1.14 Collateral Block Transaction

This topic provides the information on Collateral Block Transaction.

Note:

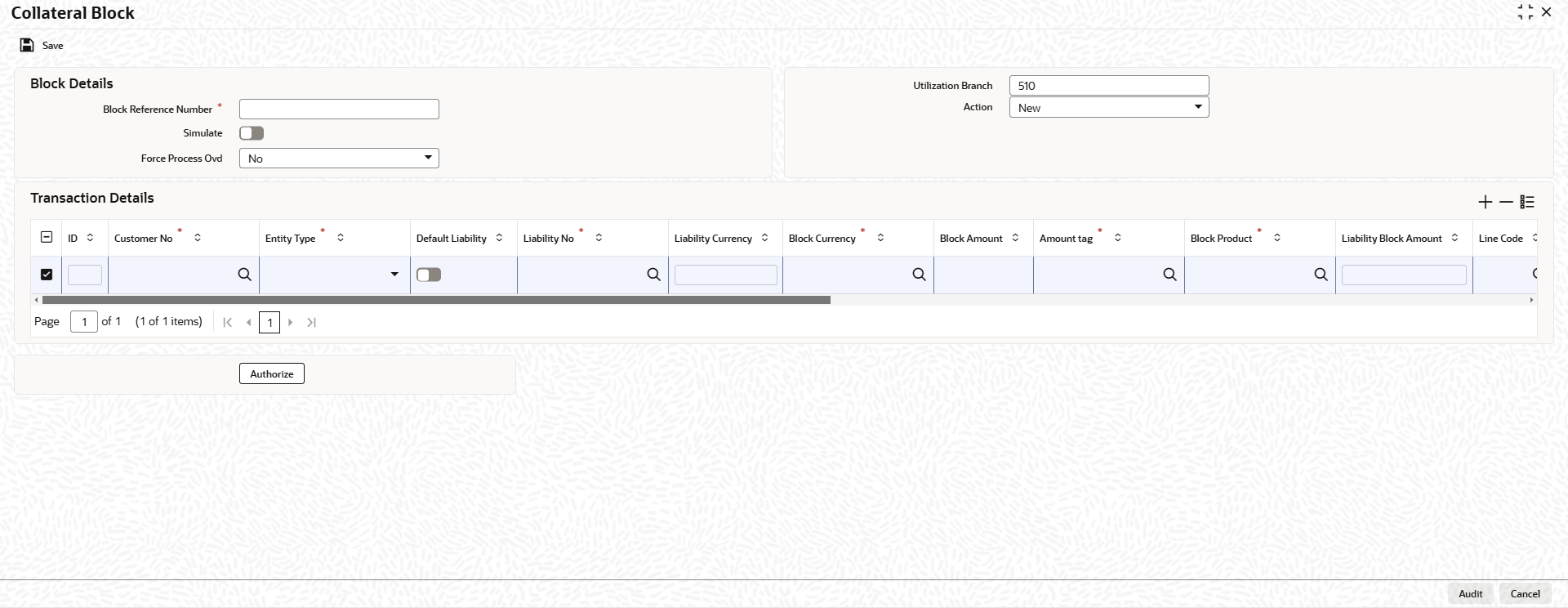

The fields, which are marked with an asterisk, are mandatory.- On the Home screen, specify

GCDBLCKS in the text box and click the

icon.The Collateral Block screen is displayed.

icon.The Collateral Block screen is displayed. - On Collateral Block screen , click

New and specify the fields.For more information on fields, refer to the field description table.

Table 1-127 Block Details Fields and Descriptions

Field Descriptions Block Reference Number Specify the unique number which is to be assigned for every block to be created. Simulate Select this check box to indicate that the details for the transaction being entered should be used only for simulation and not stored permanently within the system. After a successful simulation of a transaction, the system displays the utilized amount for liability, collateral and collateral pool. Force Process Ovd Indicates whether transaction should ignore the overrides occurred in the process or not. Utilization Branch Branch code is displayed here. It indicates the transaction branch code. Action During new block, you can perform below mentioned operations for the entities (liability, collateral, and collateral pool). - New Block

- Increase Block

- Decrease Block

- Alter Block

- Reverse Block

- Re-open Block

- Mature

- Delete

For more information on the utilizations refer examples listed after this table.

ID Indicates the transaction ID. Customer No The system displays the customer number to which the Liability, Collateral, Collateral Pool are linked. The option list displays all valid customer numbers linked to the liability number selected on this screen. You can select the customer number from the option list. Entity Type The system displays the Entity type to which the limit is associated. Default liability When a customer number is selected from list of values, default liability flag is checked by default and Liability No column shows the liability to which this customer is linked as default. If a customer is linked to multiple liabilities and block transaction needs to consider the entity belonging to a liability which is not default, then default liability needs to be unchecked and liability number can be selected from list of values against this field.

Liability No Liability which is linked to customer in Customer to Liability Link Maintenance screen (GEDCULIK). Liability Currency The currency with which the liability is associated is displayed here. Block Currency Specify the currency based on which the Block amount for the collateral has to be considered. Block Amount Specify the amount to be blocked. Amount Tag The amount tag entered in Amount Tag Maintenance screen is displayed here. Amount tag would be required when there are multiple utilization for the same reference number. This tag would indicate which component needs to be authorized.

Block Product Specify the product for the transaction. Liability Block Amount Displays the liability blocked amount. Collateral Code Specify the Collateral Code here. Each Collateral code should be unique. Pool Code Specify the Pool Code here. The pool code assigned to each collateral pool can be linked to a liability while creating credit limits. Utilization Status Indicates the utilization status, The available options are: - A-Active

- R-Reverse

- L- Liquidated

Tenor Basis Click the toggle status to indicate that the utilization should be tracked tenor wise for the facility. Tenor Enter the basis on which tenor tracking should be done for the utilization. You need to check the ‘Tenor Basis’ option before you specify the basis here. Maturity Date Specify the date on which the transaction matures. Value Date Specify the value date for the transaction. Module The module from which the transactions are triggered is displayed. Source Code Indicates the product processor name from where the transaction has been originated. This field will be as part of Header section (Source Code). Exposure Block Number Specify a unique number for the block you are creating. The system does not allow you to modify it after authorization. Exchange Rate Specify the Exchange Rate for cross currency block transaction. The block amount for all Limit Entities (Collateral, Pool, Liability and Exposure linked to liability) will be calculated in the mentioned block currency directly using this exchange rate instead of the exchange rate mentioned in GEDPARAM. Note: The exchange rate mentioned in GEDBLCKS will be used only for the calculation of direct limit entities block.

The following examples depict block applied on a collateral for different block operations.

New BlockTable 1-128 Before Block

Available Amount Block Amount Block Amount 1000 0 A Table 1-129 After Block of 1000

Available Amount Block Amount Block Status 9000 1000 A Alter BlockTable 1-130 After New Block of 1000

Available Amount Block Amount Block Status 9000 1000 A Table 1-131 After Alter Block of 3000

Available Amount Block Amount Block Status 7000 3000 A Table 1-132 After Alter Block of 2000

Available Amount Block Amount Block Status 8000 2000 A Increase BlockTable 1-133 After New Block of 1000

Available Amount Block Amount Block Status 9000 1000 A Table 1-134 After Increase of 1000

Available Amount Block Amount Block Status 8000 2000 A Decrease BlockTable 1-135 After New Block of 1000

Available Amount Block Amount Block Status 9000 500 A Table 1-136 After Decrease of 500

Available Amount Block Amount Block Status 9500 500 A Reverse BlockTable 1-137 After Block

Available Amount Block Amount Block Status 8000 2000 A Table 1-138 After Reverse of Block

Available Amount Block Amount Block Status 10000 0 R Reopen BlockTable 1-139 After Block

Available Amount Block Amount Block Status 10000 0 A Table 1-140 After Reopen of Block

Available Amount Block Amount Block Status 10000 0 A Liquidate BlockTable 1-141 After Block

Available Amount Block Amount Block Status 8000 2000 A Table 1-142 After Liquidate of Block

Available Amount Block Amount Block Status 10000 0 L - Click Save to save the record.

Parent topic: Collaterals