1.1.1.4.2 Saving or Current Product Preferences

This topic describes the saving product preferences details.

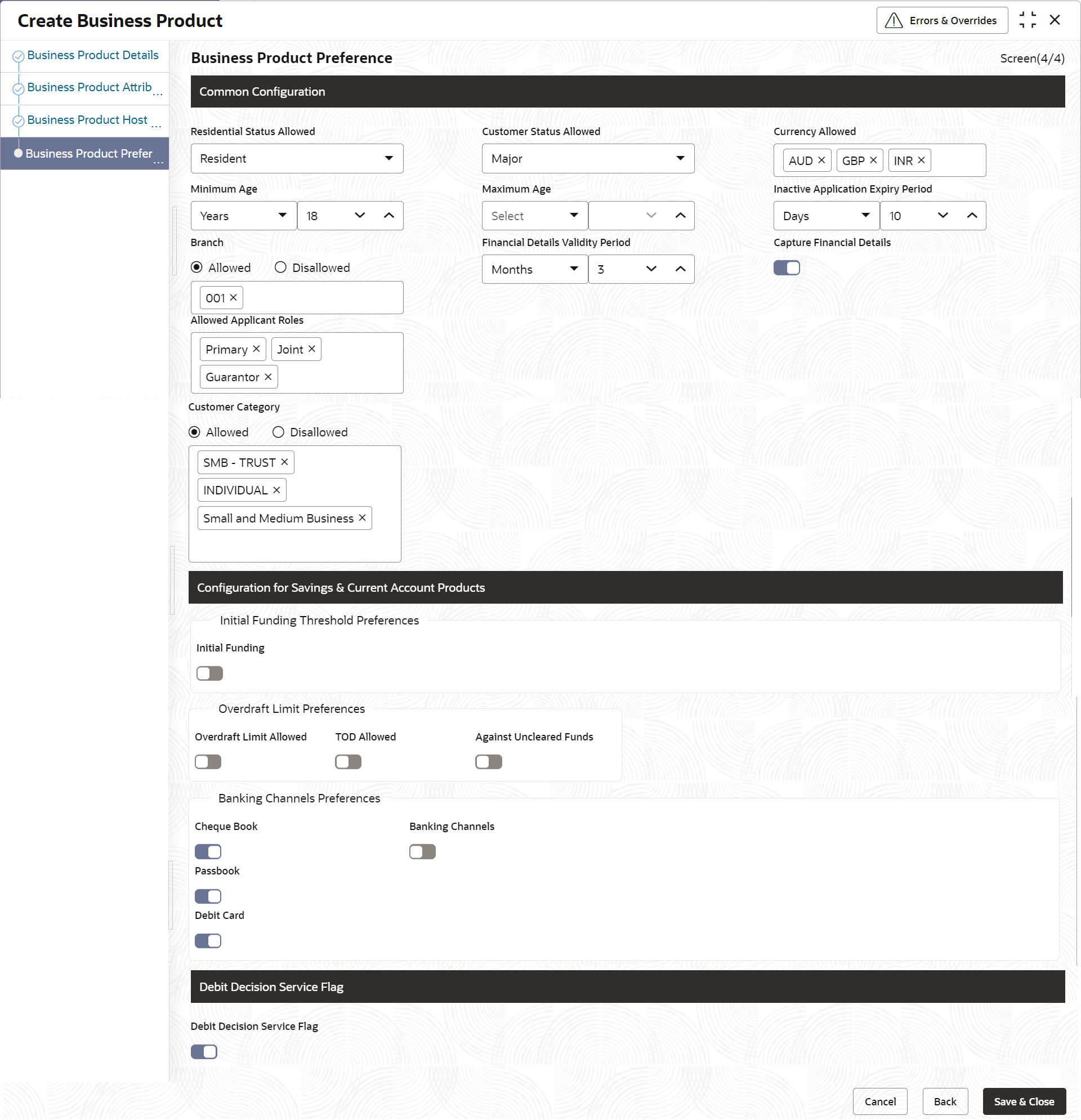

If the Product Category is selected as Individual to configure saving or current preferences:

Figure 1-7 Business Product Preference – Savings or Current Account Product

Table 1-7 Business Product Preference (Savings or Current Account Product) – Field Description

| Field Name | Description |

|---|---|

| Common Configuration | Specify the common configurations for the business product. |

| Residential Status Allowed |

Select the option for which the business product is applicable for. Available options are:

|

| Customer Status Allowed |

Select the option for which the business product is applicable for. Available options are:

|

| Currency Allowed | Select the currency or currencies that are allowed for the business product. System allows to select multiple currencies, if applicable. |

| Minimum Age |

Specify the minimum age of the applicant who are eligible to open the account for the business product being created. Select the period from the drop-down box. Available options are:

|

| Maximum Age |

Specify the maximum age of the applicant who are eligible to open the account for the business product being created. Select the period from the drop-down box. Available options are:

|

| Inactive Application Expiry Period |

Specify the period after which the application must be marked as Expired. Select the period from the drop-down box. Available options are:

Once the application has expired, no further lifecycle activity can happen for that application. |

| Branch |

Select one of the following options:

|

| Financial Details Validity Period |

Specify the validity period for financial details of the applicant. Select the period from the first drop-down box. Available options are:

Select the numeric period from the second drop-down box. This field is mandatory for Current Product and non-mandatory for Savings Product. |

| Capture Financial Details | Specify whether you need to capture financial details for this business product. |

| Allowed Applicant Roles | Specify the applicant roles that are allowed to apply this product. |

| Customer Category |

Select one of the following options:

The system allows to select Disallowed and keep it blank so that the Business Product is allowed for all the branches. |

| Configuration for Savings & Current Account Products | Specify the configurations for Savings and Account product. |

| Initial Funding | Select to indicate whether the funding process must appears at the initial stage of account opening. |

| Fund Post Account Opening |

Select to indicate whether the funding process must be performed post account opening. This field appears if the Initial Funding toggle is selected. |

| Currency |

Displays the currency based on the Currency Allowed configured in the Common Configuration section. This field appears if the Initial Funding toggle is selected.. |

| Minimum Amount |

Specify the minimum funding amount if Initial Funding is mandatory for the account origination. This field appears if the Initial Funding toggle is selected. |

| Maximum Amount |

Specify the maximum funding amount if Initial Funding is mandatory for the account origination. This field appears if the Initial Funding toggle is selected. |

| Overdraft Limit Preferences | This section you can set the preferences of overdraft limit. |

| Overdraft Limit Allowed | Select to indicate if overdraft limit is allowed for the account. |

| TOD Allowed | Select to indicate the TOD is allowed. |

| Against Uncleared Funds | Select to indicate the action against uncleared funds. |

| Offer Preferences |

This section captures the preferences of overdraft offers. This section appears only if the Overdraft Limit Allowed toggle is selected. |

| Offer Amendment | Select to indicate whether the offer is allowed to amend. |

| Offer Expiry Period |

Select the expiry period of an offer in days, months and years. Enter the count. OR Select the up and down arrow to increase or decrease the count. |

| Offer Acceptance Method |

Select the method to accept the offer. The available options are:

|

| Cheque Book | Select to indicate if cheque book is to be allowed for the account. |

| Passbook | Select to indicate if passbook is to be allowed for the account. |

| Debit Card | Select to indicate if debit card is to be allowed for the account. |

| Banking Channels | Select to indicate if multiple banking channels are allowed for the account. |

| Channels Allowed |

Select the channels that are allowed to the account. The available options are:

This field appears if the Banking Channel toggle is selected. |

| Debit Decision Service Flag | This section captures the debit decision details. |

| Debit Decision Service Flag | Select to indicate the debit decision service is allowed. |

| Credit Decision Service Flags |

Select the Credit Decision Service Flags. The below flags appear only if Overdraft Limit Allowed toggle is selected. |

| Risk Based Pricing Applicable | Select the toggle if Risk based pricing is allowed for the loan accounts. |

| Application Based | Select the toggle if the scorecard calculation should be considered based on the application. |

| Primary Applicant Based | Select the toggle if the scorecard calculation should be considered based on the Primary applicant. |

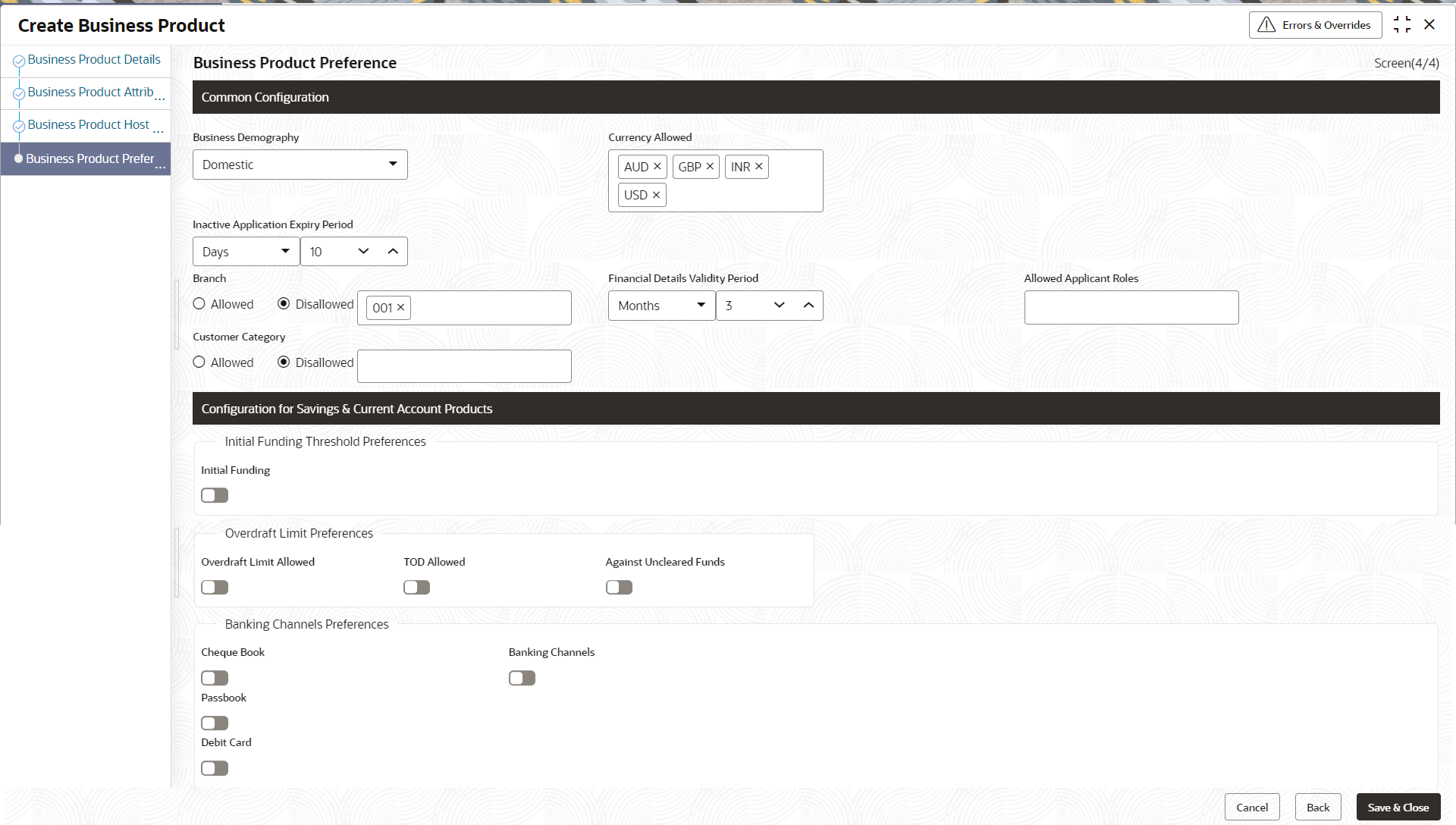

If the Product Category is selected as Small and Medium Business:

Figure 1-8 Business Product Preference – Savings and Current Account Product (SMB)

Table 1-8 Business Product Details – Field Description

| Field | Description |

|---|---|

| Common Configuration | Specify the common configurations for the business product. |

| Business Demography |

Select the option for which the business product is applicable for. Available options are:

|

| Currency Allowed | Select the currency or currencies that are allowed for the business product. System allows to select multiple currencies, if applicable. |

| Inactive Application Expiry Period |

Specify the period after which the application must be marked as Expired. Select the period from the drop-down box. Available options are:

Once the application has expired, no further lifecycle activity can happen for that application. |

| Branch |

Select one of the following options:

|

| Financial Details Validity Period |

Specify the validity period for financial details of the applicant. Select the period from the first drop-down box. Available options are:

Select the numeric period from the second drop-down box. This field is mandatory for Current Product and non-mandatory for Savings Product. |

| Allowed Applicant Roles | Specify the applicant roles that are allowed to apply this product. |

| Customer Category |

Select one of the following options:

The system allows to select Disallowed and keep it blank so that the Business Product is allowed for all the branches. |

| Configuration for Savings & Current Account Products | In this section you can capture the configurations for Savings and Account product. |

| Initial Funding Threshold Preferences | In this section you can capture initial funding threshold preferences for saving or current account. |

| Initial Funding | Select the toggle if Initial Funding is mandatory for the Account Origination. |

| Fund Post Account Opening | Select to indicate whether the funding stage should be post account opening. |

| Currency |

Displays the currency based on the Currency Allowed configured in the Common Configuration panel above. This field appears only if the Initial Funding toggle is enabled. |

| Minimum Amount |

Specify the minimum funding amount. This field appears only if the Initial Funding toggle is enabled. |

| Maximum Amount |

Specify the maximum funding amount. This field appears only if the Initial Funding toggle is enabled. |

| Offer Preferences |

This section captures the preferences of overdraft offers. This section appears only if the Overdraft Limit Allowed toggle is selected. |

| Offer Amendment | Select to indicate whether the offer is allowed to amend. |

| Offer Expiry Period |

Select the expiry period of an offer in days, months and years. Enter the count. OR Select the up and down arrow to increase or decrease the count. |

| Offer Acceptance Method |

Select the method to accept the offer. The available options are:

|

| Banking Channels Preferences | In this section you can capture the banking channel preferences for saving or current product. |

| Cheque Book | Select to indicate if cheque book is to be allowed for the account. |

| Banking Channels | Select to indicate if multiple banking channels are allowed for the account. |

| Channels Allowed |

Select the channels that are allowed to the account. The available options are:

|

| Passbook | Select to indicate if passbook is to be allowed for the account. |

| Debit Card | Select to indicate if debit card is to be allowed for the account. |

| Direct Banking | Select to indicate if direct banking is to be allowed for the account. |

| Phone Banking | Select to indicate if phone banking is to be allowed for the account. |

| Kiosk Banking | Select to indicate if Kiosk banking is to be allowed for the account. |

| TOD Allowed | Select to indicate if TOD is allowed for the account. |

| Against Uncleared Funds | Select to indicate if against uncleared funds is allowed for the account. |

| Overdraft Limit Allowed | Select to indicate if overdraft limit is allowed for the account. |

| Credit Decision Service Flags |

Select the Credit Decision Service Flags. The below flags appear only if Overdraft Limit Allowed toggle is selected. |

| Risk Based Pricing Applicable | Select the toggle if Risk based pricing is allowed for the loan accounts. |

| Application Based | Select the toggle if the scorecard calculation should be considered based on the application. |

| Primary Applicant Based | Select the toggle if the scorecard calculation should be considered based on the Primary applicant. |

- Click Next in Business Product Host Mapping screen to proceed with next data segment, after successfully capturing the data.

- Specify the details in the relevant data fields. The fields which are marked with Required are mandatory. For more information on fields, refer to the field description table.