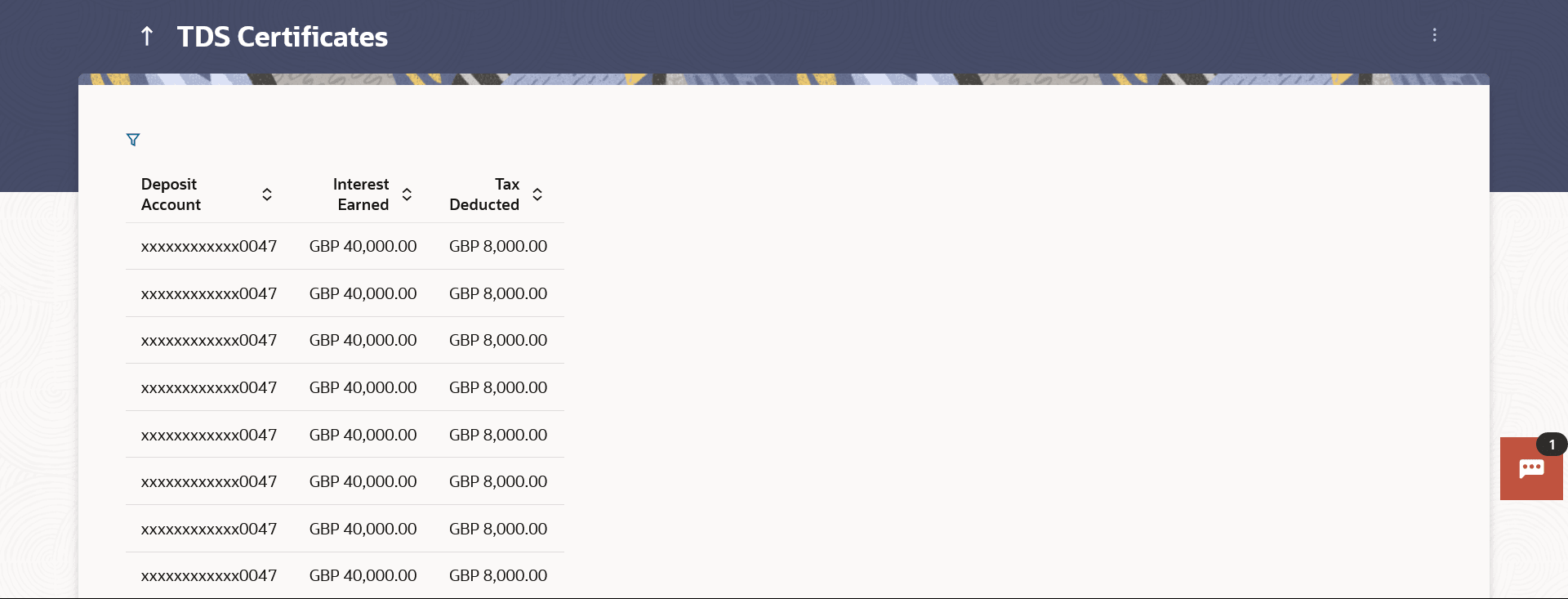

14 TDS Certificates

This topic describes the information about TDS Certificates screen. This option provides a consolidated view of TDS for all user's accounts and deposits.

TDS or Tax Deducted at Source, is a means of indirect tax collection by Indian authorities according to the Income Tax Act, 1961. As per the Act, any company or person making a payment is required to deduct tax at source if the payment exceeds certain limits. TDS has to be deducted at the rates prescribed by the tax department. The concept of TDS was introduced with an aim to collect tax from the very source of income. TDS is applicable on the various incomes received such as salaries, interest received etc. which is deducted when income is generated rather than at a later date.

TDS is deducted when the interest payable or reinvested on Recurring Deposits or Fixed Deposits is above the government specified limit in a financial year. A retail user can view the TDS deducted from his account for the financial year. For taxation purposes, the retail user can download the TDS report for all his accounts.

To generate TDS Certificates: