act (FATCA) is a United States federal law that was introduced to enable the Internal Revenue Service (IRS) to obtain detailed account information of US tax payers that invest and earn income through non U.S. institutions.

The Common Reporting Standard (CRS), is a global reporting standard developed by the Organization for Economic Cooperation and Development (OECD). This information standard was brought into effect for the purpose of combatting tax evasion at a global level.

The goal of both FATCA and CRS is to enable tax authorities to obtain information pertaining to the financial assets held by their citizens in foreign or overseas financial institutions, thereby greatly strengthening global tax compliance.

The FATCA and CRS Self – Certification Forms for Individuals and Entities has been created so as to capture required information for the purposes of complying with both FATCA and CRS.

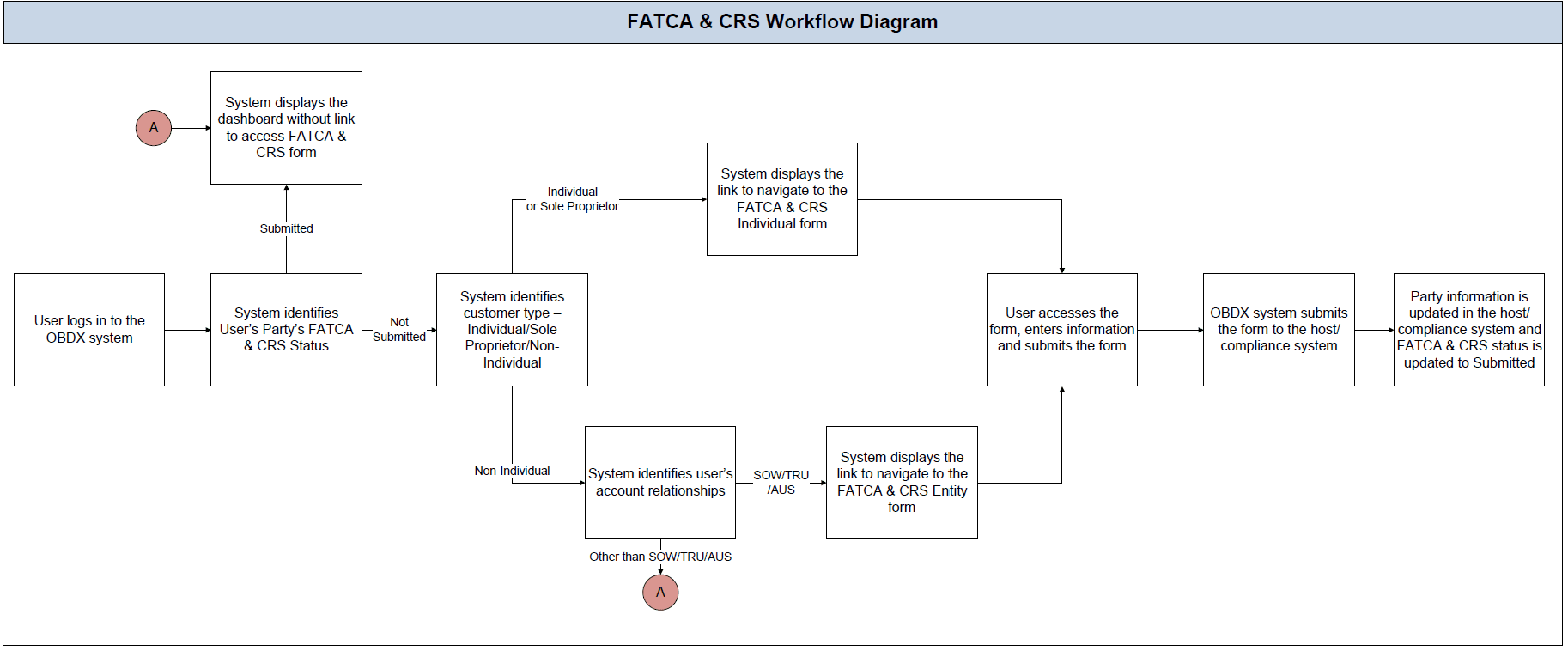

A FATCA & CRS check is maintained under system configurations by the system administrator to identify if FATCA & CRS is to be enabled or not. If enabled, every time a business user logs into the banking application, the system will identify whether the user is required to fill out the form or not and further identify the type of form to be provided to the user based on the type of user. Individuals and sole proprietors will be displayed the FATCA & CRS Self – Certification form for Individuals and Corporates and other business entities will be displayed the FATCA & CRS Self – Certification form for Entities. Moreover, the FATCA & CRS Self – Certification from for Entities will be made available only to users that are accessing the online banking services of the entities in the capacity of trustees, sole owners or authorized signatories.

This section documents the information captured in the FATCA & CRS Self – Certification forms for both Individuals and Entities.

Workflow

The following workflow identifies the steps involved in the process of capturing customer information required from the view point of complying with FATCA & CRS, considering that the FATCA & CRS check in system configuration is set to Enabled.

Navigation Path:

From the Retail Dashboard, click FATCA and CRS Self - Certification Form link, and then click FATCA and CRS self - certification Form.

- FATCA and CRS Self - Certification Form for Individuals

This topic describes the systematic instruction to FATCA and CRS Self - Certification Form for Individual option. - FATCA and CRS Self - Certification Form for Entities

This topic describes the systematic instruction to FATCA and CRS Self - Certification Form for Entities. - FAQ