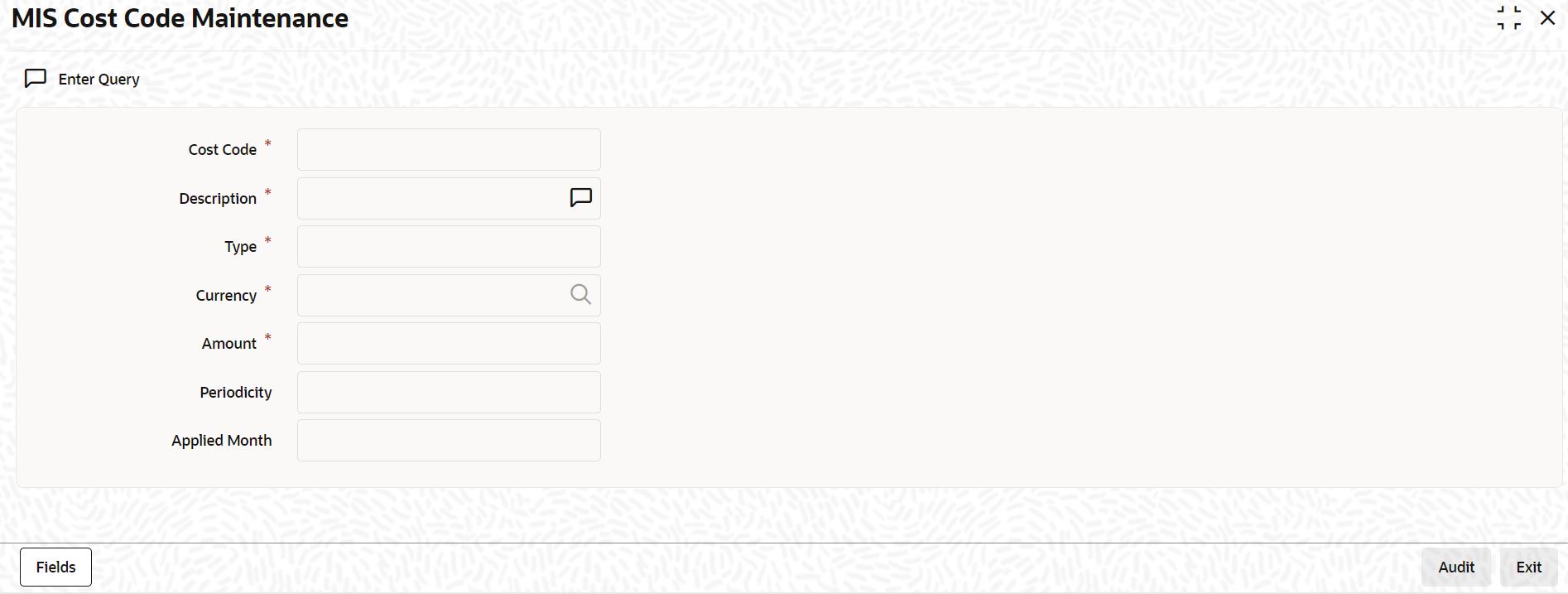

1.56 Maintain MIS Cost Codes

This topic explains systematic instructions to maintain MIS cost codes.

An MIS cost code represents the notional cost incurred for a transaction. An MIS cost code can be attached either to an account or to a contract, in the following manner:

- The user can link a Cost Code to an account class. This will default to the accounts maintained under the account class. The user can change this default. Alternatively, the user can link an MIS Cost Code to an account when maintaining it.

- When creating a product, the user can identify the cost codes against which contracts involving the product should be reported.

- When processing a contract, the Cost Code identified for the product (the contract involves) will automatically default. These defaults can be changed. If cost codes have not been identified for the product, the user can identify one for the contract.

Note:

The fields which are marked in asterisk are mandatory.Parent topic: Core Maintenance