1.3.3 Maintain ICCB Rule Master

This topic provides systematic instructions to maintain ICCB rule master.

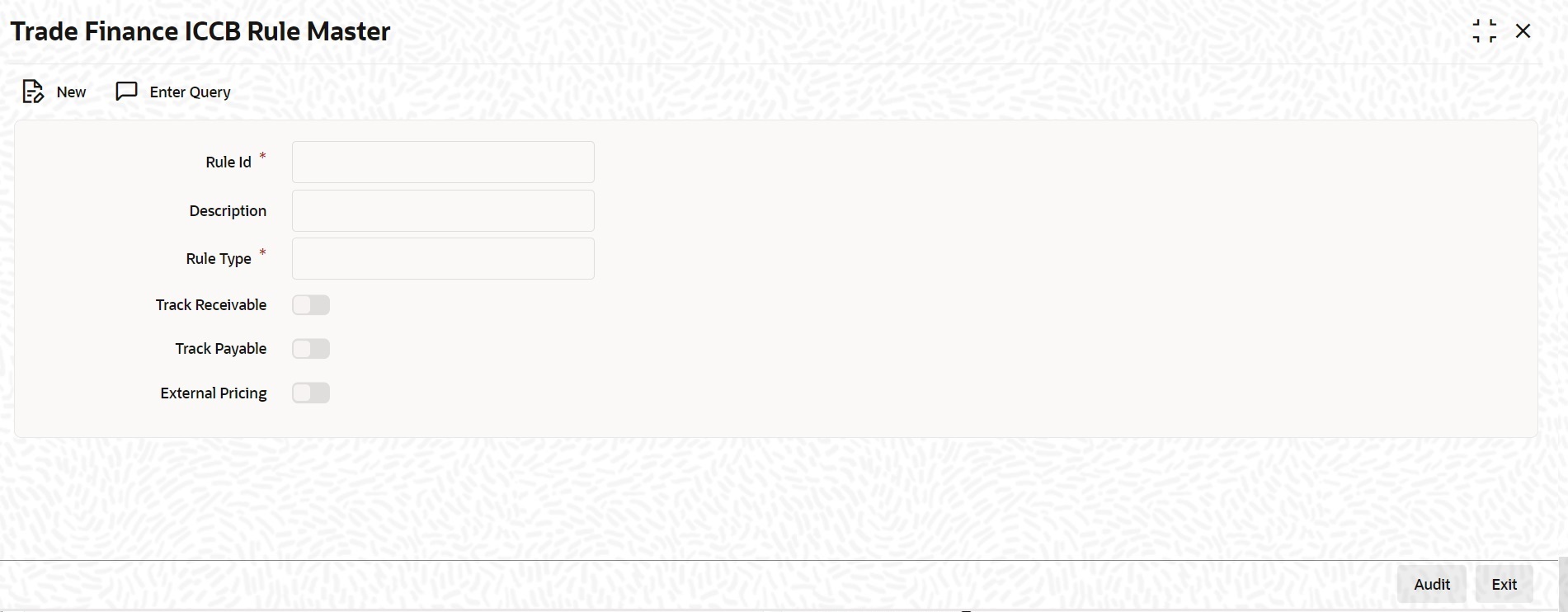

The Trade Finance ICCB Rule Master screen enables you to

define rule identification for rule types such as Interest, Charges/Fees and

Brokerage.

Specify User ID and Password, and login to Homepage.

- On Homepage, type CFDTFRUL in the text box, and click

next arrow.The Trade Finance ICCB Rule Master screen is displayed:

- On Trade Finance ICCB Rule Master screen, specify the

fields.For more information about the fields, refer to Table 1-3:

Table 1-3 Trade Finance ICCB Rule Master - Field Description

Field Description Rule Id Specify the Rule Id for the ICCB rule you are creating.

Description Specify the unique description for the Rule Id.

Rule Type Select the Rule Type from for the list. The drop-down list displays the following operators:

- Interest

- Commission

- Charges

- Brokerage

Track Receivable Check this box if the rule is eligible for receivable tracking.

User can configure whether the system should display an ERROR or an OVERRIDE message when outstanding Account Receivables exist during the specific lifecycle events of the contract operations.- If set to OVERRIDE, the system displays an override message allowing the user to proceed after acknowledgment.

- If set to ERROR, the system restricts further action until the AR is cleared.

Track Payable Check this box if the rule is eligible for payable tracking.

Note:- When a rule is linked at the product level, the system marks the Track Receivable and Track Payable for amount tags associated with the rule based on whether ‘Track Receivable’ and ‘Track Payable’ check boxes are checked.

- Netting is disallowed for amount tags marked for ‘Track Receivable’ or ‘Track Payable’.

External Pricing Check this box if the rule is eligible for External Pricing details.

Parent topic: Charge Rules