- Classes and Fees User Guide

- Create Classes

- Tax Class Maintenance

- Tax Class Maintenance

1.6.1 Tax Class Maintenance

This topic describes the systematic instructions to maintain the Tax Class.

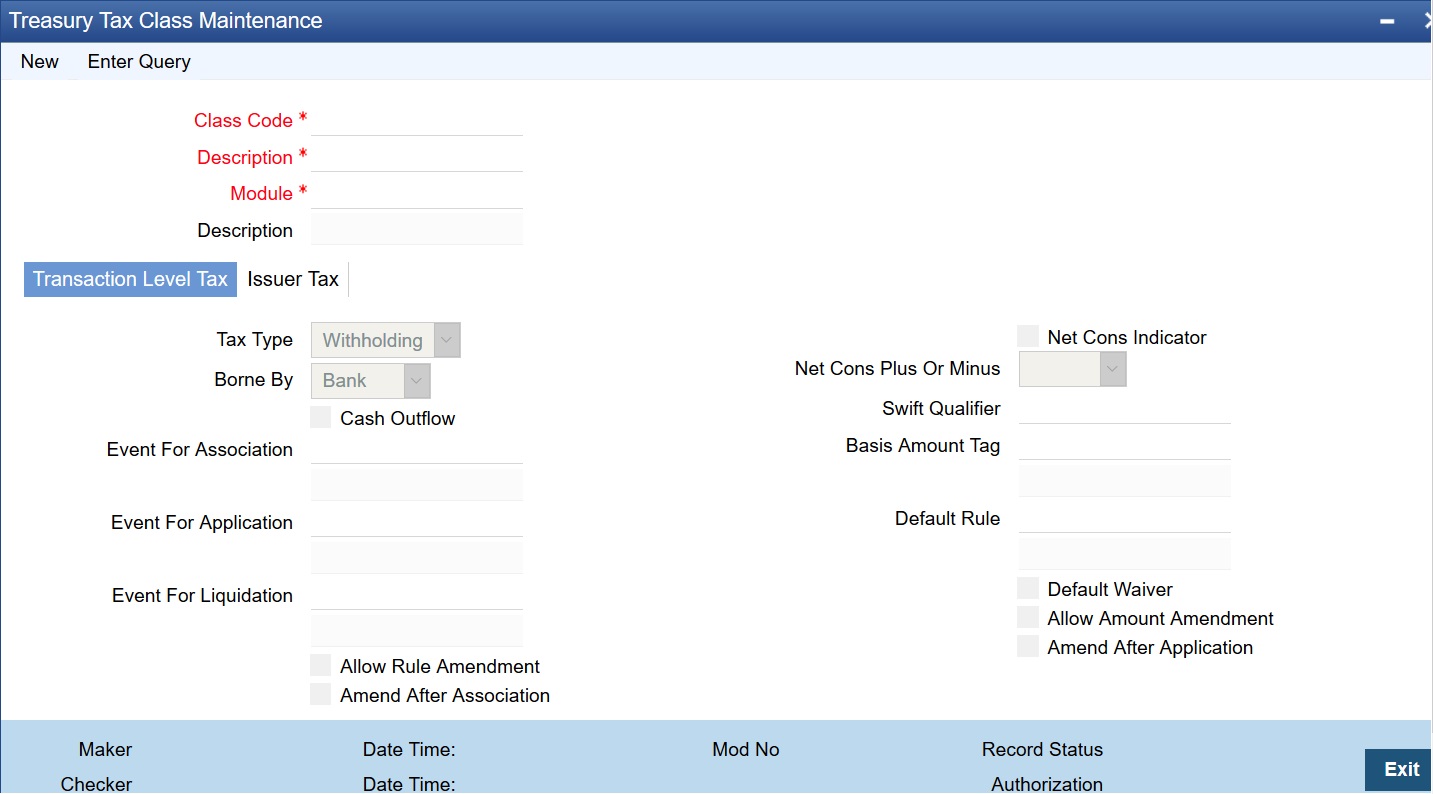

- On the Homepage, enter TADTRTXC in the text field and then click the next arrow.The Treasury Tax Class Maintenance screen is displayed.

- On the Treasury Tax Class Maintenance screen, specify the fields.For field details and description, refer to the below table.

Table 1-8 Treasury Tax Class Maintenance - Field Description

Field Description Class Code Specify a unique code to identify the class.

Description Specify a brief description for the class.

Module A tax class is built for use in a specific module. This is because the basis amounts on which the tax is applied could vary with the modules. In the Foreign Exchange module, for instance, you might want to levy tax on the brokerage paid. In the Securities module, you might have to pay a tax on the value of a security that you purchase. The basis on which the tax component is calculated is different in these two cases.Note:

The Basis Amount Tags available, in this screen, would depend on the module for which you build the class.Description The system displays description of the module.

Tax Type Select the Tax Type from the drop-down list. The available options are:- Withholding

- Others

Withholding type tax is borne by the beneficiary on an income (either the bank or the customer). For example, the tax on the brokerage paid would be borne by the broker. You withhold this component in a Tax Payable account, by debiting the customer account (since brokers are defined as Customers in Oracle Banking Treasury Management) and later paying the tax to the government on behalf of the broker.

Borne By Select the Borne by from the drop-down list. The available options are:- Bank

- Customer

Cash Outflow Select the Cash Outflow check box.

Event For Association Select the code of Event for Association from the displayed list of values.

Event For Application Select the code of Event for Application from the displayed list of values.

Event For Liquidation Select the code of Event for Liquidation from the displayed list of values.

Allow Rule Amendment Specify the event at which collection of the charge should be triggered, The adjoining option list displays all events available in the system for the module specified. You can choose the appropriate one.

Amend After Association Check this box to indicate that charge should be collected for dispatching the customer advice.

External Pricing Check this box to indicate that external charges can be fetched from external pricing and billing engine for contracts created under this product.

Debit Customer as part of Billing Check this box to indicate that the configured charge will be debited from customer account as part of billing feed from external pricing and billing engine.

Parent topic: Tax Class Maintenance