1.5 Issuer Maintenance

This topic provides information on issuer maintenance.

Note:

The fields, which are marked with an asterisk, are mandatory.A customer is granted credit on the basis of his/her credit worthiness. The credit worthiness of a customer depends on the assets constituting the customer’s portfolio. The type of collateral that a customer offers can be in the form of marketable or non-marketable securities.

Marketable collaterals, driven by market forces, tend to fluctuate unpredictably. You may hence need to monitor your bank’s exposure to issuers of such collateral. The details of the issuer and limit for his securities can be defined using the Issuer Maintenance screen.

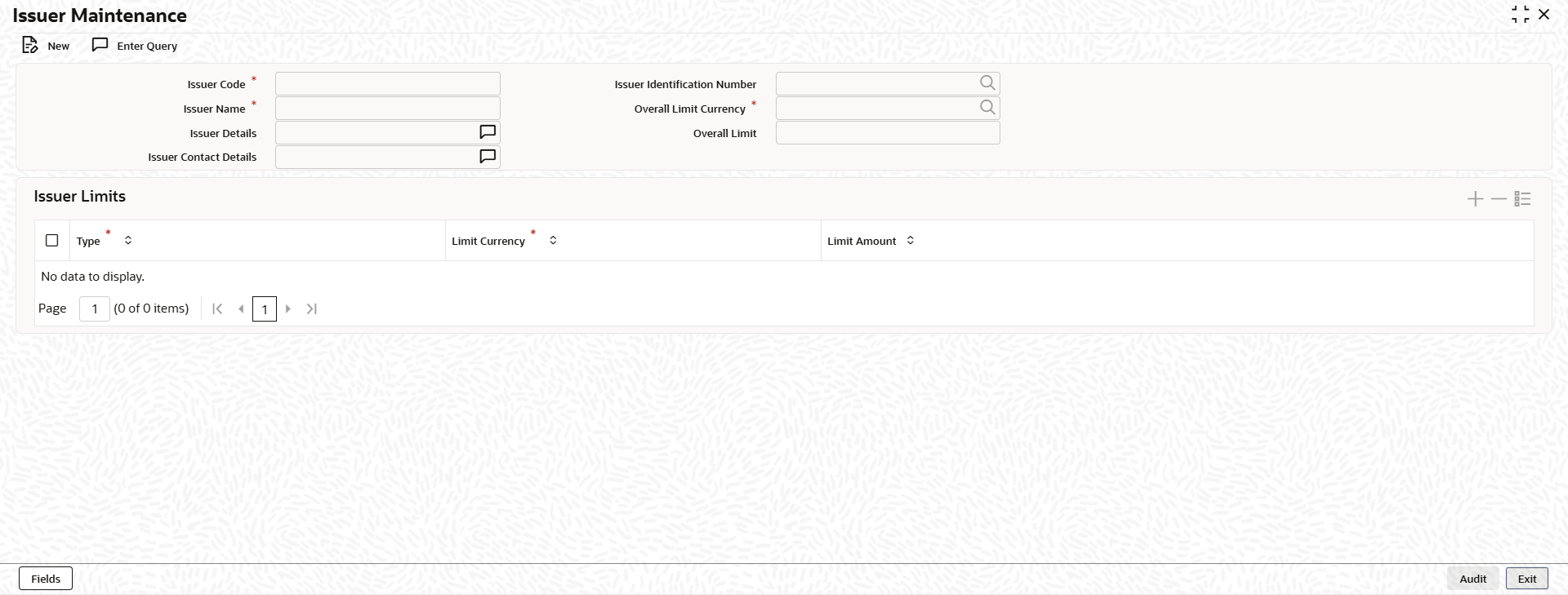

- On the Home screen, specify

GCDISSUR in the text box and click the

icon.The Issuer Maintenance screen is displayed.

icon.The Issuer Maintenance screen is displayed. - On Issuer Maintenance screen, click

New and specify the fields.For more information on fields, refer to the field description table.Limits for the issuers of Collateral can be setup at the following two levels:

- Overall limit for each Issuer.

- Limit for the Securities issued by an Issuer.

Table 1-10 Issuer Maintenance - Field Description.

Field Description Issuer Code Specify the unique code for the issuer whose securities the bank accepts. The Issuer is identified by this code. This code can also be used to retrieve information about the issuer,. Issuer Name This field defaulted based on selected Security Code in GCDSECTY. Issuer Details Specify the additional details of the issuer. Issuer Contact Details Specify the contact details of the issuer. Issuer Identification Number Click the  icon and select the identification number from

the list.

icon and select the identification number from

the list.

Overall Limit Currency Click the  icon and select the currency in which the

Overall Limit is specified.

icon and select the currency in which the

Overall Limit is specified.

Overall Limit Specify an overall limit for the issuer. This limit indicates the maximum limit beyond which your bank would not like to expose itself to the Issuer. An issuer can issue different types of market based securities; these could be debentures, shares, bonds, and so on. By defining an overall limit for an Issuer, the bank can limit its exposure to the issuer.

When the total of all the collateral given by the customer in the form of market- based securities exceeds the overall limit specified for the Issuer, the system shows an appropriate message indicating that the limit has been exceeded.Issuer Limits for Collateral Types An Issuer of Securities may issue different types of securities. These can be used by a customer as collateral for credit availed from the bank. The securities used as collateral can be debentures, shares, bonds, commercial papers, and so on. These securities can therefore be classified under different Collateral Types too. For each security type that your bank accepts as collateral from the issuer, you can specify a limit indicating the maximum exposure amount (in value) to the issuer for this security type.

When the total of the collateral given by the customer in the form of a particular collateral type exceeds the limit set for the Issuer, the system will show you a notification.

You can define Issuer Limits for different collateral types under Issuer Limits. You can maintain several collateral types here, with their respective Limit Currencies and Limit Amounts.

Type Click the  icon and select the collateral type for which

issuer limits are being specified.

icon and select the collateral type for which

issuer limits are being specified.

Limit Currency Click the  icon and select the limit currency from the

list.

icon and select the limit currency from the

list.

Limit Amount Specify the limit amount in selected limit currency. - Click Save to save the record.

Parent topic: Collaterals