2.25 Alert Definition Maintenance

This topic describes about the procedure to maintain rule criteria code.

Note:

The fields, which are marked with an asterisk, are mandatory.User can define specific alerts to be sent to the bank users. User need to define the alert codes and map the alert code to the bank user using Alert Definition Maintenance screen.

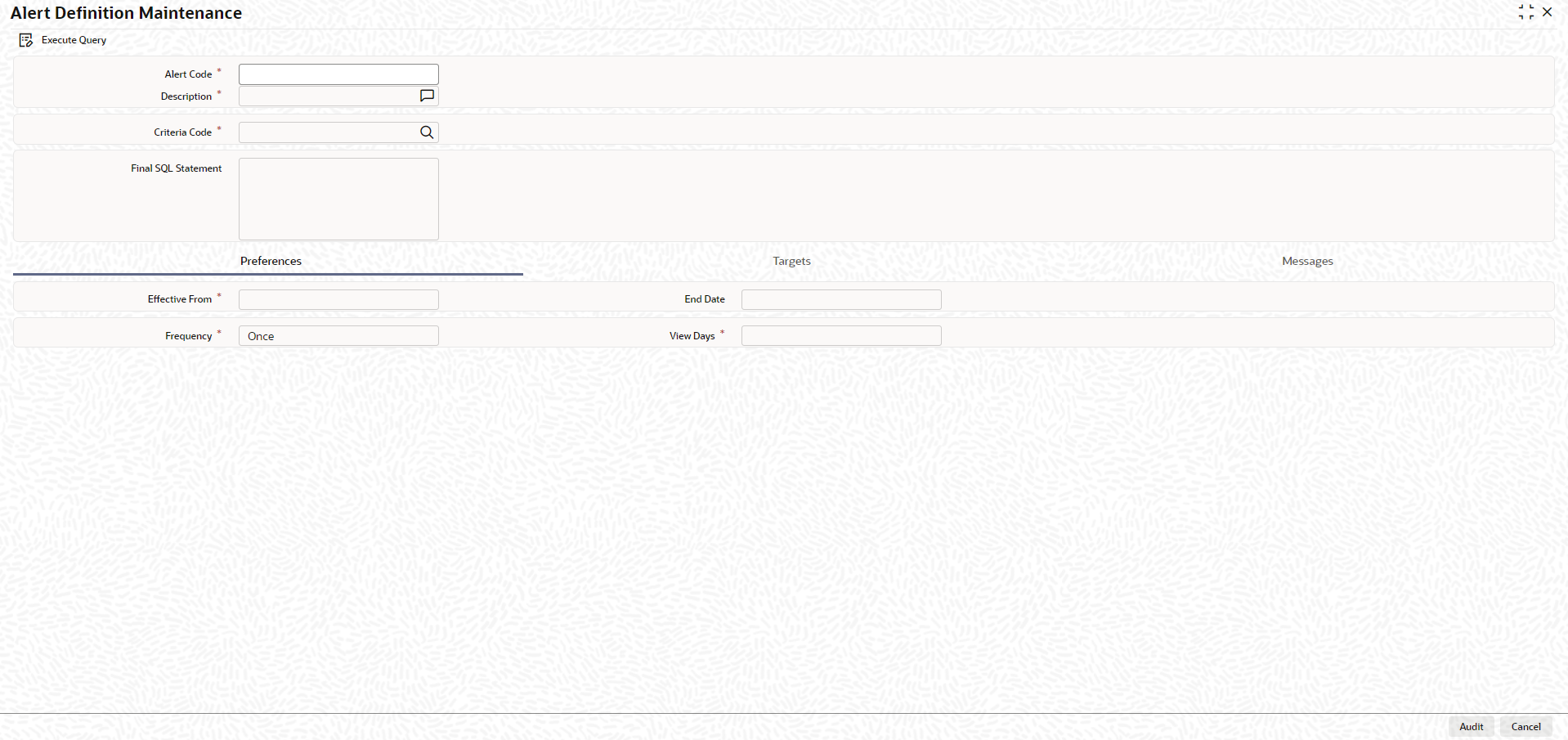

- On the Home screen, specify

CODADMNT in the text box and click the

icon.The Alert Definition Maintenance screen displays.

icon.The Alert Definition Maintenance screen displays. - On Alert Definition Maintenance screen, click

New and specify the fields.For more information on fields, refer to the field description table.

Table 2-87 Alert Definition Maintenance - Field Description

Field Description Alert Code Specify the alert code to be mapped to the bank. Description The system displays the description of the alert based on the alert code specified. Criteria Code Click the  icon and select the criteria code to be used for

the alert. The option list displays valid criteria codes

(Rules 1 to 9 which are factory shipped) that are maintained

in the system. The description of each criteria code is

explained below table:

icon and select the criteria code to be used for

the alert. The option list displays valid criteria codes

(Rules 1 to 9 which are factory shipped) that are maintained

in the system. The description of each criteria code is

explained below table:

For more information on rule code description, refer Table 2-88.

Final SQL Statement Based on the criteria code selected, the system displays the final SQL statement. Table 2-88 Rule Code Description

Rule Code Rule Name Rule Description Parameter Configured Trigger for Alert Alert Message Description Rule1 Limits Due for Expiry Review required X days before Limit Expiry Date, where X is configurable parameter Notice Days (GEDLMPRS) Screen Limit Expiry Date <FACILITY_ ID> - Limit <LIAB_ ID> - <LINE_CO DE> due for expiry Rule 2 Limits where Collateral due for expiry Review required X days before Collateral Expiry Date, where X is a configurable parameter Notice Days (GEDLMPRS Screen) Collateral Expiry Date <COLLATERAL_ ID> - Collaterals <COLLATERAL CODE> for Limit <LIABILITY ID> due for expiry Rule 3 Limits where the Utilization Threshold% is breached with respect to Sanctioned Limit Review required for Limit Utilization % breached with respect to Sanctioned Limit, where Threshold % is a configurable parameter Threshold % (GEDLMPRS Screen) Sanctioned Limit Amount <FACILITY_ ID> - Sanctioned Limit for Limit <LIABILITY ID> - <LINE CODE> has breached the predefined threshold percentage Rule 4 Limits where the Utilization Threshold% is breached with respect to Collateral Value Review required for Limit Utilization % breached with respect to Collateral Value, where Threshold % is a configurable parameter Threshold % (GEDLMPRS Screen) Collateral Value <COLLATERAL_ ID> - Collaterals Value for Limit <LIABILITY ID> has breached the predefined threshold percentage Rule 5 Frequency Based Limit Review Frequency Based Limit Review Frequency maintained in the Facilities Maintenance (GEDFACLT) screen. Frequency and Next Review Date on the Facilities Maintenance Screen (GEDFACLT) <FACILITY_ ID> - Limit Review for Limit <LIABILITY ID> - <LINE CODE> is due Rule 8 Documents due for Expiry Review required when the documents are expired Frequency, Start Month, Due date on field on the Covenant Maintenance Screen (GEDCOVNT) and Notice Days on the Rule Criteria Code Screen. Notice days on the Covenant Maintenance Screen will not be considered for Alert generation Revision Date on the Covenants tab on the Collateral Maintenance (GCDCOLLT) <COVENANT_ ID> - Documents/ Covenants <COVENANT NAME> for Limit <LIABILITY ID> due for expiry RULE 9 Marketable/ non-marketable securities value decrease Review required when the marketable or the non marketable securities value is decreased From Securities Maintenance Level Securities Value <SECURITY_ ID> - Securities <SECURITY CODE> for Limit <LIABILITY ID> value decreased Rule 11 Liabilities where Credit rating has been lowered Review required when the Credit Rating for liability is lowered Liability Credit Rating (GEDMLIAB) Credit Rating Grade Credit Rating for LIABILITY NO issued by AGENCY NAME has been lowered Rule 12 Facilities where Credit rating has been lowered Review required when the Credit Rating for facility is lowered Facility Credit Rating (GEDFACLT) Credit Rating Grade Credit Rating for LINE CODE issued by AGENCY NAME has been lowered - On Alert Definition Maintenance screen, click

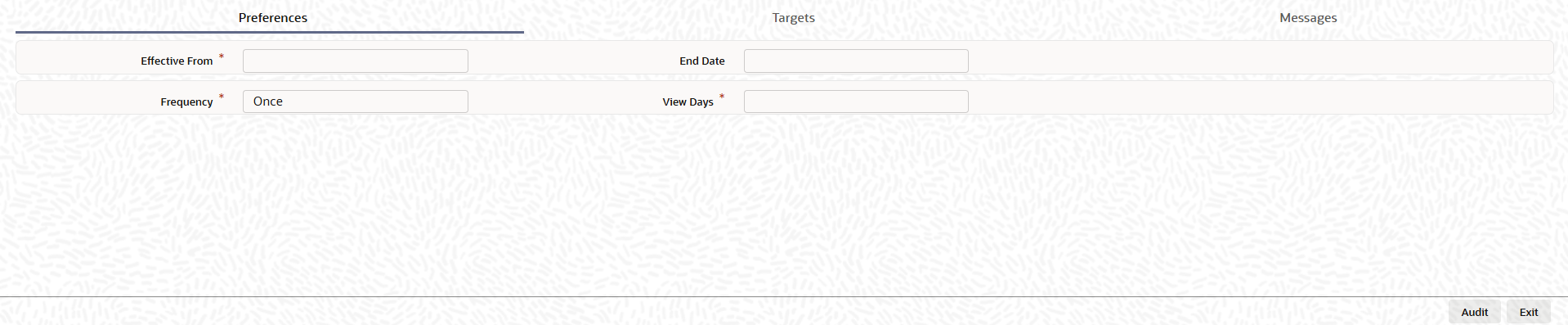

Preferences tab.The Preferences screen displays. For more information on fields, refer to the field description table.

Table 2-89 Preferences - Field Description

Field Description Effective From Specify the start date of the alert message generation. Click the date button to choose a date from the calendar. The system generates the alerts for the users from this date.

End Date Specify the end date of the alert message generation. Click the date button to choose a date from the calendar. The system generates the alerts for the users until this date.

Frequency Select the frequency for the alert message generation from the drop down list. The options available are: - Once

- Daily

- Weekly

- Monthly

- Yearly

- Always

View Days Specify the number of days to keep the alert message in the dashboard or the portal. The user can view the alert message in the dashboard or portal for the number of view days maintained here. After that, the message disappears from the dashboard or portal. - On Alert Definition Maintenance screen, click

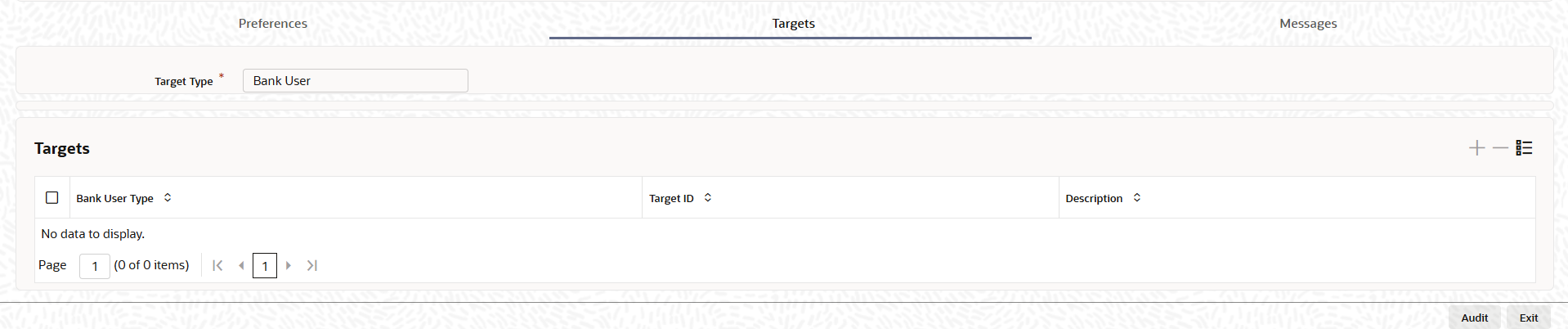

Target tab.The Target screen displays. For more information on fields, refer to the field description table.

Table 2-90 Target - Field Description

Field Description Target Type The target type indicates the receiver of the alert message. The system displays the default value as a Bank User. Bank User Type Specify the bank user type to receive the alert message. The drop-down list displays the following user types: - Role

- User ID

Target ID Specify the target ID. If the Bank User Type is Role, specify the particular user role. If the Bank User Type is User ID, specify the respective user ID. User can choose the appropriate target ID from the option list. The alert message is generated to the target IDs selected here.

Description The system displays the description of the selected target ID. User can add more bank user types by clicking the Add button. User can also delete a bank user type using Delete button.

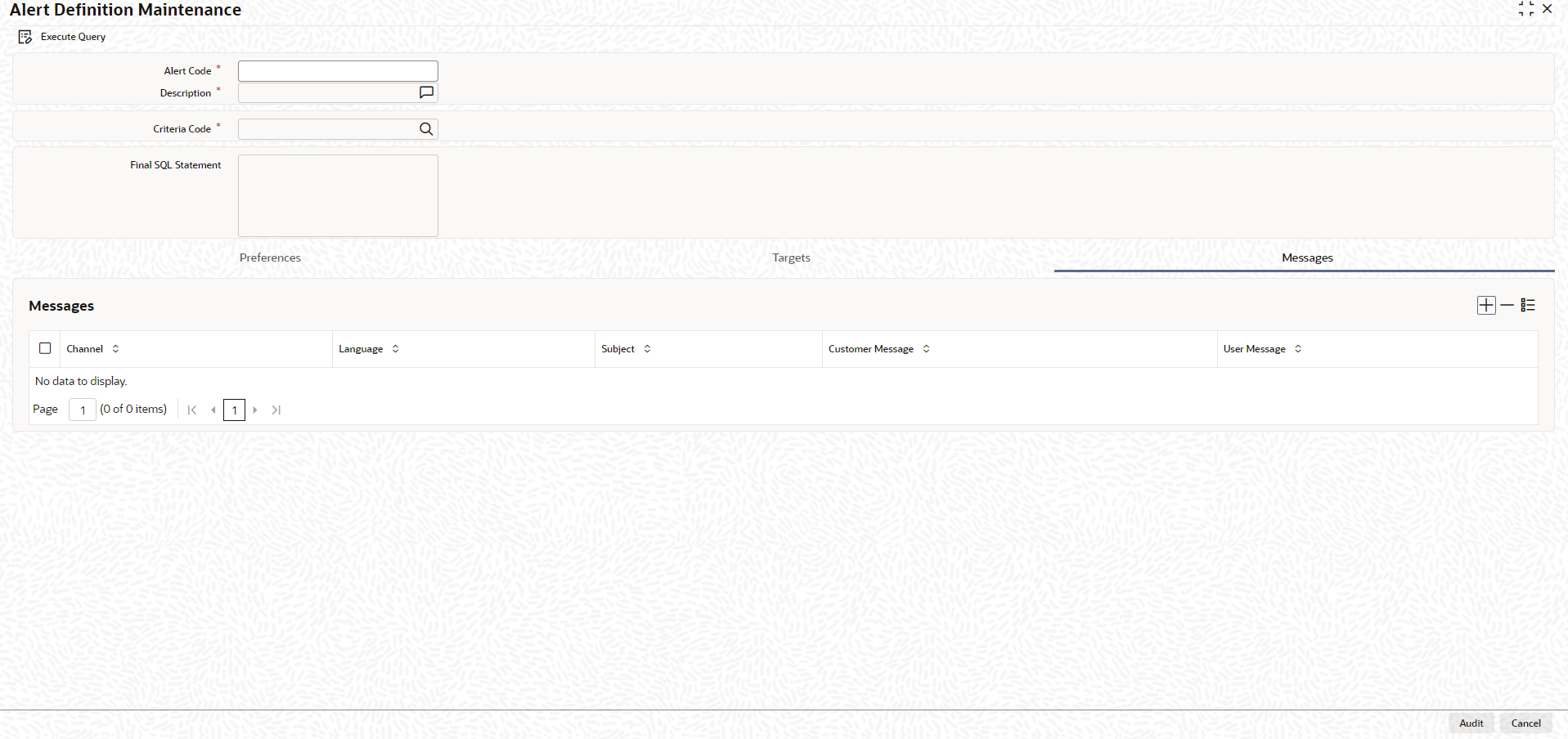

- On Alert Definition Maintenance screen, click

Message tab.The Message screen displays. For more information on fields, refer to the field description table.

Table 2-91 Message - Field Description

Field Description Channel Select the mode of message delivery. The following options are: - Dashboard

Language Specify the language of the alert message. The option list displays all valid languages that are applicable. Subject Specify a subject that is significant to the alert message to be generated. User Message Specify the message to be generated for the bank user or RM. The message may contain two types of text: - Static

- Variables

- Click Execute Query to execute the record.

- Alert Definition Summary

This topic describes about the procedure to view alert definition summary.

Parent topic: Limits and Collateral