6 Repayment

This topic describes the quick and convenient online loan and finance repayment option, which allows users to initiate payments against outstanding amounts using the digital banking platform.

Customers can make a payment equal to the installment amount, lower than or more than the installment amount of the loan account. If the amount is higher than the installment amount, it can be considered as partial payoff or full settlement (depending upon the penalties and charges settings at the host).

Note:

If customer makes a payment equal to the total outstanding loan amount (inclusive of arrears), it may lead to settlement of the loan account, depending upon the configuration (premature penalty/any charges) at the host system.To repay the loan partially or completely:

- Perform anyone of the following navigation to access the Loan & Finance

Repayment screen.

- From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Loans & Finances tab, and then click Loans & Finances Account Number. From the Loans & Finance Details page, click on the More Actions, and then click on the Loan & Finance Repayment.

- From the Search bar, type Loan & Finances – Loan & Finance Repaymentand press Enter.

- On the Dashboard, click Overview widget, click Loan & Finances card, then click Loans & Finances Account Number. From the Loans & Finance Details page, click on the More Actions, and then click on the Loan & Finance Repayment.

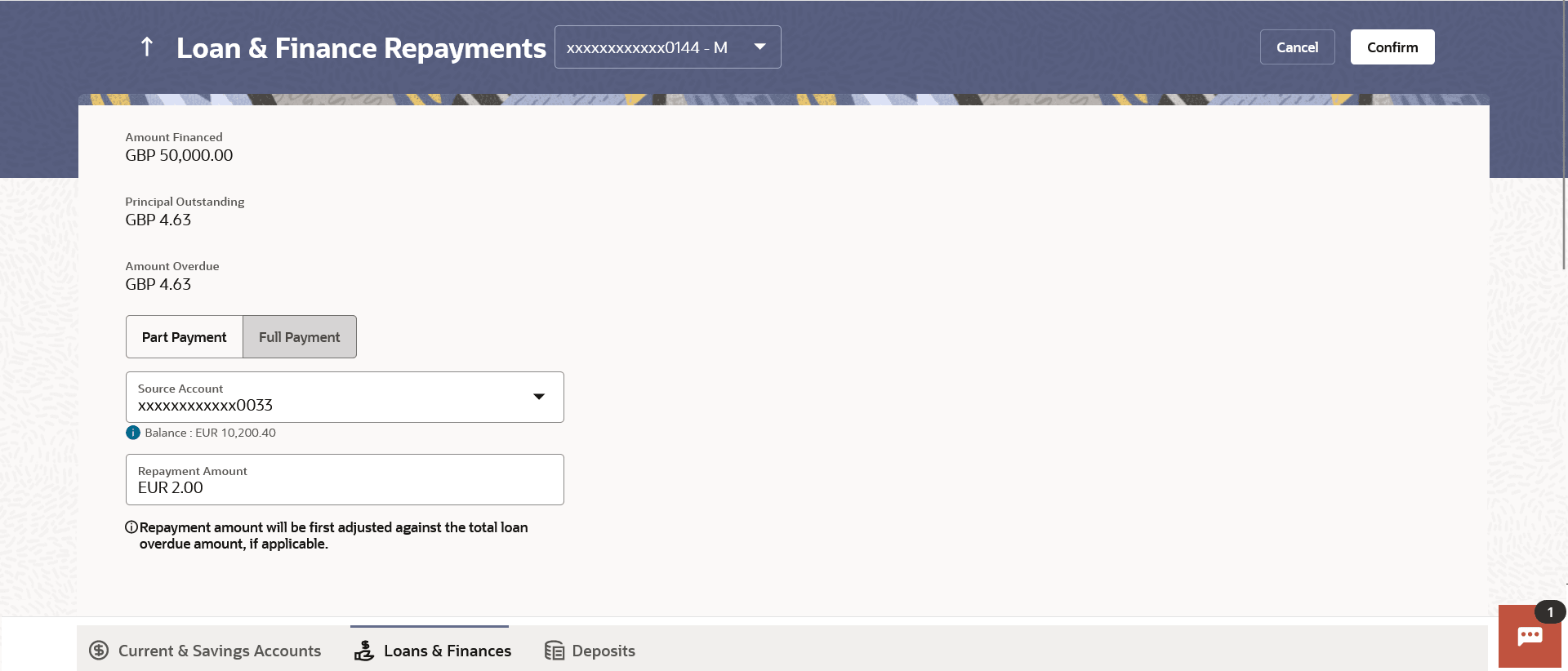

The Repayment screen appears.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 6-1 Loan & Finance Repayments - Field Description

Field Name Description Loan Account All the loan accounts of the user will be listed in a drop-down in masked format along with nicknames, if defined. The user can select the loan account which is to be repaid. The account number will be masked as per account number masking configurations. For more information on Account Nickname, refer Account Nickname.

Amount Financed The total financed amount, in local currency, that has been lent by the bank to the party. Principal Outstanding The outstanding principal balance that is yet to be repaid. Amount Overdue The overdue amount, if any. This amount is the summation of the principal, interest and charges (if any). What do you want to do? The options of paying off the loan partially or completely. The options are:

- Part Payment

- Full Payment

The order in which the fields below are displayed, will vary based on the option selected in this field.

Source Account The user’s linked current and savings accounts that can be debited to make the loan prepayment, will be listed in a lists. The account number will be masked as per account number masking configurations and nicknames, if set, will be displayed against each account. For more information on Account Nickname, refer Account Nickname.

Current Balance The current balance of the selected source account. This amount will be displayed against the source account field when an account has been chosen from the list. Principal Outstanding The amount of principal outstanding on the loan. Interest The interest component of the amount that is due. This field appears if the user selects the Full Payment option in the Repayment Type field.

Charges The charge that is due.

This field appears if the user selects the Full Payment option in the Repayment Type field.

Repayment Amount The amount to be repaid. Payment currency is defaulted to loan account currency. This field is editable only if the user selects the Part Payment option. In this case, the amount should be less than the outstanding principal balance. If the user selects the Full Payment option, then this field displays the total outstanding amount, which will include the principal, the interest and pre-payment charges.

Note:

The Source Account should have sufficient balance to cover the repayment amount. - From the Select Account list, select the loan account which is to be repaid.

- From the What do you want to do? field, select whether the loan must be paid off partially or fully.

- From the Source Account list, select the CASA account from which the repayment is to be made.

- If the Part Payment option has been selected,

- In the Repayment Amount field, enter the repayment amount.

- Perform one of the following actions:

- The Confirm.

- Click Cancel to cancel the transaction.

- A message confirming the repayment appears, along with the transaction reference number.

- Perform one of the following actions:

- Click Transaction Details to view the details of the transaction.

- Click Loan Details to view the Loans & Finance account details.

- Click on the View Loans link to visit Loans & Finance accounts summary page.

- Click on the View Transactions link to view the transactions in the Loans & Finance account.

- Click on the Go To Dashboard link to navigate back to dashboard page.