3.1 New Conventional Term Deposit

This topic provides the systematic instructions for user to apply for new term deposits.

The Small & Medium Business user can open new conventional term deposit account based on the CASA accounts.

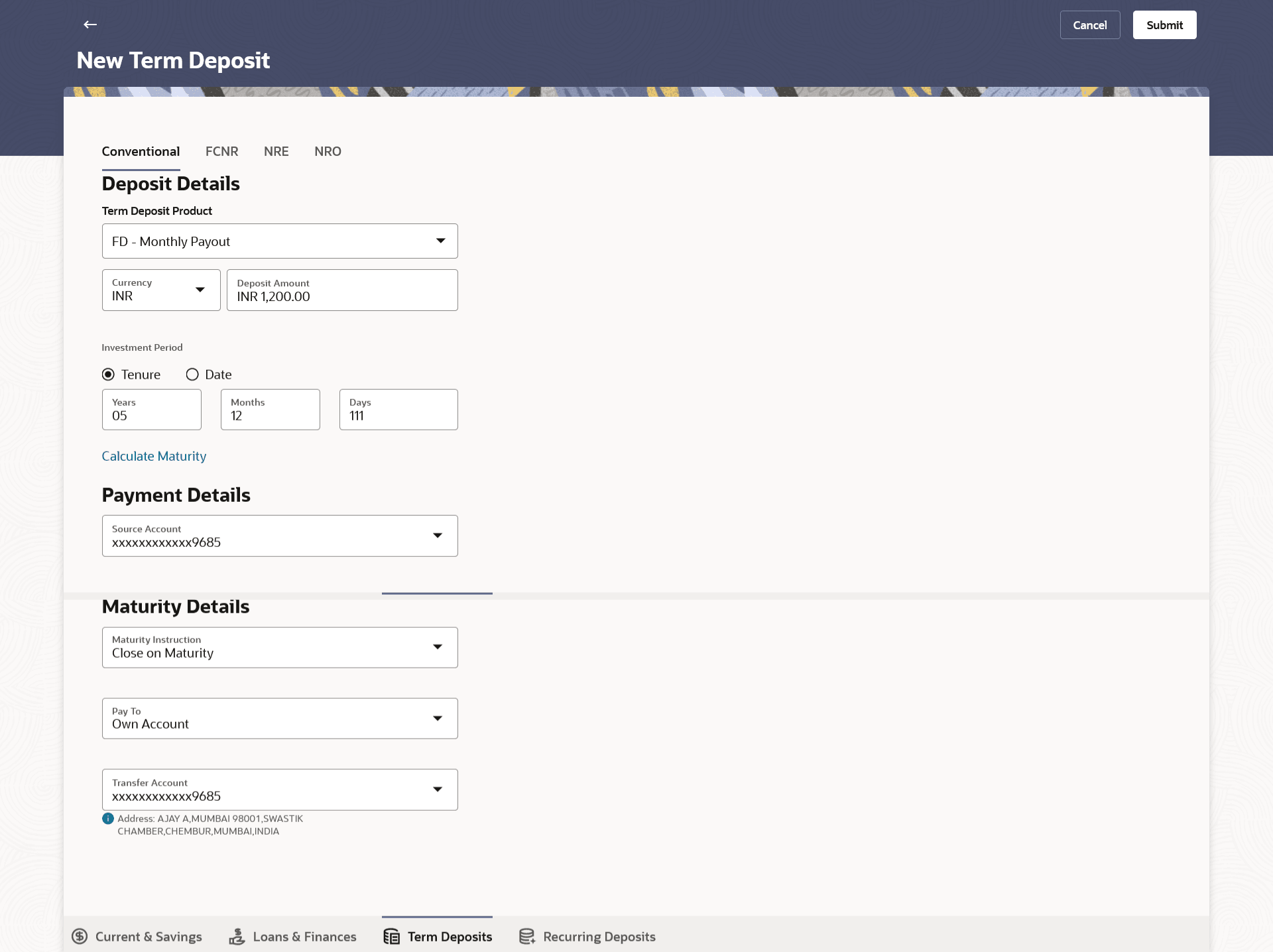

To open a new conventional term deposit:

- To access the New Term Deposit screen, refer Step 1- New

Term Deposit under Oracle FLEXCUBE Core Banking transaction.The New Term Deposit screen appears.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 3-1 New Conventional Term Deposit - Field Description

Field Name Description Deposit Details The fields related to deposit details are described below Term Deposit Product All the term deposit products available for application will be listed down. Currency Currency in which the deposit is to be held. If the deposit product supports only a single currency this field is displayed as a label (instead of a list for selection).

Deposit Amount The customer is required to specify the amount for which the deposit is to be opened. Investment Period The customer can specify the tenure of the deposit in terms of a period i.e., years/ months/ days or by selecting a specific date on which the deposit should mature. The available options are:- Tenure

- Date

Years The customer can mention the deposit tenure in years. This field is enabled if the customer selects the Tenure option in the Deposit Tenure field.

Months The customer can mention the deposit tenure in months. This field is enabled if the customer selects the Tenure option in the Deposit Tenure field.

Days The customer can mention the deposit tenure in days. This field is enabled if the customer selects the Tenure option in the Deposit Tenure field.

Date The customer can define the deposit tenure by selecting a date on which the deposit should mature. This field is enabled if the customer selects the Date option in the Deposit Tenure field.

Calculate Maturity =The customer can click the Calculate Maturity link to view the maturity amount and interest rate for the deposit account, based on the provided information. Maturity Amount The system will calculate and display the estimated maturity amount based on the parameters defined by the customer. Standard Interest Rate The rate of interest applicable for all customers on deposit account. Relationship Benefits Customers can receive special interest rate benefits on their deposit accounts depending on the total business they do with the bank. Effective Interest Rate The final effective rate of interest offered to the customer on the deposit account. Effective Interest Rate = Standard Interest Rate + Relationship Benefits

This is offered as a reward to eligible customers with an opportunity to earn higher interest rates on qualifying consumer accounts.

Information Icon The information icon provides the details about relationship pricing. Holding Pattern The holding pattern that will be applied to the deposit being opened is displayed. This field will be displayed only if the current or savings account selected as the Source Account has a joint holding pattern.

The available options are:- Single

- Joint

Note:- This field will be displayed only if the current or savings account selected as the Source Account has a joint holding pattern.

- If the user selects option Joint, the new deposit will be opened in the joint names of the holders of the current or savings account selected as the Source Account.

Payment Details The fields related to payment details are described below Source Account The customer is required to select the current or savings account to be debited with the deposit amount. All the active current and savings accounts of the customer are displayed along with nicknames, if defined.

For more information on Account Nickname, click Account Name

Current Balance On selection of a current or savings account in the Source Account field, the current balance of the specific account is displayed against the field. Maturity Details The fields related to maturity details are described below Maturity Instructions Maturity instructions to be set by the customer for the deposit account. The options available are dependent on the deposit product selected. The available options are:- Close on maturity

- Renew Principal and Interest

- Renew Principal and Pay Out the Interest

- Renew Specific Amount and Pay Out the remaining amount

Rollover Amount The amount to be rolled over. This field is displayed if the customer selects Renew Specific Amount and Payout the remaining amount option from the Maturity Instruction list.

Note:

Renew special amount and Pay Out the remaining amount option is not supported when the host is Oracle FLEXCUBE Core Banking.Pay To This field is displayed if the customer has selected any maturity instruction that involves any part of the deposit amount to be paid out at the time of maturity. The customer is required to select the mode through which the amount to be paid out is transferred.

The available options are:- Own accounts

- Internal Bank Account

Note:- This field is not displayed, if the customer has selected Renew Principal and Interest option from the Maturity Instructions list.

- If the host is Oracle FLEXCUBE Core Banking, payout to only Own and Internal Accounts is supported.

Own Account This section is displayed if the customer has selected the option Own Account in the Pay to field.

Transfer Account The customer can select a current or savings account to which the funds will be transferred when the deposit matures. All the customer’s current and savings accounts held with the bank will be listed down and available for selection. The following fields are displayed once the customer has selected an account in the Transfer Account field. Beneficiary Name The name of the holder of the account selected in Transfer Account. Bank Name Name of the beneficiary bank. Bank Address Address of the beneficiary bank. City City of the beneficiary bank. Country Country of the beneficiary bank Internal Account This section is displayed if the customer has selected the option Internal Account in the Pay to field. Account Number The customer is required to specify a current or savings account, held within the bank, to which the funds will be transferred when the deposit matures. Confirm Account Number The customer must re-enter the account number in this field so as to confirm the account number entered in the above field is correct. - From the Term Deposit Product list, select the term deposit product that user want to apply for.

- From the Currency list, select the currency in which user want the term deposit to be held.

- In the Deposit Amount field, enter the deposit amount.

- Select the desired option against the Investment Period

field.Perform any one of the following actions:

- If user select the Tenure option:

- In the Years, Months, and Days field enter the appropriate values.

- If user option the Date option:

- From the Date list, select the appropriate date.

- If user select the Tenure option:

- To view the deposit maturity amount and applicable interest rate, click on the

Calculate Maturity link. The overlay screen appears displaying the maturity amount and interest rate applicable on the deposit account.

- From the Holding Pattern field, select whether the deposit being opened is to have a single holding pattern or a joint holding pattern.

- From the Source Account list, select the current or savings account to be debited in order to open the term deposit.

- Specify maturity instructions as desired, in the Maturity

Instruction field. Perform any one of the following actions:

- If user have selected the option Close on

Maturity;

- Select the mode through which the maturity amount is to be transferred, in the Pay To field.

- If user have selected the option Renew Principal and Pay Out

the Interest;

- Select the mode through which the interest amount is to be transferred, in the Pay To field.

- If user have selected the option Close on

Maturity;

- From the Pay To list; Perform any one of the following actions:

- If user have selected the option Own Account;

- From the Transfer Account list, select an appropriate current or savings account which is to be credited with the specific amount at the time of deposit maturity.

- If user have selected the option Internal

Account;

- In the Account Number field, enter the account number which is to be credited with the specific amount at the time of deposit maturity.

- In the Confirm Account Number field, re-enter the account number as entered in the Account Number field.

- If user have selected the option Own Account;

- Perform any one of the following actions:

- Click Submit.The Deposit Details, and Maturity Details appears.

The Review screen appears.

- Click Cancel to cancel the transaction.

- Click Submit.

- Perform any one of the following actions:

- Verify the details and click Confirm.The confirm screen is displayed with a success message along with the reference number.

- Click Back to navigate back to the previous screen.

- Click Cancel to cancel the transaction.

- Verify the details and click Confirm.

- Perform any one of the following actions:

- Click the Transaction Details to view the details of the transaction.

- Click the Deposit Details link to view the deposit account details.

- Click the View Accounts link to visit Term Deposit Summary page.

- Click the Open New Deposit link to open a new deposit account.

- Click the Go To Dashboard link to navigate back to dashboard page.

Parent topic: New Term Deposit under Oracle FLEXCUBE Core Banking