1.1.1.4.1 Loan Product Preferences

This topic describes the loan product preferences details.

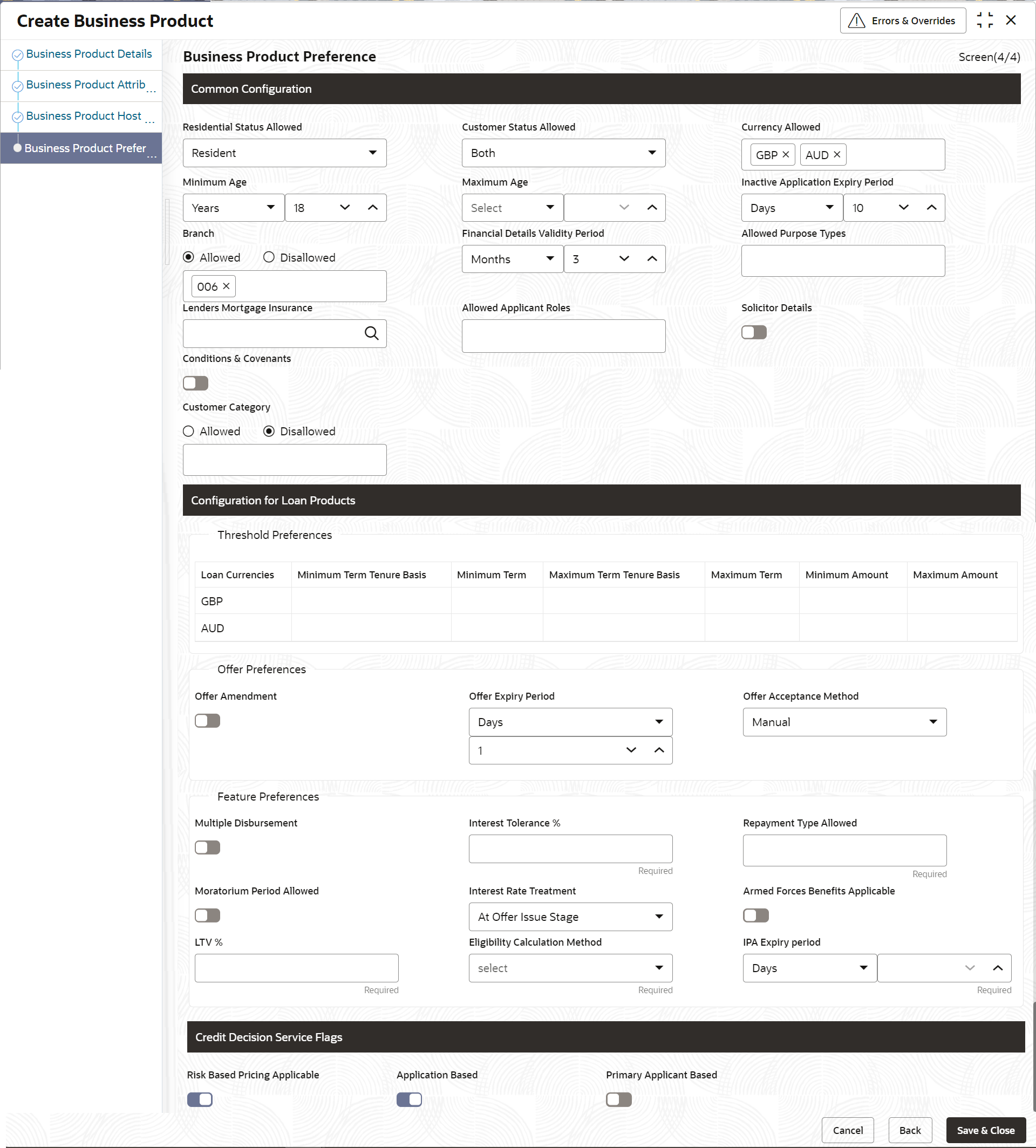

If the Product Category is selected as Individual to configure loan preferences:

Figure 1-5 Business Product Preference – Loan Product

Table 1-5 Business Product Preference – Loan Product- Individual

| Field Name | Description |

|---|---|

| Common Configuration | Specify the common configurations for the business product. |

| Residential Status Allowed |

Select the option for which the business product is applicable for. Available options are:

|

| Customer Status Allowed |

Select the option for which the business product is applicable for. Available options are:

|

| Currency Allowed |

Select the currency that are allowed for the business product. System allows to select multiple currencies, if applicable. The list of currencies appears based on the host configuration. |

| Minimum Age |

Specify the minimum age of the applicant who are eligible to open the account for the business product being created. Select the period from the drop-down box. Available options are:

|

| Maximum Age |

Specify the maximum age of the applicant who are eligible to open the account for the business product being created. Select the period from the drop-down box. Available options are:

|

| Inactive Application Expiry Period |

Specify the period after which the application must be marked as Expired. Select the period from the drop-down box. Available options are:

Once the application has expired, no further lifecycle activity can happen for that application. |

| Branch |

Select one of the following options:

System allows to select Disallowed and keep it blank so that the Business Product is allowed for all the branches. |

| Financial Details Validity Period |

Specify the validity period for financial details of the applicant. Select the period from the first drop-down box. Available options are:

Select the numeric period from the second drop-down box. |

| Allow Purpose Types |

Select the purpose types that are allowed for business product. System allows to select multiple purpose types, if applicable. The available options are:

This field appears if the Loan Account option and Home Loan option is selected from the Product Type list and Product Sub Type list respectively. If you configure purpose types for loan product then purpose type list appears while updating Product Details throughout the account opening process. |

| Lender Mortgage Insurance |

Search and select the lender mortgage insurance rule that are defined. This field appears if the Loan Account option and Home Loan option is selected from the Product Type list and Product Sub Type list respectively. |

| Allowed Applicant Roles | Specify the applicant roles that are allowed to apply this product. |

| Solicitor Details | Specify whether the solicitor details are allowed to capture while submitting this products account opening application. |

| Condition &Covenants | Specify whether the conditions and covenants are allowed to capture while submitting this products account opening application. |

| Customer Category |

Select one of the following options:

The system allows to select Disallowed and keep it blank so that the Business Product is allowed for all the branches. |

| Configurations for Loan Products | Specify the configurations for the loan products. |

| Threshold Preference | In this section you can capture the threshold preference of loan product. |

| Loan Currencies | Displays the currency based on the Currency Allowed configured in the Common Configuration tab above. |

| Minimum Term Tenure Basis |

Select the minimum term tenure. Available options are:

|

| Minimum Term | Specify the minimum tenure of the loan for the selected currency. |

| Maximum Term Tenure Basis |

Select the maximum term tenure. Available options are:

|

| Maximum Term | Displays the maximum tenure of the loan for the selected currency. |

| Minimum Amount | Displays the minimum amount of the loan for the selected currency. |

| Maximum Amount | Displays the maximum amount of the Loan for the selected Currency. |

| Offer Preferences | In this section you can set the offer related preference for loan product. |

| Offer Amendment | Select to indicate whether the offer is allowed to amend. |

| Offer Expiry Period |

Select the expiry period of an offer in days, months and years. Enter the count. OR Select the up and down arrow to increase or decrease the count. |

| Offer Acceptance Method |

Select the method to accept the offer. The available options are:

|

| Feature Preference | In this section you can capture the features preference for loan product. |

| Multiple Disbursement | Select the toggle if multiple disbursement is allowed for the loan accounts. |

| Interest Tolerance % |

Specify the maximum interest margin, the user can provide for the loan account. You can specify the maximum value as 100.00%. Tolerance Percentage = Interest Rate Interest Tolerance Percentage. |

| Repayment Type Allowed |

Displays the repayment type allowed for the loan product based on the host product mapped with the business product. Available options are:

|

| Moratorium Period Allowed | Select the toggle if moratorium period is allowed for the loan accounts. |

| Interest Rate Treatment |

Select the interest rate treatment from the drop-down list. Available options are:

If Pegged Period is selected, you need to additionally select the period from Month or Year and enter the numeric value for the Pegged Period definition. |

| Armed Forces Benefits Applicable | Select to indicate the armed forces benefits are applicable to the loan product. |

| LTV% |

Specify the percentage for Loan to Value (LTV). LTV = Loan Amount / Collateral Value This field is displayed, if Product Sub Type is selected as Home Loan in Business Product Details segment. |

| Eligibility Calculation Method |

Select the required option for the eligibility calculation method from the drop-down list. Available options are:

Eligibility Amount = (Net Savings / EMI per Lakh) 100000

Eligibility Amount = (Gross Income FOIR% - Financial Liability) / EMI per Lakh 100000 Note: Banks will compare the eligible amount as per FOIR and LTV, and the lowest eligible amount will be considered. This field is displayed, if IPA Applicable is selected in Business Product Details segment. |

| FOIR% |

Specify the FOIR percentage. This field is displayed if Eligibility Calculation Method is selected as FOIR Method. |

| IPA Expiry Period |

Select the IPA expiry period. Available options are:

This field is displayed if IPA Applicable is selected in Business Product Details segment. |

| Credit Decision Service Flags | Select the Credit Decision Service Flags. |

| Risk Based Pricing Applicable | Select the toggle if Risk based pricing is allowed for the loan accounts. |

| Application Based | Select the toggle if the scorecard calculation should be considered based on the application. |

| Primary Applicant Based | Select the toggle if the scorecard calculation should be considered based on the Primary applicant. |

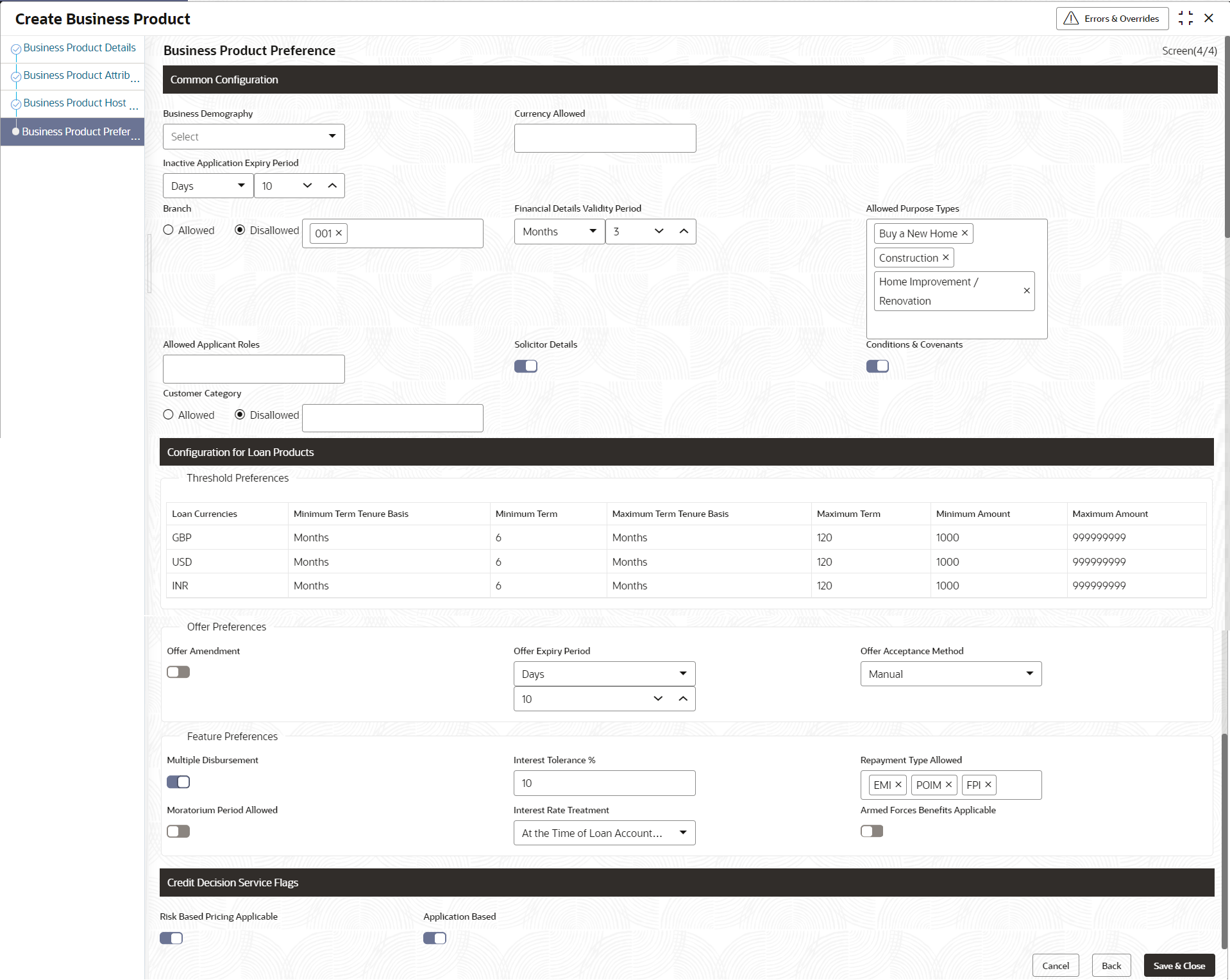

If the Product Category is selected as Small and Medium Business:

Figure 1-6 Business Product Preference – Loan Account Product (SMB)

Table 1-6 Business Product Details – Field Description

| Field | Description |

|---|---|

| Common Configuration | Specify the common configurations for the business product. |

| Business Demography |

Select the option for which the business product is applicable for. Available options are:

|

| Currency Allowed | Select the currency or currencies that are allowed for the business product. System allows to select multiple currencies, if applicable. |

| Inactive Application Expiry Period |

Specify the period after which the application must be marked as Expired. Select the period from the drop-down box. Available options are:

Once the application has expired, no further lifecycle activity can happen for that application. |

| Branch |

Select one of the following options:

|

| Financial Details Validity Period |

Specify the validity period for financial details of the applicant. Select the period from the first drop-down box. Available options are:

Select the numeric period from the second drop-down box. |

| Allow Purpose Types |

Select the purpose types that are allowed for business product. System allows to select multiple purpose types, if applicable. The available options are:

If you configure purpose types for loan product then purpose type list appears while updating Product Details throughout the account opening process. |

| Allowed Applicant Roles |

Specify the applicant roles that are allowed to apply this product. The available options are:

|

| Solicitor Details | Specify whether the solicitor details are allowed to capture while submitting this products account opening application. |

| Condition & Covenants | Specify whether the conditions and covenants are allowed to capture while submitting this products account opening application. |

| Customer Category |

Select one of the following options:

The system allows to select Disallowed and keep it blank so that the Business Product is allowed for all the branches. |

| Configuration for Loan Products | Specify the configurations for Loan products. |

| Threshold Preferences | In this sections you capture threshold preferences for loan product. |

| Loan Currencies | Displays the currency based on the Currency Allowed configured in the Common Configuration tab above. |

| Minimum Term Tenure Basis |

Select the minimum term tenure. Available options are:

|

| Minimum Term | Specify the minimum tenure of the loan for the selected currency. |

| Maximum Term Tenure Basis |

Select the maximum term tenure. Available options are:

|

| Maximum Term | Specify the maximum tenure of the loan for the selected currency. |

| Minimum Amount | Specify the minimum amount of the loan for the selected currency. |

| Maximum Amount | Specify the maximum amount of the Loan for the selected Currency. |

| Multiple Disbursement | Select the toggle if the multiple disbursement is allowed for the loan accounts. |

| Moratorium Period Allowed | Select the toggle if moratorium period is allowed for the loan accounts. |

| Repayment Type Allowed |

Select the repayment type allowed for the loan product based on the host product mapped with the business product. Available options are:

|

| Offer Preferences | In this section you can capture the offer preferences of the loan product. |

| Offer Amendment | Select the toggle if offer amendment is allowed for the loan accounts. |

| Offer Expiry Period |

Specify the offer expiry period. Available options are:

|

| Offer Acceptance Method |

Select the offer acceptance method. Available options are:

|

| Feature Preferences | In this section you can set the feature preferences of the loan product. |

| Multiple Disbursement | Select to indicate whether the multiple disbursement is allowed for the loan product. |

| Repayment Type Allowed |

Displays the repayment type allowed for the loan product based on the host product mapped with the business product. Available options are:

|

| Moratorium Period Allowed | Select the toggle if moratorium period is allowed for the loan accounts. |

| Interest Rate Treatment |

Select the interest rate treatment from the drop-down list. Available options are:

|

| Pegged Period |

Select the pegged period in Days, Months and Years. Enter the value of the pegged period. OR Select up or down arrow to increase or decrease the value respectively. |

| Armed Forces Benefits Applicable | Select to indicate the armed forces benefits are applicable to the loan product. |

| Credit Decision Service Flags | Select the Credit Decision Service Flags. |

| Risk Based Pricing Applicable | Select the toggle if Risk based pricing is allowed for the loan accounts. |

| Application Based | Select the toggle if the scorecard calculation should be considered based on the application. |

- Click Next in Business Product Host Mapping screen to proceed with next data segment, after successfully capturing the data.

- Specify the details in the relevant data fields. The fields which are marked with Required are mandatory. For more information on fields, refer to the field description table.