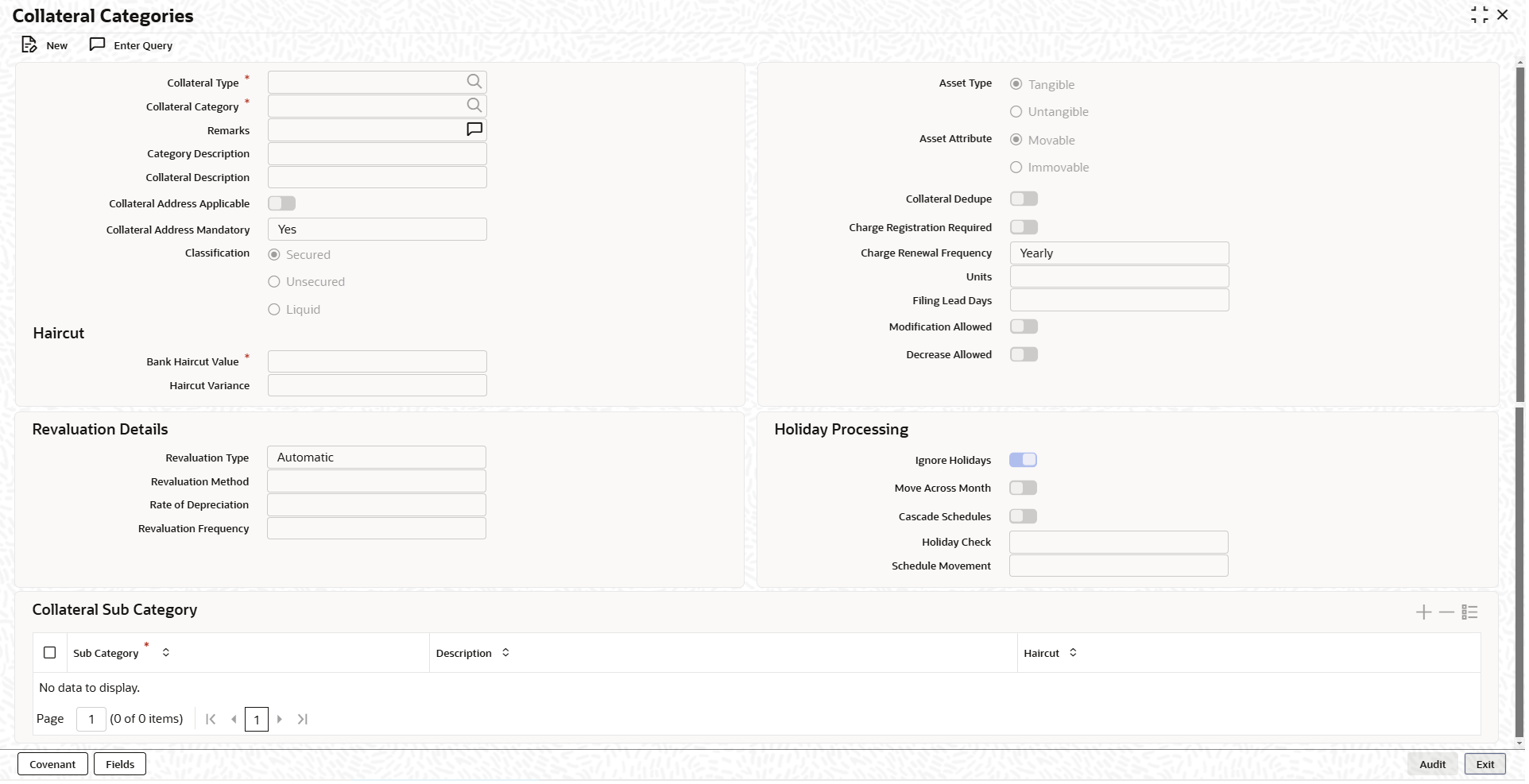

1.2 Collateral Categories

This topic provides information on collateral category maintenance.

Note:

The fields, which are marked with an asterisk, are mandatory.- On the Home screen, specify

GCDCOLCA in the text box and click the

icon.The Collateral Categories screen is displayed.

icon.The Collateral Categories screen is displayed. - On Collateral Categories screen, click

New and specify the fields.For more information on fields, refer to the field description table.

Table 1-2 Collateral Categories - Field Description.

Field Description Collateral Type Click the  icon and select the collateral type from the list.

The types maintained by the bank in the

Collateral Types screen

(GCDCOLTY) are displayed.

icon and select the collateral type from the list.

The types maintained by the bank in the

Collateral Types screen

(GCDCOLTY) are displayed.

Collateral Category Click the  icon and select the collateral category from the

list. The system displays the possible values for selected

Collateral Type.

icon and select the collateral category from the

list. The system displays the possible values for selected

Collateral Type.

Note: User defined category is applicable only for Vehicle and Property types of collateral.

Remarks Specify the Remarks for the collateral type and category combination, if any. Category Description Displays the description based on the selected collateral category selected. Collateral Description Displays the description based on the collateral type selected. Collateral Address Applicable and Collateral Address Mandatory Switch to Select the Collateral Address Applicable field in the "Collateral Category" Screen for property type of collaterals. - Selection is optional at category level. It is a check box

- By default, it is un-checked

If you select Collateral Address Applicable check box, then Collateral Address Mandatory additional field will be available for selection.

Collateral Address Mandatory field is a drop-down list with option Yes/No. By default, value is selected as No. This value can be modified by the user.

Note:- The above fields will indicate, if the Collateral Address needs to be captured or not while creating/ updating the property collateral record.

- If this check-box is selected, then while creating the property collateral record the system will validate whether address is captured in address panel of property collateral type.

- Collateral Address Applicable and Collateral Address Mandatory fields can be updated in the collateral category.

Refer Property Details - Common for more information.

Classification Select the classification type from the list. The available options are: - Secured

- Unsecured

- Liquid

Asset Type Select the asset type from the list. The available options are: - Tangible

- Untangible

Asset Attribute Select the attribute from the list. The available options are: - Movable

- Inmovable

Collateral Dedupe Select this check box if you want to perform collateral dedupe validation for the selected collateral type and category combination during collateral creation. Note: Collateral Dedupe validation can be performed only for the following collateral types:- Property

- Vehicle

- Agriculture

- Aircraft

- Vessel

Charge Registration Required Select this check box for recording registration details for the charge on collateral. As part of charge registration, notice with required details can be sent to the appropriate registration authority. Filing statement has to be sent to registrar for charge creation. Charge Renewal Frequency Select the charge renewal frequency from the drop-down list. The available options are: - Yearly

- Half Yearly

- Quarterly

- Monthly

- Daily

- Weekly

Units Specify the units. For example, if Frequency is selected as Monthly and Unit is selected as 2, then the system updates the charge end date considering perfection date + 2 months.

Filing Lead Days Specify the lead days. The days before charge expiry date. You can renew the charge registration during these days. Modification Allowed Enable this check box to indicate that modification to the ‘Bank Haircut Value’ is allowed. Decrease Allowed Enable this check box to indicate that decrease in the ‘Bank Haircut Value’ is allowed, in case ‘Modification Allowed’ check box is enabled. Haircut Specify the details under this section. Bank Haircut Value Specify the haircut value set by the bank for the selected collateral type and category combination. Bank Haircut Value can be any value between 0 to 100. Haircut Variance Specify the haircut variance allowed for the Bank Haircut Value, in case the Modification Allowed toggle is enabled. This is mandatory when Modification Allowed is enabled. Haircut variance can be any value between 0 to 100.You can increase or decrease the Bank Haircut Value to the extent of Haircut Variance during collateral creation. Revaluation Details Specify the details under this section. Revaluation details can be configured at collateral category level based on revaluation type and revaluation method as applicable to the collateral type.

Revaluation Type Select the type from the drop-down list. The available options are: - Automatic

- Manual

For more information on manual revaluation, refer Table 1-3.

For more information on automatic and manual revaluation, refer Table 1-4.

For more information on automatic revaluation, refer Table 1-5.

For more information on manual of revaluation, refer Table 1-6.

Revaluation Method Select the method from the drop-down list. The available options are: - Straight line method

- Written down value method

- Sum of years digit method

- External

- Custom

Note: The above following are the methods of revaluation when Revaluation Type is selected as Automatic.

Rate of Depreciation Specify the percentage. Rate of depreciation is applicable only when the revaluation method is straight line method or written down value method. Revaluation Frequency Select the frequency from the drop-down list. The available options are: - Daily

- Weekly

- Monthly

- Quarterly

- Half Yearly

- Yearly

This field is applicable only when Revaluation Type is Automatic. Revaluation frequency can be of yearly only for sum of years digit method.

Holiday Processing Specify the details under this section. Note: The holiday processing settings are applicable only when Revaluation Type is Automatic.

Ignore Holidays Switch to

to enable this parameter.

to enable this parameter.

Switch to

to disable this parameter.

to disable this parameter.

Move Across Month Switch to

to enable this parameter.

to enable this parameter.

Switch to

to disable this parameter.

to disable this parameter.

This field becomes available when the Ignore Holidays is disabled.

Cascade Schedules Switch to

to enable this parameter.

to enable this parameter.

Switch to

to disable this parameter.

to disable this parameter.

This field becomes available when the Ignore Holidays is disabled.

Holiday Check Select the holiday check from the drop-down list. The available options are: - Currency

- Local

- Both

Schedule Movement Select the schedule movement from the drop-down list. The available options are: - Move Forward

- Move Backward

Sub Category Speicfy the sub-category for the selected collaterals This is an optional maintenance for the collateral categories for which sub-categories are available. For example, if Residential Property is selected as category for Property collateral type, Villa/Flat/Duplex can be specified as sub-category.

If haircut is not provided at sub-category level, the system will apply the Bank Haircut Value maintained for collateral type and category combination to the sub-categories.

The following configurations set for the collateral type and category combination is applicable also for the sub-categories.- Modification Allowed

- Decrease Allowed

- Haircut Variance

Note:- Sub Category value must be unique across all collateral type and category combination records.

- Sub Category cannot be de-linked once it is linked to a collateral.

- New record cannot be created in

GCDCOLCA for the following collateral

types. Only modification is allowed for these

collateral types.

- Agriculture

- Property

- Water Vessel

- Aircraft

- Vehicle

Description Specify the brief description about the subcategory. Haircut Specify the haircut for the collaterals of mentioned sub-category. Haircut can be any value between 0 to 100. If haircut is not provided at sub-category level, the system will apply the Bank Haircut Value maintained for collateral type and category combination to the sub-categories.

Table 1-3 Manual Revaluation

SL.No Collateral types - Only manual Function Id 1 Corporate Deposits GCDCOLCD 2 Inventory GCDCOLIY 3 Account receivable GCDCOLAR 4 Guarantee GCDCOLLG 5 Other bank deposits GCDCOLOD 6 Accounts & Contracts GCDCOLAC 7 Main Screen GCDCOLLT 8 Obligation GCDCOLLO 9 Insurance GCDCOLLI Auto and Manual Revaluation

Revaluation is based on configured depreciation method and percentage or external price change. The following collateral types are applicable for both ‘Auto’ and ‘Manual ‘revaluation type.Table 1-4 Auto and Manual Revaluation

SL.No Collateral types with revaluation type Manual & Auto External/Depreciation Function ID 1 Vehicles GCDCOLLV 2 Machinery GCDCOLLY 3 Vessel GCDCOLVE 4 Aircraft GCDCOLLA Auto Revaluation

The following collateral types are applicable only for ‘Auto’ revaluation type.Table 1-5 Auto Revaluation

SL.No Collateral types with only Auto-external Function ID 1 Funds GCDCOLFU 2 Bonds GCDCOLBO 3 Stocks GCDCOLLS Following collateral types are considered for manual type of revaluation as well as automatic revaluation with external revaluation method.

Table 1-6 Manual of Revaluation

SL.No Collateral types with Manual and Auto-External revaluation Function ID 1 Commercial papers GCDCOLCP 2 Agriculture GCDCOLAG 3 Perishables GCDCOLPC 4 Commodities GCDCOLCO 5 Metals GCDCOLLL 6 Property GCDCOLLP For more information on collateral revaluation, refer Collateral Revaluation section in this User Manual.

- Click Save to save the record.

- Covenants

This topic provides information on Maintaining Covenant Details for Collateral Category.

Parent topic: Collaterals