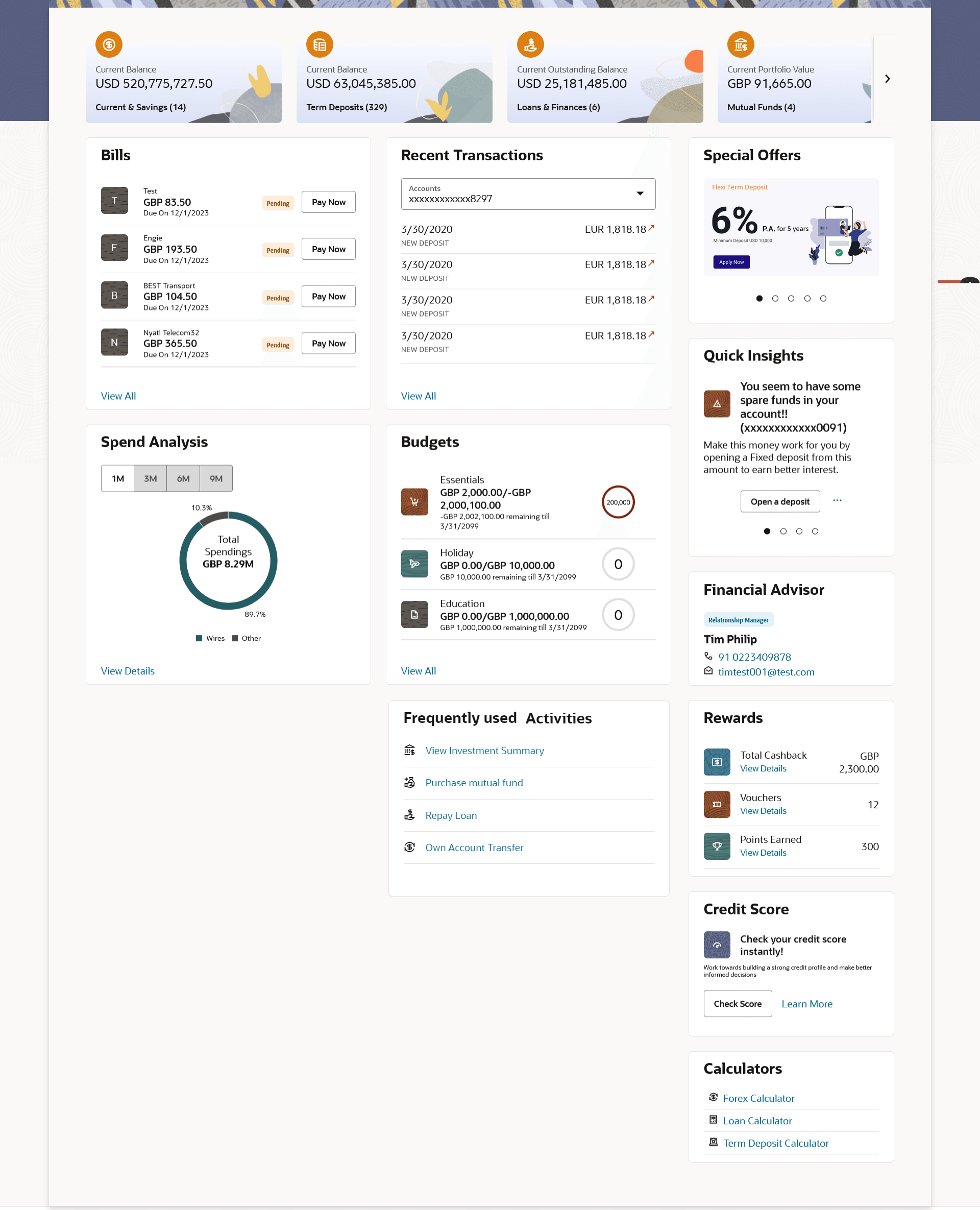

6.1 Small & Medium Business Dashboard

This topic describes the information about Small & Medium Business Dashboard screen.

The Small & Medium Business Dashboard is displayed in the form of widgets. It follows the creative concept of cards which results in an organized dashboard that engages the user and displays information that is easy to decipher.

Figure 6-1 Oracle Banking Digital Experience Dashboard

Dashboard Overview

Icons

The following icons are present on the portal page:

: The logo of the bank.

: The logo of the bank.

: Clicking this icon takes you to the Mailbox screen.

: Clicking this icon takes you to the Mailbox screen.

: Enter the transaction name and click search icon to search the

transactions.

: Enter the transaction name and click search icon to search the

transactions.

: Click this icon to view the user’s name along with the last login date and

time. Clicking on this icon displays a drop-down with the options to change

entities, view the user’s profile or to log out from the application.

: Click this icon to view the user’s name along with the last login date and

time. Clicking on this icon displays a drop-down with the options to change

entities, view the user’s profile or to log out from the application.

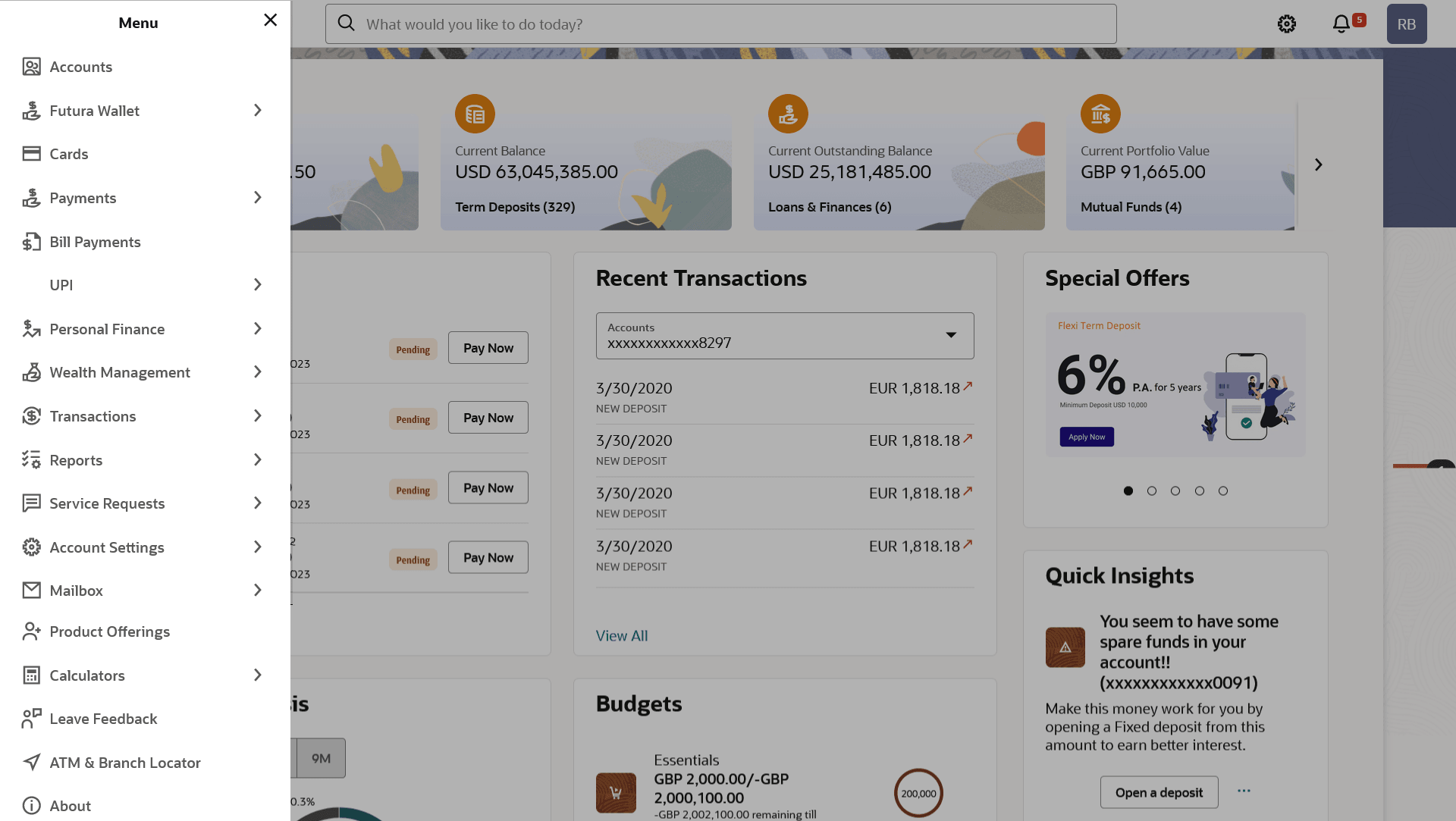

: Click the toggle menu to access various transactions.

: Click the toggle menu to access various transactions.

: Click this icon to close the toggle menu. This icon appears if the toggle

menu is open.

: Click this icon to close the toggle menu. This icon appears if the toggle

menu is open.

Header Menu Options

- Preferred Language :Click on the

, and click Langauge to set your desired language to use the

application.

, and click Langauge to set your desired language to use the

application.

- Select Entity: Users with multiple relationships (Retail and

Business relationships) will be able to login using single login credentials. Click

on

icon and then click on the Entity, then select your desired entity.

Based on the selected entity, the parties within it and listed for selection.

icon and then click on the Entity, then select your desired entity.

Based on the selected entity, the parties within it and listed for selection.

Note:

- For Oracle Banking Digital Experience profile, 'Personal' will be shown in the party expansion. On selecting 'Personal', the Party Name will be shown next to the user initials.

- For all business profiles, the Business Names will be shown in the party expansion as well as next to the user initials.

- If the user has presence only in a single entity with single party, then the entity value will not be available in the drop-down.

FATCA & CRS link

Click the link to access the FATCA and CRS Self – Certification Form so as to provide information required by the bank to comply with the FATCA and CRS regulations. This link will be displayed on the dashboard only if you are required to submit the FATCA & CRS Self-Certification form.

Following items are present on the Toggle Menu:

: This menu consists of sub menu items like Current and Savings account,

Term Deposits and Loans and Finances to navigate to the respective account related

transactions.

: This menu consists of sub menu items like Current and Savings account,

Term Deposits and Loans and Finances to navigate to the respective account related

transactions.

: This menu contains options to access all the wallet related transactions

and screens.

: This menu contains options to access all the wallet related transactions

and screens.

: This menu contains options to access all the wallet related transactions

and screens.

: This menu contains options to access all the wallet related transactions

and screens.

: Click here to access Payments related transactions or setting up of

payments.

: Click here to access Payments related transactions or setting up of

payments.

: Click here to access the Electronic Bill Payments and Presentment related

transactions.

: Click here to access the Electronic Bill Payments and Presentment related

transactions.

: Click this menu to manage your Letter of Credits (LCs), Bills, Guarantees,

Line Limits and Beneficiary maintenance for trade finance.

: Click this menu to manage your Letter of Credits (LCs), Bills, Guarantees,

Line Limits and Beneficiary maintenance for trade finance.

: Click here to access the UPI Payments transaction.

: Click here to access the UPI Payments transaction.

: Click this menu to plan finances and track expenditure. It consists of sub

menu items like Goal, Spends and Budget.

: Click this menu to plan finances and track expenditure. It consists of sub

menu items like Goal, Spends and Budget.

: Click this menu to access the wealth management related transactions.

: Click this menu to access the wealth management related transactions.

: Click this menu to raise a new service request and track the status of a

service request.

: Click this menu to raise a new service request and track the status of a

service request.

: Click this menu to manage your virtual accounts.

: Click this menu to manage your virtual accounts.

: Click this menu to view the Mails, Alerts and Notifications.

: Click this menu to view the Mails, Alerts and Notifications.

: Click this menu to apply for a new account.

: Click this menu to apply for a new account.

: Click this menu to access financial calculators to do certain

calculation.

: Click this menu to access financial calculators to do certain

calculation.

: Click this menu to leave your feedback about the user interaction of the

application.

: Click this menu to leave your feedback about the user interaction of the

application.

: Click to view the address and location of the ATMs and the branches of the

Bank. For more information refer ATM & Branch

Locator section.

: Click to view the address and location of the ATMs and the branches of the

Bank. For more information refer ATM & Branch

Locator section.

: Click this menu to track your loan, trade finance and credit facility

applications.

: Click this menu to track your loan, trade finance and credit facility

applications.

-

: Click this menu to launch the online help.

: Click this menu to launch the online help.

: Click this menu to log out of the application.

: Click this menu to log out of the application.

Overview

This section displays an overview of the customer’s holdings with the bank as well as links to various transactions offered to the customer. The Overview widget displays the customer’s holdings in each account type such as Current and Savings Accounts, Term Deposits, Loans Credit Cards, and Mutual Funds. The user can select an account type in order to view details of each account belonging to that specific account type. It is a container and user can scroll from left to right, right to left.

Note:

If the user does not have any Loans, Credit Cards and CASA - On the empty state screen, when the Oracle Banking Digital Experience user selects a product for CASA, loans or credit cards, then the user is re-directed to the origination flow.If the user does not have any Term Deposits and Recurring Deposits - On the empty state screen, when the Oracle Banking Digital Experience user selects a product for recurring or term deposit, then the user is re-directed to the NewTerm Deposits or New Recurring Deposits screen.

The account types the can be listed in this widget are as follows:

- Overview

- Recent Transactions

- Financial Advisor

- Special Offers

- Budgets

- Spend Analysis

- Quick Insights

- Bills

- Calculators

- Credit Score

- Rewards

The Overview widget displays cross sell cards i.e. cards which enable the user to navigate to the other modules of the bank. The Overview widget displays the customer’s holdings in each account type such as Current and Savings Accounts, Term Deposits, Loans, Credit Cards, and Mutual Funds as well as links to various transactions offered to the customer. The widget displays details specific to that account type, such as summary of that specific module which consists of information like the total count of accounts/loans/cards, etc. held by the customer with the bank along with information such as the current balance across all accounts of that module, total dues (in case of credit cards), the total amount of loan outstanding, etc.

On clicking on any account type card, the summary page gets displayed which consist of information such as the total count of accounts/loans/cards, etc. held by the customer with the bank, along with information such as the current balance across all accounts of that module, total dues (in case of credit cards), the total amount of loan outstanding, etc. on next page.

Note:

The Overview widget is applicable for both desktop and mobile (responsive) view.Quick Insights

This widget will display notifications to the user based on events such as when the user’s term deposit is nearing maturity or has matured, an upcoming credit card bill due date, etc. A separate card will be displayed for each event and the user will be able to take actions as provided on each card. Multiple cards can be displayed at a time in the widget and the user will be able to scroll through the cards. Following are the insights are added for Oracle Banking Digital Experience user:

- Personal Loan to Credit Card user: If a credit card customer is making partial credit card payment or if the credit card payment is overdue, an Insight will be shown to the customer to avail a Personal Loan from the bank to pay the credit card outstanding amount.

- Investment advice on deposit maturity: If a user’s Deposit account has just matured, an Insight will be shown to invest the proceeds in another Deposit account to get better returns as compared to just keeping the funds in the savings account.

- Investment advice on Excess funds: If a user‘s Savings Account has some excess funds (amount threshold defined by the bank admin), an Insight will be shown to invest the excess amount in a Deposit account to get better returns as compared to just keeping the funds in the savings account.

- Renewal advice for deposit nearing maturity: If a user’s Deposit account is nearing maturity and auto-renew is set to Off for the deposit, then an Insight will be shown to user to enable auto-renew for the deposit

- Warning on insufficient funds: If the user’s account does not have sufficient funds for upcoming payments scheduled for the current month, then a warning is shown to the customer. There are options to see the details of the upcoming payments as well as to add funds to the account.

- Relevant activities for the customer: There is a widget that lists the frequently used activities by the user. It allows the user to quickly navigate to the desired section of the application.

Recent Transactions

This widget displays the recent activity in the user’s Savings, Term Deposit and Loans accounts. It displays the date of transaction, a description of the transaction and the debit / credit amount. The user can select an account number of a particular account type, to view the recent account activity of that account.

Click the View All link to view the statements of the selected account type.

Bills

The Bills widget enables the Oracle Banking Digital Experience user to access the Electronic Bill Payments and Presentment related transactions. Different bills are placed on the widgets, which enables the users to pay utility bills towards various types of billers such as payment, payment and presentment or recharge. All the bills, that are due to be paid are listed in this widget, users can pay their bills easily and quickly. The bill payments widget enables the user to gain easy access to the following transactions and features:

- Pay Now: This feature enables users to pay utility bills towards various types of billers like payment, payment and presentment, recharge.

- View All :This feature enables users to view all the billers.

Spend Analysis

This section displays the spending analysis of the customer. The user can view the total expenditure incurred during the past 1/3/6/9 months. Click the View All link to open the Spend Analysis transaction screen.

Goals

This widget displays all the active goals that are created by the user. Click the Add Goal link to open the My Goal transaction screen from which the customer can view, modify, contribute to a goal or even withdraw some amount from a goal.

Budgets

This widget displays the all the budgets created by the user. Click the View All link to open the Budgets transaction screen where all budgets are listed. It allows user to view, edit and delete budget.

Calculators

This widget showcases financial calculators which helps users to do certain calculation helping to take a decision with some predefined criteria. Banks can provide details of their products and offers such as loan interest rates, fixed deposit interest rates, loan tenure etc. through calculators. Users can also use these calculators to compare different offers and products offered by the bank.

Oracle Banking Digital Experience provides calculators which banks can offer to their users on their digital channel. Calculators can be used by customers as well as prospects.

The different calculators offered are:

- Loan Calculator

- Term Deposit Calculator

- Forex Calculator

Credit Score

This widget assists users in comprehending their current credit status more effectively.

Rewards

This widget presents the rewards points, vouchers, and total cashback accumulated by the user, enabling them to redeem these for merchandise, gift vouchers, or air miles as desired.

Financial Advisor

This widget displays the names and contact details of the user’s relationship manager. If the relationship manager is not assigned to the user, then bank’s contact details are displayed .

- Click

Up arrow to go back to the previous page.

Up arrow to go back to the previous page.

- Oracle Banking Digital Experience User can access the transactions under 'More Actions' based on the status of Credit Card/ Debit Card/ Loan Account/ Term Deposit account/ CASA account.

- All transactions are supported on Desktop, Mobile and Tablet form factor.

Parent topic: Dashboards