10.2.2 Tax Residency

This topic describes the systematic instruction to Tax Residency option. This section captures information pertaining to the tax residency of the entity.

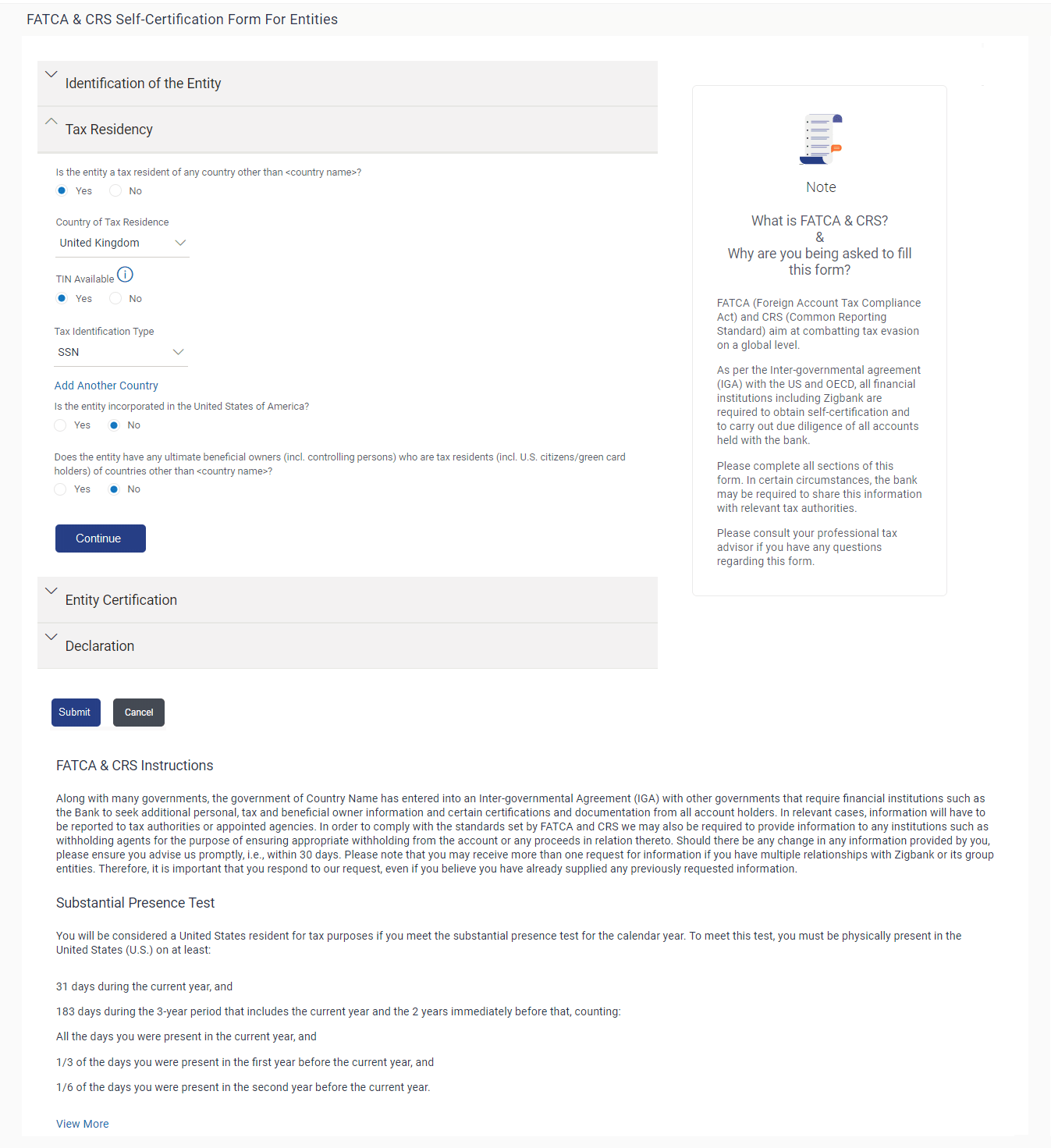

Users are required to specify whether the entity can be considered as a tax resident of any country other than the country in which its accounts are held and subsequently specify details pertaining to the countries in which the entity is a tax resident. Information specific to the entity’s operations in the United States is also captured in this section.

Figure 10-8 Tax Residency

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 10-5 Tax Residency - Field Description

| Field Name | Description |

|---|---|

| Is the Entity a tax resident of any country other than <country name>? | Specify whether the entity is a tax resident of any country other than country in which the entity’s accounts are held.

The options are:

|

| Is the entity a tax resident of any country other than <country name>? | The following fields are enabled if you have selected the option Yes against the field. |

| Country of Tax Residence | Select the country in which the entity is considered a tax resident. |

| TIN Available | Specify whether the entity's taxpayer identification number of the country of which it is a tax resident, is available or not.

The options are:

|

| Tax Identification Type | Specify the tax identification type of the entity that will be provided as proof of tax residency. The values in this list are populated based on the Identification documents that are accepted as TINs in the country that you have selected as Country of Tax Residence. This field appears if you have selected the option Yes in the TIN Available field. |

| Other Tax Identification Type | Specify the identification document of the entity that you are providing as TIN, if the tax identification type is other than the listed option in the Tax Identification Type list.

This field appears if you have selected the option Other in the Tax Identification Type field. |

| TIN/ TIN Equivalent | Specify the Taxpayer Identification number. |

| Reason for Non Availability | Specify the reason of non-availability of taxpayer identification number.

This field appears if you have selected the option No in the TIN Available field. |

| Add Another Country | The link to add details of another country in which the entity is a tax resident. You may choose to add further records, up to a defined number, if the entity is a tax resident of more than one country. |

| Remove Country | This link is displayed against the record of a country that has been added as country of tax residence. Select this link to delete the specific record against which the link is displayed. |

| Is the entity incorporated in the United States of America | Specify whether the entity was incorporated in the United States of America.

The options are:

|

| Does the entity have any ultimate beneficial owners (incl. controlling persons) who are a tax residents (incl. US citizens/ green card holders) of countries other than <country name>? | Specify whether the beneficial owners including the controlling persons of the entity/ organization are tax residents of any other country.

The options are:

|

Parent topic: FATCA and CRS Self - Certification Form for Entities