1.6.2 Define Issuer Taxes as Classes

This topic describes the systematic instruction to define issuer taxes as classes.

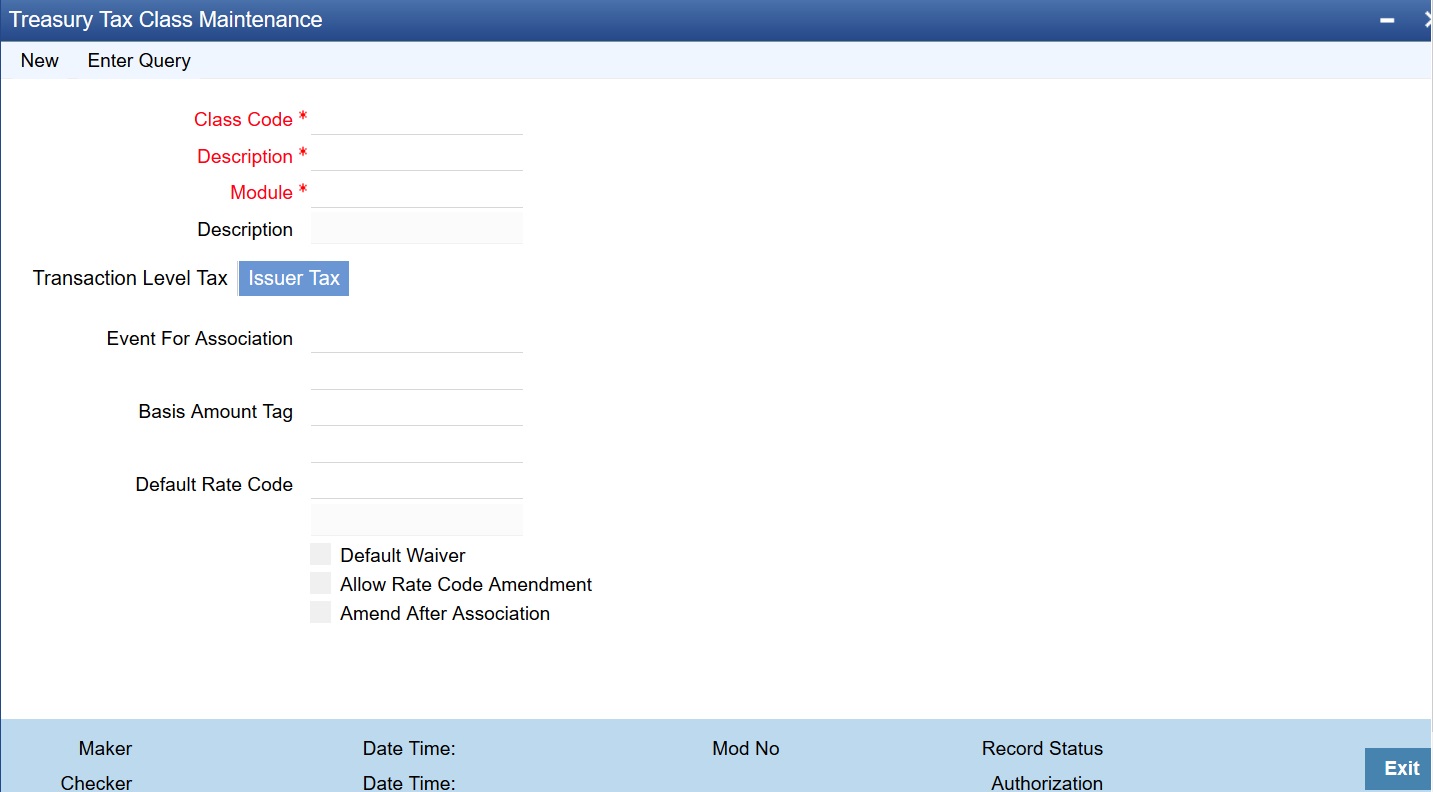

An issuer tax can be levied on the coupon paid, or on a cash dividend. The issuer of a security determines the tax. To process the tax levied on a security, you have to maintain Issuer Tax classes. An Issuer Tax class can be maintained in its corresponding section of the Tax Class Maintenance screen invoked from the Application Browser.

Note:

It is not necessary to associate tax rules to an Issuer Tax class. For an Issuer Tax component, you only have to furnish the following details:- The Association Event

- The Basis Amount

- The Rate Code

- Other operational controls

(Optional) Enter task prerequisites here.

Parent topic: Tax Class Maintenance