3.2 Risk Profiling

This topic describes the systematic instruction to Risk Profiling screen.

Banks/ investment advisers have a practice of doing a Risk Profile of the prospective investor. A risk profile is an evaluation of an investor's attitude and ability to take risks. Risk profiling involves the assessment of investor psychological level with the volatility of capital markets. A risk profile is important to determine which asset should be allocated to an investor's portfolio.

A risk profiling involves the series of questionnaire and based on the answers assign a risk profile to the investor. The tolerance to risk is reflected in the Asset Allocation that the bank recommends to the investor. Aggressive investors who have high tolerance to equity usually have a high percentage of Equity in their allocation, conservative investors tend to have more of debt. The MF portfolio that the investor invests has to match his/ her asset allocation, which is based on risk profile.

Note:

The risk profile questionnaire, recommended asset allocation will be fetched from mutual fund processor. OBDX will display the questionnaire, capture the answers and pass them on to the mutual fund processor. Further, the computation of risk profile based on user provided answers will happen at mutual fund processors and will be communicated to OBDX which will display it to the user.Pre-requisites

- Transaction access is provided to the Retail User.

Features Supported In Application

The module supports the following features:

Navigation Path:

Perform the following navigation to access the Risk Profiling screen.

From the Dashboard, click Toggle menu, and then click Menu. From the Menu, then click Financial Management , and click Wealth Management . Under Wealth Management , and then click Start Investing , click Risk Profiling .

To calculate risk profile of a user:

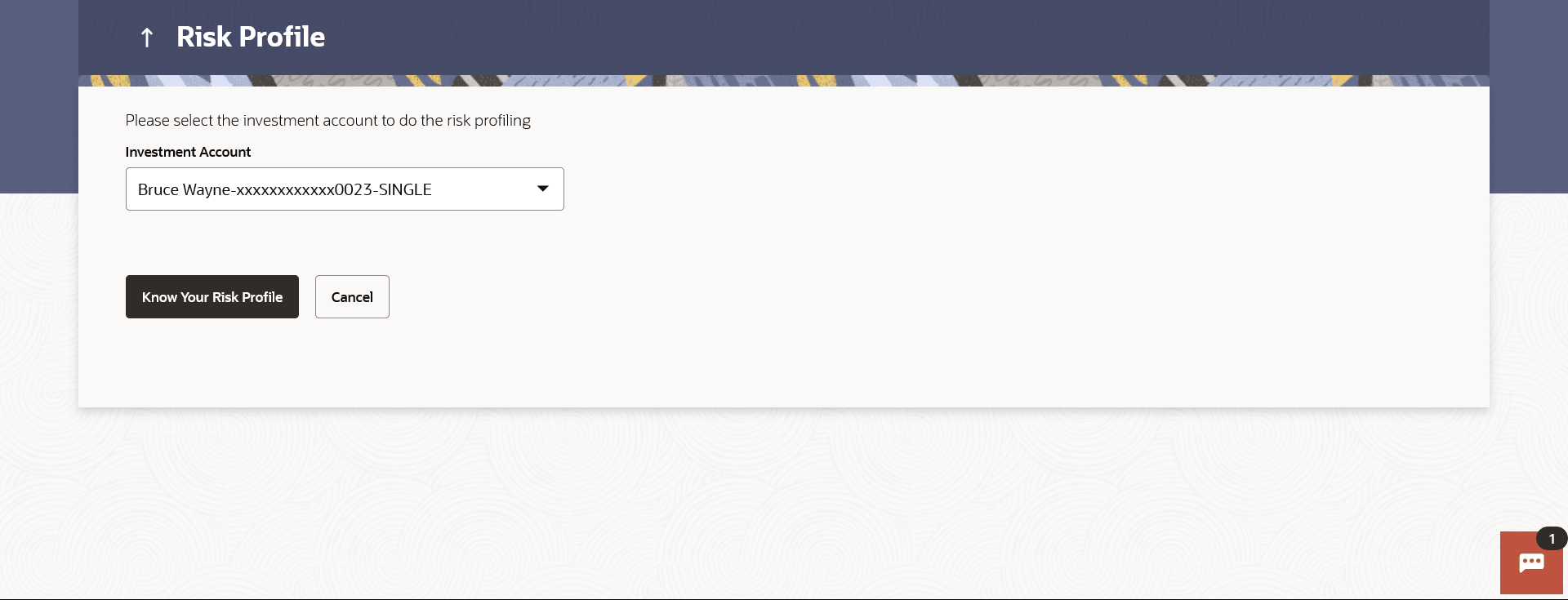

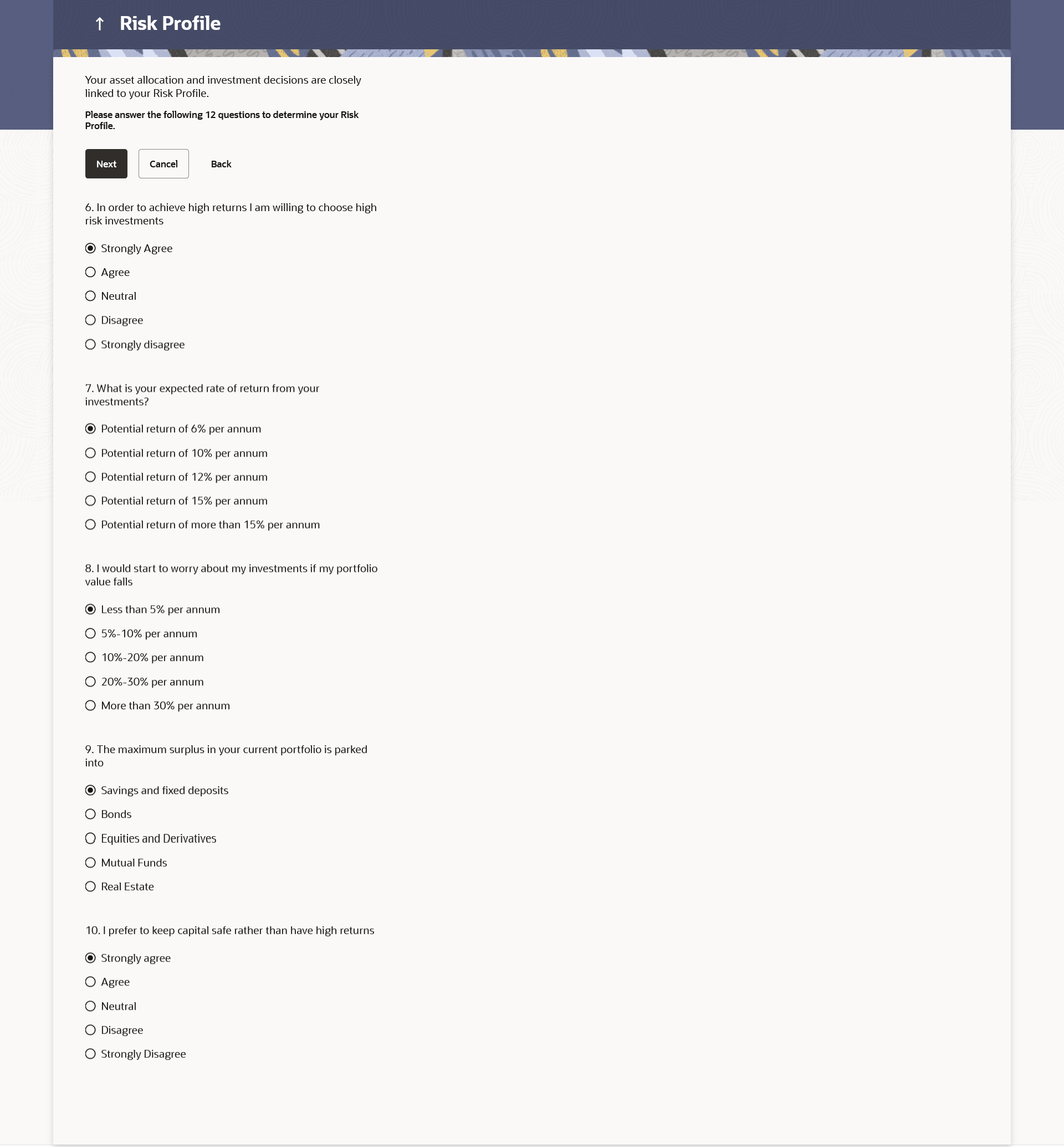

Figure 3-11 Risk Profile

Note:

The fields which are marked as Required are mandatory.For more information on fields, refer to the field description table.

Table 3-9 Risk Profile - Field Description

| Field Name | Description |

|---|---|

| Fund Details | Fund Details Please select the investment account to do the risk profiling. |

| Investment Account | The investment account to which the current purchase order belongs. |

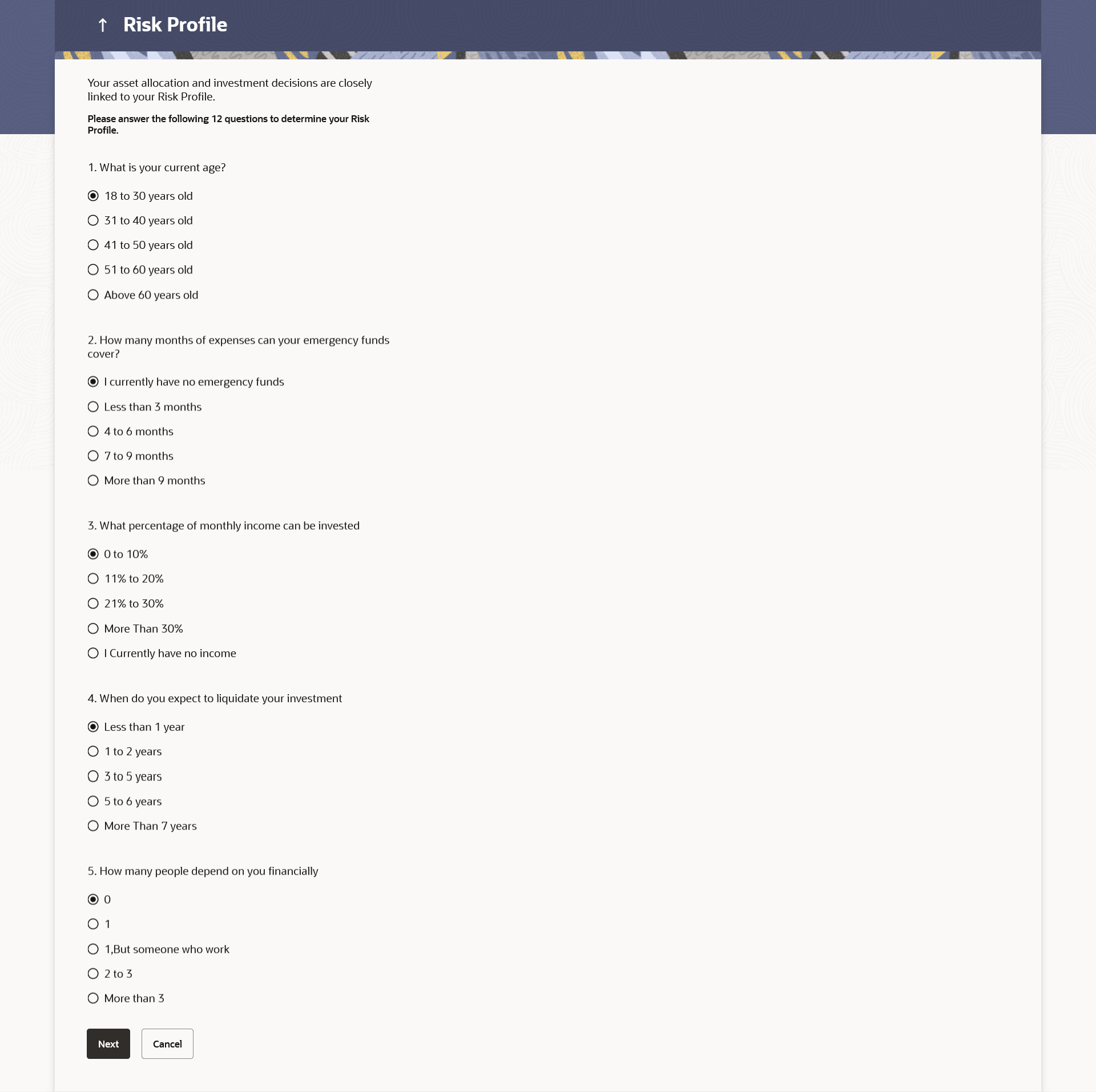

Figure 3-12 Risk Profile - Questions Note:

For more information on fields, refer to the field description table.

Table 3-10 Risk Profile - Questions - Field Description

| Field Name | Description |

|---|---|

| Risk Profile - Questions | The set of questions asked to the user to assess the risk profiling. |

| Risk Profile - Answer | The fund house from which user intends to purchase the fund for current purchase order. |

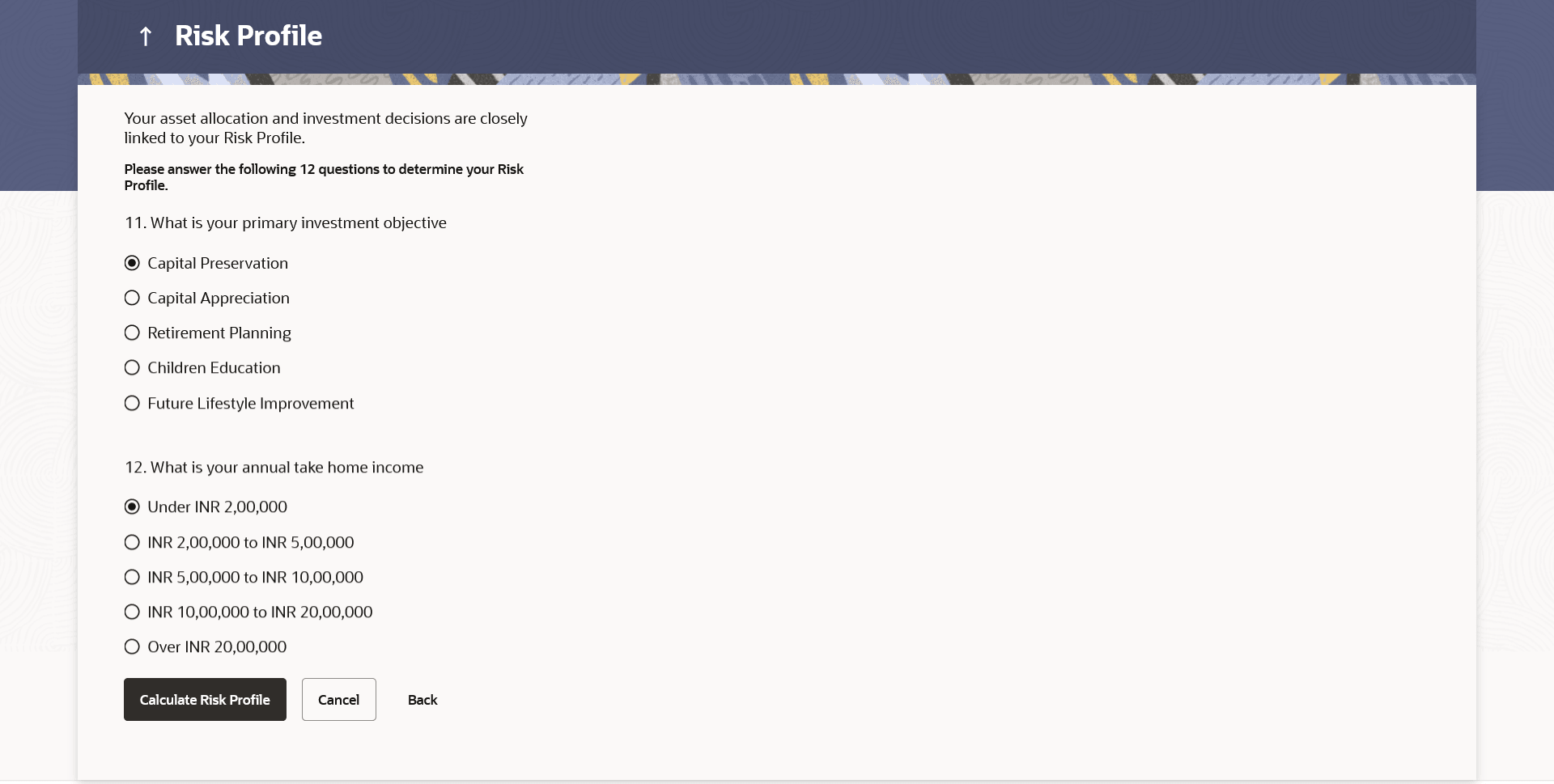

Figure 3-13 Risk Profile - Questions

Figure 3-14 Risk Profile - Questions

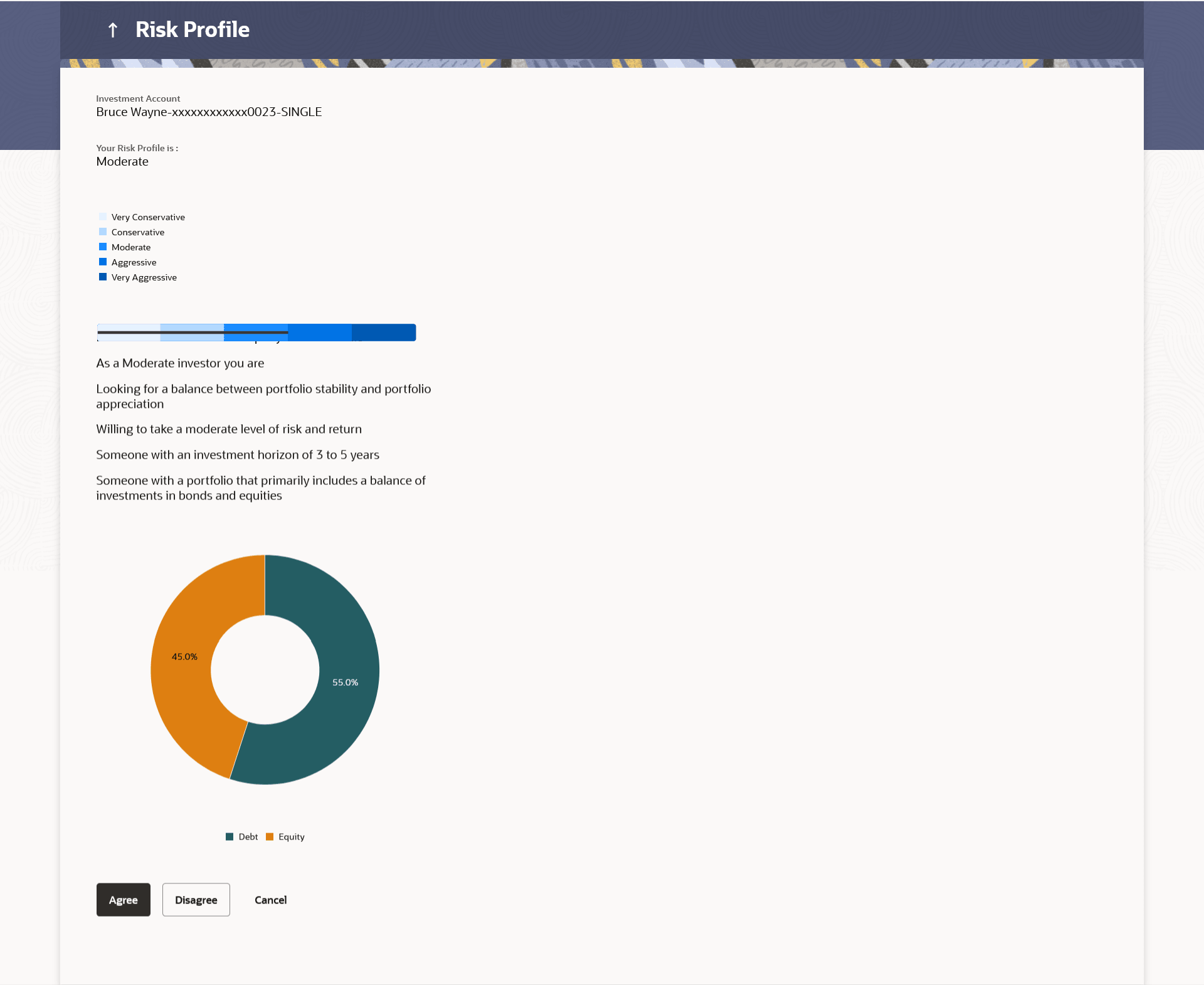

Figure 3-15 Risk Profile

- Edit Risk Profile

This topic describes the systematic instruction to Edit Risk Profile screen. This option allows the user to edit his risk profile, as evaluated by the application.

Parent topic: Start Investing