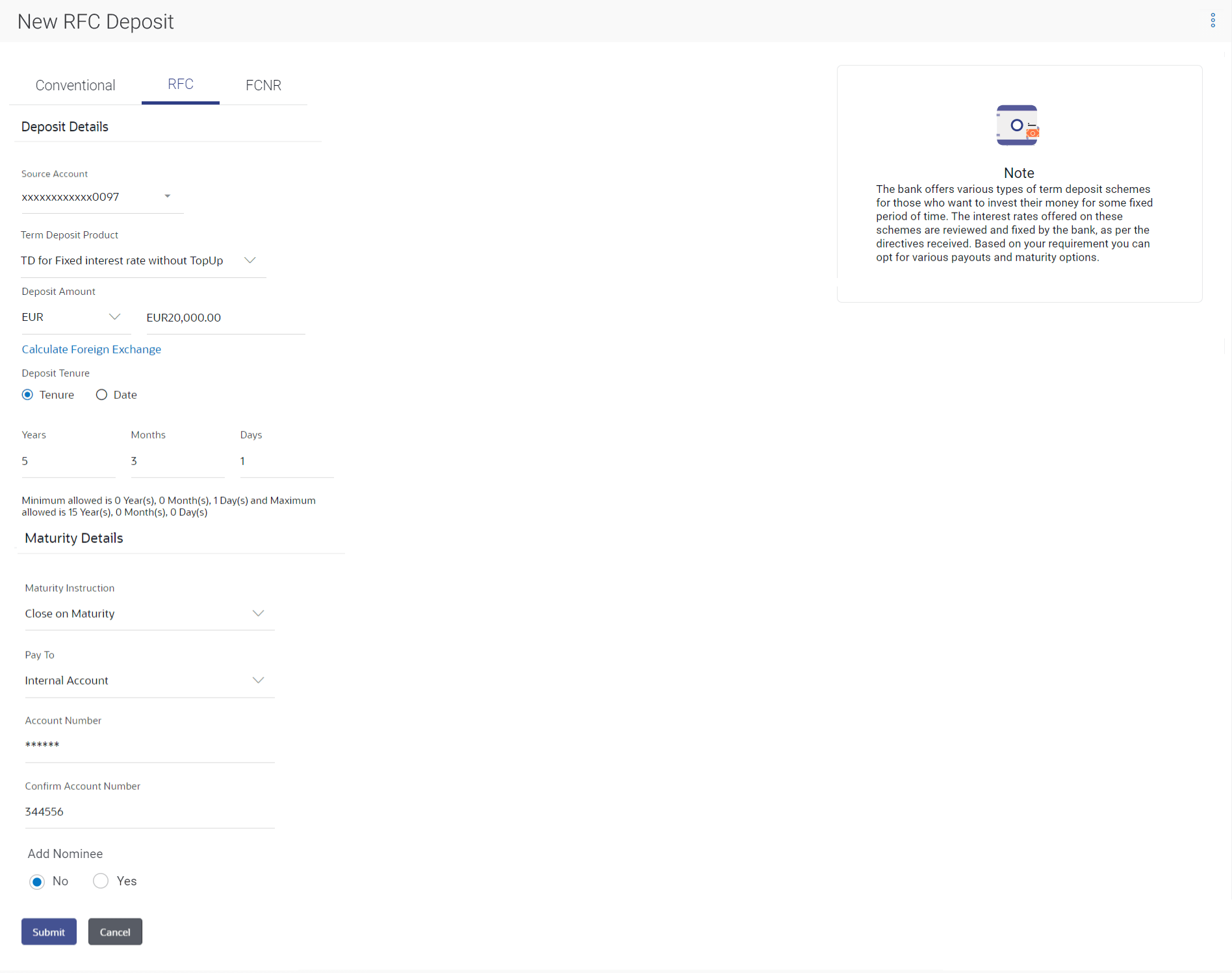

3.2 New RFC Deposit

This topic provides the systematic instructions for user to apply for new term deposits.

Resident customers, who have foreign currency with them, can open RFC (Resident Foreign Currency) term deposit account from the RFC accounts available with the same currency. In case of premature withdrawal from an RFC Term Deposit, the maturity amount goes to RFC accounts with the same currency.

To open a new RFC term deposit:

- To access the New Term Deposit screen, refer Step 1- New

Term Deposit under Oracle FLEXCUBE Core Banking transaction.The New Term Deposit screen appears.

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 3-2 New RFC Deposit - Field Description

Field Name Description Deposit Details The fields related to deposit details are described below Term Deposit Product All the RFC deposit products available for application will be listed down. Currency The currency in which the deposit is to be held. If the deposit product supports only a single currency this field is displayed as a label (instead of a list for selection).

Deposit Amount The customer is required to specify the amount for which the deposit is to be opened. Deposit Tenure The customer can specify the tenure of the deposit in terms of a period i.e., years/ months/ days or by selecting a specific date on which the deposit should mature. The available options are:- Tenure

- Date

Years The customer can identify the deposit tenure in years. This field is enabled if the customer select the Tenure option in the Deposit Tenure field.

Months The customer can identify the deposit tenure in months. This field is displayed if the customer selects the Tenure option from the Deposit Tenure field.

Days The customer can identify the deposit tenure in days. This field is displayed if the customer selects the Tenure option from the Deposit Tenure field.

Date The customer can define the deposit tenure by selecting a date on which the deposit should mature. This field is displayed if the customer selects the Date option from the Deposit Tenure field.

Calculate Maturity The customer can click on the Calculate Maturity link in order to be displayed the maturity amount and interest rate applicable on the deposit account based on the information defined. Maturity Amount The system will calculate and display the estimated maturity amount based on the parameters defined by the customer. Source Account The customer is required to select the RFC account to be debited with the deposit amount. All the active RFC accounts of the customer are displayed along with nicknames, if defined.

For more information on Account Nickname, click Account Name

Holding Pattern The holding pattern that will be applied to the deposit being opened is displayed. This field will be displayed only if the current or savings account selected as the Source Account has a joint holding pattern.

The available options are:- Single

- Joint

Note:- This field will be displayed only if the current or savings account selected as the Source Account has a joint holding pattern.

- If the user selects option Joint, the new deposit will be opened in the joint names of the holders of the current or savings account selected as the Source Account.

Maturity Details The fields related to maturity details are described below Maturity Instructions Maturity instructions to be set by the customer for the deposit account. The options available are dependent on the deposit product selected. The maturity proceeds go only to RFC accounts.

The available options are:- Close on maturity

- Renew Principal and Interest

- Renew Principal and Pay Out the Interest

- Renew Specific Amount and Pay Out the remaining amount

Note: Renew Specific amount and Pay Out the remaining amount option is not supported when host is Oracle FLEXCUBE Core Banking.

Rollover Amount The amount to be rolled over. This field is displayed if the customer selects Renew Specific Amount and Payout the Remaining Amount option from the Maturity Instruction list.

Pay To This field is displayed if the customer has selected any maturity instruction that involves any part of the deposit amount to be paid out at the time of maturity. The customer is required to select the mode through which the amount to be paid out is transferred.

The available options are:- Own accounts

- Internal Bank Account

Note:- This field is not displayed, if the customer has selected Renew Principal and Interest option from the Maturity Instructions list.

- If the host is Oracle FLEXCUBE Core Banking, payout to only Own and Internal Accounts is supported.

Own Account This section is displayed if the customer has selected the option Own Account in the Pay To field. Transfer Account The customer can select a RFC account to which the funds will be transferred when the deposit matures. All the customer’s RFC accounts held with the bank will be listed down and available for selection. The following fields are displayed once the customer has selected an account in the Transfer Account field. Beneficiary Name The name of the holder of the account selected in Transfer Account. Bank Name Name of the beneficiary bank. Bank Address Address of the beneficiary bank. City City of the beneficiary bank. Internal Account This section is displayed if the customer has selected the option Internal Account in the Pay To field. Account Number The customer is required to specify a current or savings account, held within the bank, to which the funds will be transferred when the deposit matures. Confirm Account Number The customer must re-enter the account number in this field so as to confirm the account number entered in the above field is correct. - From the Term Deposit Product list, select the term deposit product that user want to apply for.

- From the Currency list, select the currency in which user want the term deposit to be held.

- In the Deposit Amount field, enter the deposit amount.

- Select the desired option against the Deposit Tenure

field.Perform any one of the following actions:

- If user select the Tenure option:

- In the Years, Months and Days field enter the appropriate values.

- If user option the Date option:

- From the Date list, select the appropriate date.

- If user select the Tenure option:

- To the deposit maturity amount and interest rate chargeable, click the

Calculate Maturity link.

Note:

Click Reset to clear the calculated details. - From the Source Account list, select the current or savings account to be debited in order to open the term deposit.

- From the Holding Pattern field, select whether the deposit being opened is to have a single holding pattern or a joint holding pattern.

- Specify maturity instructions as desired, in the Maturity Instruction field. Perform any one of the following actions:

- If user have selected the option Close on

Maturity;

- Select the mode through which the maturity amount is to be transferred, in the Pay To field.

- If user have selected the option Renew Principal and Pay Out

the Interest;

- Select the mode through which the interest amount is to be transferred, in the Pay To field.

- If user have selected the option Renew Specific Amount and

Pay Out the Remaining Amount;

- Enter the amount to be rolled over in the Rollover Amount field.

- Select the mode through which the remaining amount (Maturity Amount minus Rollover Amount) is to be transferred, in the Pay To field.

- If user have selected the option Close on

Maturity;

- From the Pay To list; Perform any one of the following actions:

- If user have selected the option Own Account;

- From the Account Number list, select an appropriate account which is to be credited with the specific amount at the time of deposit maturity. .

- If user have selected the option Internal

Account;

- In the Account Number field, enter the account number which is to be credited with the specific amount at the time of deposit maturity.

- In the Confirm Account Number field, re-enter the account number as entered in the Account Number field.

- If user have selected the option Own Account;

- Perform any one of the following actions:

- Click Submit.The Deposit Details, and Maturity Details appears.

The Review screen appears.

- Click Cancel to cancel the transaction.

- Click Submit.

- Perform any one of the following actions:

- Verify the details and click Confirm.The confirm screen is displayed with a success message along with the reference number.

- Click Back to navigate back to the previous screen.

- Click Cancel to cancel the transaction.

- Verify the details and click Confirm.

- Perform one of the following actions:

- Click the Transaction Details to view the details of the transaction.

- Click the Deposit Details link to view the deposit account details.

- Click the View Accounts link to visit Term Deposit Summary page.

- Click the Open New Deposit link to open a new deposit account.

- Click the Go To Dashboard link to navigate back to dashboard page.

Parent topic: New Term Deposit under Oracle FLEXCUBE Core Banking