4 Redemption under Oracle FLEXCUBE Core Banking

In times of financial emergencies, the primary source of funds for most people is their savings and investments. The facility to liquidate funds becomes imperative in such cases. The redeem term deposit feature enables customers to quickly liquidate their term deposits in any such situations.

Using this option, the customer can redeem either the entire amount or a partial amount of a term deposit.

Customers can choose to payout the funds from a deposit through any of the following methods for premature withdrawal or full redemption:

- Transfer to own account

- Transfer to internal account

- Transfer to a domestic account

- Transfer to international account

Note:

Transfers to only Own and Internal Accounts are supported when the host is Oracle FLEXCUBE Core Banking.In case of premature withdrawal or on deposit maturity of Term Deposit, the following transfers are permitted:

- Conventional term deposit transfer is permissible to Current and Savings account with same local currency

- RFC term deposit transfer is permissible only to RFC accounts with same currency

- NRE term deposit transfer is permissible only to NRE account or its international account

- NRO term deposit transfer is permissible only to NRO account with same currency

- FCNR term deposit transfer is permissible only to NRE account with same currency

Navigation Path:

From the Dashboard, click Toggle menu, click Menu, then click Accounts, and then click Deposits tab, and then click on the Deposit Account Number . From the Deposit Details page, click on the More Actions, and then click on the Redeem Term DepositOR

From the Search bar, type Deposits – Redeem Term Depositand press Enter

OR

On the Dashboard, click Overview widget, click Deposits card, then click on the Deposit Account Number . From the Deposit Details page, click on the More Actions, and then click on the Redeem Term Deposit

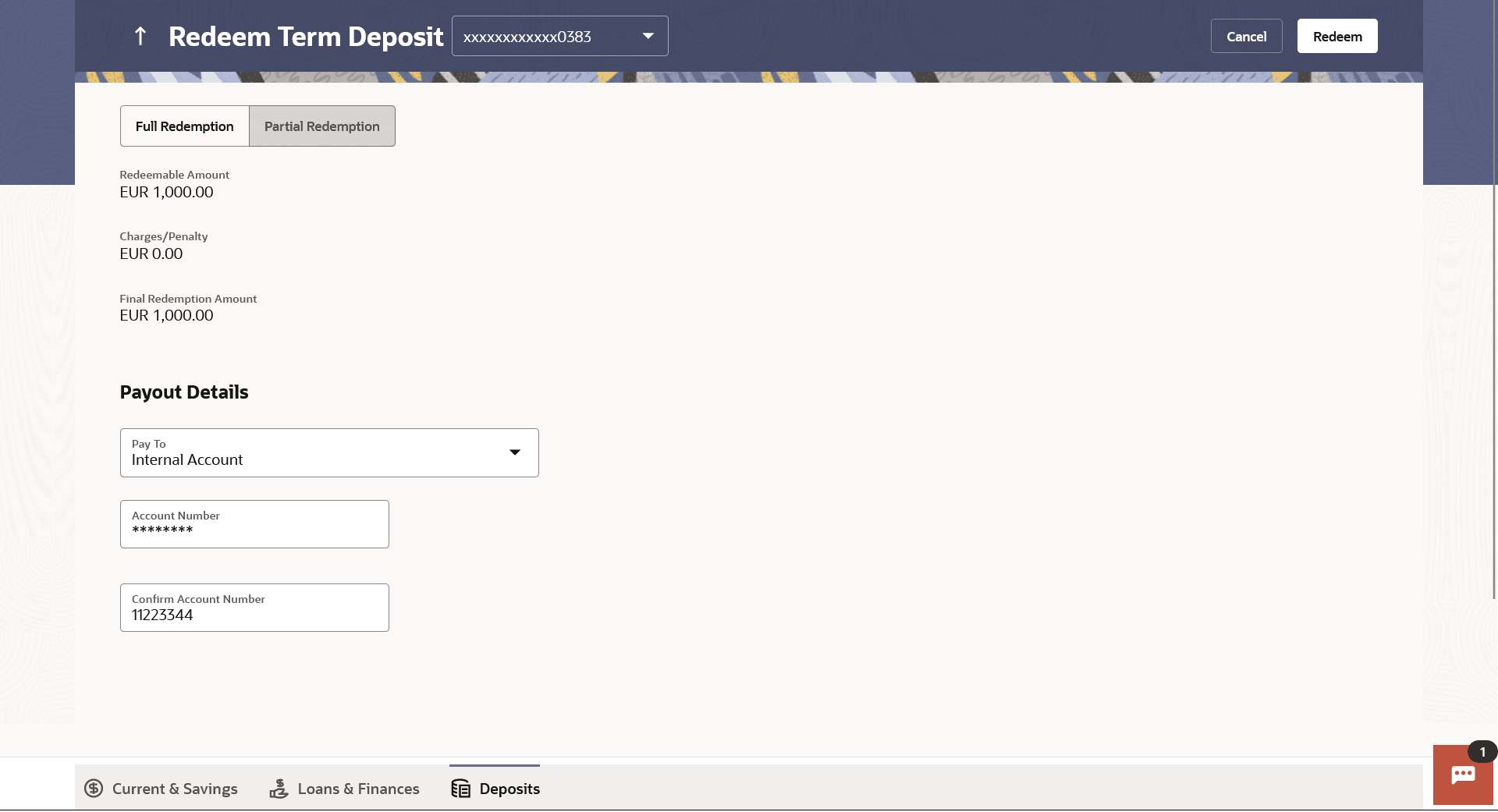

Figure 4-1 Redeem Term Deposit

Table 4-1 Field Description

| Field Name | Description |

|---|---|

| Deposit Account |

Select the term deposit that is to be redeemed. |

| Redemption Type | The customer can select whether redemption is to be partial or

full.

The options are:

|

| Redeemable Amount | The total amount of the deposit that can be redeemed is displayed. |

| Redemption Amount | The customer is required to specify the amount to be redeemed.

The amount specified will be in the same currency as that in which the deposit is

held.

This field is displayed only if the customer selects the option Partial Redemptionin the Redemption Type field. |

| Charges/ Penalty | Any charges or penalty, if applicable, will be displayed. |

| Final Redemption Amount | The amount being redeemed is displayed. This amount will include any deductions in terms of charges or penalties added to the amount being redeemed. (i.e. after deducting any penalty charges if applicable). |

| Payout Details | |

| Pay To |

The customer is required to specify the mode through which the redeemed amount is to be transferred. The options are:

Note: Pay out to only Own and Internal Accounts are supported when the host is Oracle FLEXCUBE Core Banking. |

|

Own Account The following field is displayed if the customer has selected the option Own Account in the Pay To field. |

|

| Transfer Account | The customer can select a current or savings account to which the funds will be transferred. All the customer’s current and savings accounts held with the bank will be listed down and available for selection. |

| The following fields are displayed once the customer has selected an account in the Transfer Account field. | |

| Beneficiary Name | The name of the holder of the account selected in Transfer Account. |

| Bank Name | The name of the bank in which the selected account is held |

| Bank Address | The address of the bank in which the selected account is held. |

| City | The city of the bank in which the account is held. |

|

Internal Account The following field is displayed if the customer has selected the option Internal Account in the Pay To field. |

|

| Account Number | The customer can identify a current or savings account held within the same bank, to which the funds are to be transferred. |

| Confirm Account Number | The customer must re-enter the account number in this field so as to confirm the account number entered in the above field is correct. |

|

Domestic Bank Account The following fields are displayed if the customer has selected the option Domestic Bank Account in the Pay To field. |

|

| Account Number | The customer can identify a current or savings account to which the funds are to be transferred. |

| Account Name | Enter the name of the account holder who will be the beneficiary to whom funds will be transferred. |

| Bank Code | The customer is required to identify the bank code in which the beneficiary account is held. |

| Look Up Bank Code | The search option to look for bank code of the destination account. |

| The following fields and values will be displayed once the customer has specified a bank code. | |

| Bank Name | The name of the bank in which the beneficiary account is held. |

| Bank Address | The address of the bank in which the beneficiary account is held. |

| City | The city of the bank in which the beneficiary account is held. |

|

International Bank Account This section is displayed if the customer has selected the option International Bank Account in the Pay To field. |

|

| Account Number | Specify the account number of the payee. |

| SWIFT Code | The SWIFT code will need to be identified if SWIFT Code has been selected in the Pay Via field. |

| Lookup SWIFT Code | Link to search the SWIFT code. |

|

Search SWIFT Code The following fields appear on a pop up window if the Lookup SWIFT Code link is selected. |

|

| SWIFT Code | The facility to lookup bank details based on SWIFT code. |

| Bank Name | The facility to search for the SWIFT code based on the bank name. |

| Country | The facility to search for the SWIFT code based on the country. |

| City | The facility to search for the SWIFT code based on city. |

|

SWIFT Lookup - Search Result The following fields are displayed once the required SWIFT code is selected from the search results. |

|

| SWIFT Code | SWIFT code value. |

| Bank Name | Name of the bank. |

| City | City to which the bank belongs. |

| Branch | Bank branch name. |

| Country | Country of the bank. |

| Address | Displays complete address of the bank. |

| Beneficiary Name | Name of the beneficiary. |

| Correspondence Charges |

Specify who is bearing the charges for transfer. The options are:

|

To redeem the term deposit: