10.2.1 Identification of the Entity

This topic describes the systematic instruction to Identification of the Entity section.

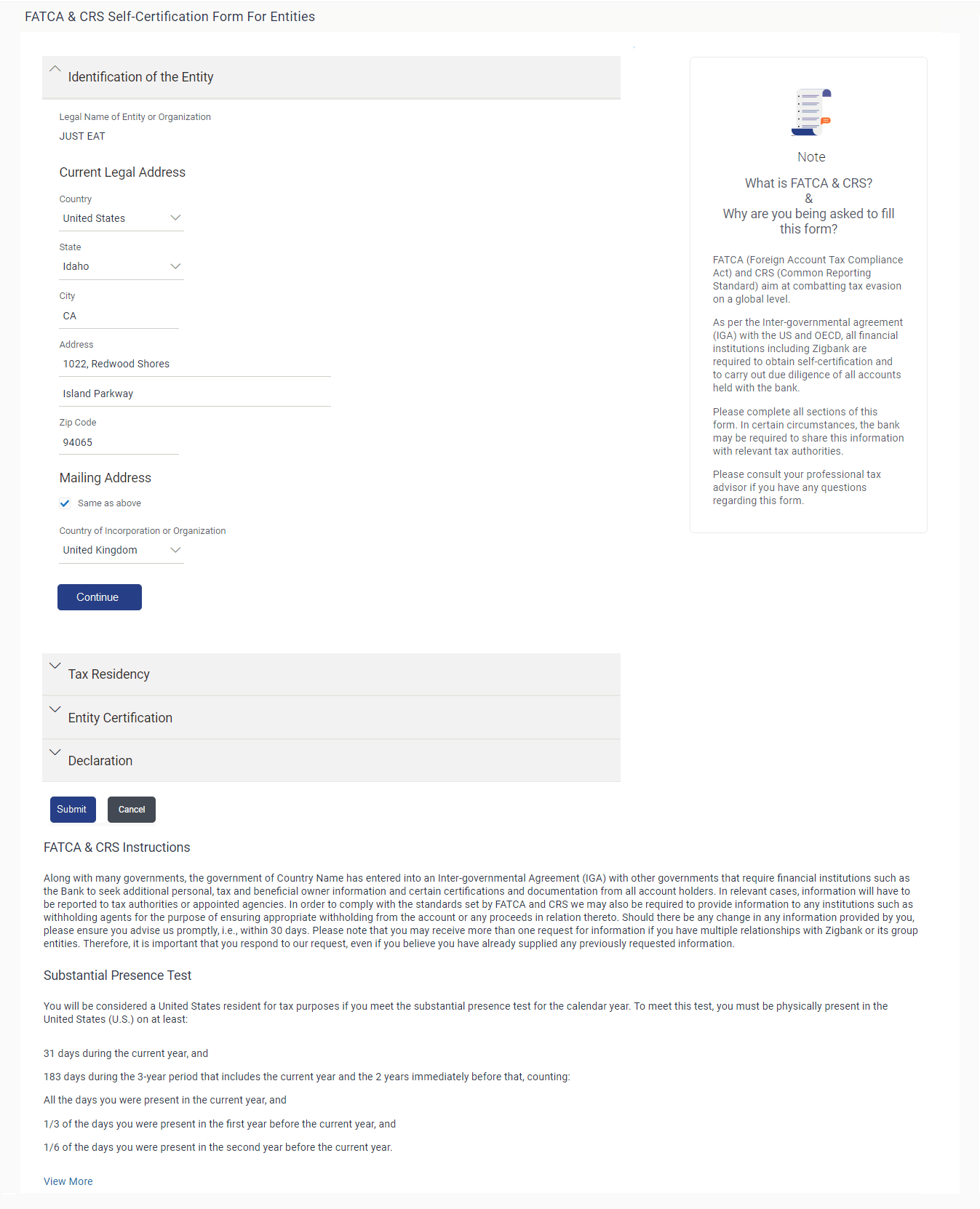

In this section, basic details of the entity are captured such as the name and address details of the entity.

Figure 10-7 Identification of Entity

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 10-4 Identification of Entity - Field Description

| Field Name | Description |

|---|---|

| Legal Name of the Entity or Organization | The name of the entity or company as maintained with the bank is displayed. |

| Current Legal Address | Information specified in below fields are related to current legal address. |

| Country | Select the country in which the entity is operating. |

| City | Enter the name of the city in which the entity has its main headquarters. |

| Address 1-2 | Enter the address details of the main headquarters of the entity. |

| Zip Code | Enter the zip code of the entity’s address. |

| Mailing Address | Information specified in below fields are related to mailing address. |

| Same as above | Select this check-box if the entity’s mailing address is the same as the current legal address. |

| Country | Select the country of the entity’s mailing address.

This field appears if the Same as above check box is not selected. |

| City | Enter the name of the city of the mailing address of the entity.

This field appears if the Same as above check box is not selected. |

| Address 1-2 | Enter the mailing address details.

This field appears if the Same as abovecheck box is not selected. |

| Zip Code | Enter the zip code of the mailing address of the entity.

This field appears if the Same as above check box is not selected. |

| Country of Incorporation or Organization | Select the country of origin of the entity or organization. |

Parent topic: FATCA and CRS Self - Certification Form for Entities