1.6 Securities

This topic provides information on securities maintenance.

Note:

The fields, which are marked with an asterisk, are mandatory.- Limit granted under a particular security.

- Credit worthiness of a security when it’s used as collateral.

Security maintenance is used for creating securities which are considered for external revaluation including market based securities.

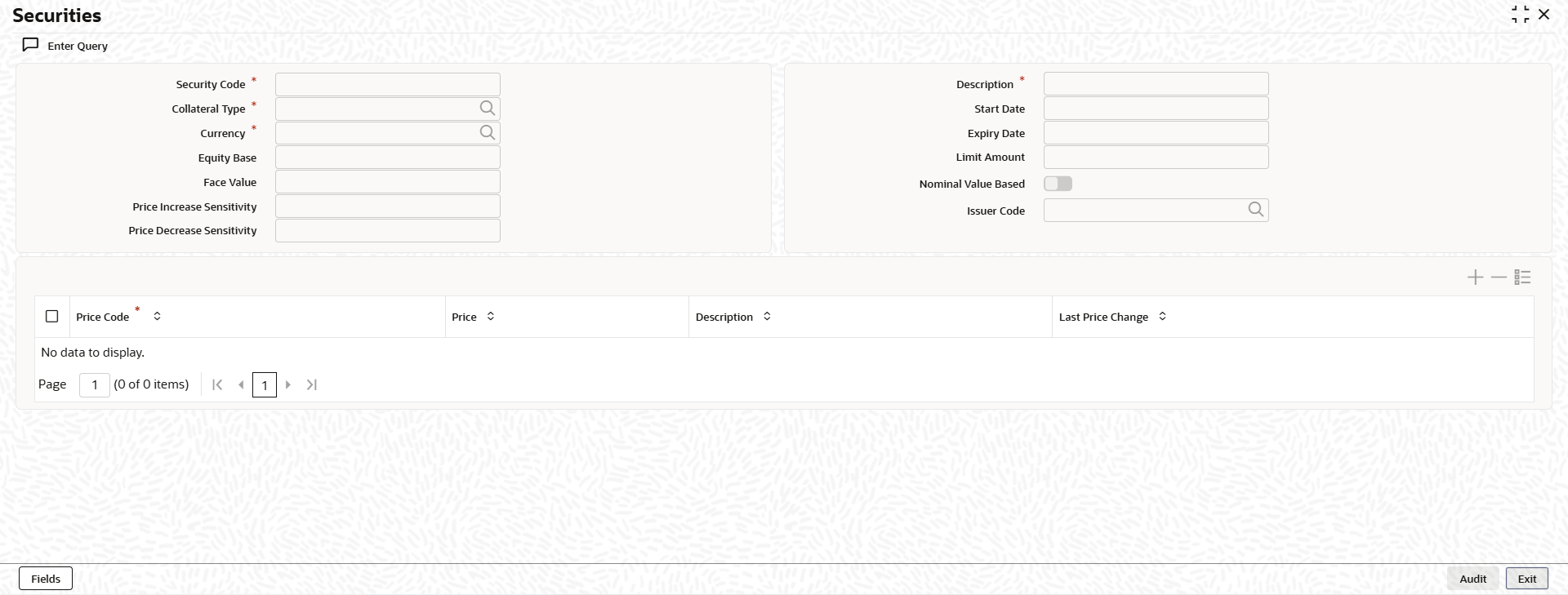

- On the Home screen, specify

GCDSECTY in the text box and click the

icon.The Securities screen is displayed.

icon.The Securities screen is displayed. - On Securities screen, click Enter

Query and specify the fields.For more information on fields, refer to the field description table.

Table 1-11 Securities - Field Description

Field Description Security Code Specify a unique ID to identify the security. This ID is called the Security Code. This ID is used while maintaining Collateral for a market value based Security. Description Specify in description of the securtity code. Collateral Type Click the  icon and select the type from the list.

icon and select the type from the list.

Currency Click the  icon and select the currency to be associated with

the security from the list. Once authorized this entry

cannot be changed.

icon and select the currency to be associated with

the security from the list. Once authorized this entry

cannot be changed.

Equity Base Specify the equity base for the security, which represents the total amount raised through its issuance. This entry is for information purposes only. For example: Gem granites have come out with Debentures 98 and have raised US $1 Million through this issue. This US $1M that Gem Granites has raised constitutes the equity base for Debentures 98.

Face Value Specify the face value of the security. A maximum of 50 numeric characters are allowed. Note: Face value and Nominal value is applicable only for Collateral Types selected as Funds, Stocks, and Bonds.

Price Increase Sensitivity and Price Decrease Sensitivity If the value of collateral is backed by a marketable security (whose value is driven by market forces) you may want to revalue the collateral, so that its value reflects the current market price of the security, which backs it. To do so, you should specify your sensitivity to the security. The price sensitivity of a security is expressed as a percentage. You should specify the percentage increase or decrease (the upper and lower limits) above or below the current market price, which should trigger the revaluation process. The revaluation process revaluates the collateral if the price of the securities that backs it fluctuates above or below the sensitivity you have defined.

Price Increase Sensitivity Denotes the percentage increase in the market price that should trigger a revaluation of the Collateral. This means, if the current market price of the security rises above the old market price by the percentage you have defined as the increase sensitivity for the security, then the revaluation process happens. For example: Consider a case wherein you have specified the price increase sensitivity for Debentures 98 to be 15%. If the market price of the security has increased from $100 to $125. At this rise in the market price of the security (which is 25% above the old market value), the revaluation process is triggered off, so that the Collateral value of the security reflects its current market value.

Price Decrease Sensitivity Denotes the percentage decrease in the market price of the security that should trigger a revaluation of the Collateral. This means, if the current market price of the security falls below the old market price by the percentage you have defined as the decrease sensitivity for the security, the revaluation process happens. For example: Consider a case wherein you had specified the price decrease sensitivity of Debentures 98 to be 15%. If the market price of the security has decreased from US $100 to US $75. At this fall in the market price of the security (which is 33.33% below the old market value of the security), the revaluation process is triggered off, so that the Collateral value of the security reflects it s current market price.

Note: Expired securities are not available for attaching to collateral at the time of collateral maintenance.

Start Date and Expiry Date Specify the start date and expiry date of the security. Note: Only securities which are active (after start date and before expiry date) are available at collateral maintenance level for considering the security for creating collateral. Expired securities are not available for attaching to collateral at the time of collateral maintenance.

Limit Amount Specify the limit amount for the particular security. Limit amount is applicable for funds, bonds, stocks, and commercial papers. This is validated against the limit specified for the issuer in GCDISSUR for the collateral type under which security is created as Nominal Value Based. Select Nominal Value Based check box if the collateral value is to be calculated on the nominal value based for a particular security Nominal Value Based. Switch to

to calculate the nominal value based for a

particular security for the collateral value.

to calculate the nominal value based for a

particular security for the collateral value.

Switch to

to disable this parameter.

to disable this parameter.

Issuer Code Click the  icon and select the issuer code for the customer

for whom the securities are collected. The list of issuers

is available here. Issuer code is mandatory for securities

of collateral type funds, bonds, stocks and commercial

papers.

icon and select the issuer code for the customer

for whom the securities are collected. The list of issuers

is available here. Issuer code is mandatory for securities

of collateral type funds, bonds, stocks and commercial

papers.

Price Details If the security is quoted in different markets, its value would differ in different markets. You can maintain the various market prices of the security under the Price table. You can specify the following details under this section. Security created can be used in Collaterals Maintenance screen of collateral types which are enabled for external revaluation.

Price Code Indicates the market place for which the price is quoted. This is a unique code for the security to signify the price, like market place/exchange where the price is quoted for the security. Note: Price Code modification for a new price with a new effective date is not allowed on an expired security.

Price Specify the price of the security in that market Description Specify the description of the price. Market Price Price of the security in that market. Last Price Change Date on which the price was last changed. This gets updated with the date on which new price is signified for the price code. This can later be linked to Collaterals Maintenance screen GCDCOLLT for maintaining market value based collaterals. Security created can be used in Collaterals Maintenance screen of collateral types which are enabled for external revaluation.

- Click Save to save the record.

Parent topic: Collaterals