3.2.3 Collateral Agreement preferences

User can override some of the specific preferences for the Collateral Agreement at the contract level.

Click the Collateral button at the bottom of the Collateral-Netting screen to open this screen.

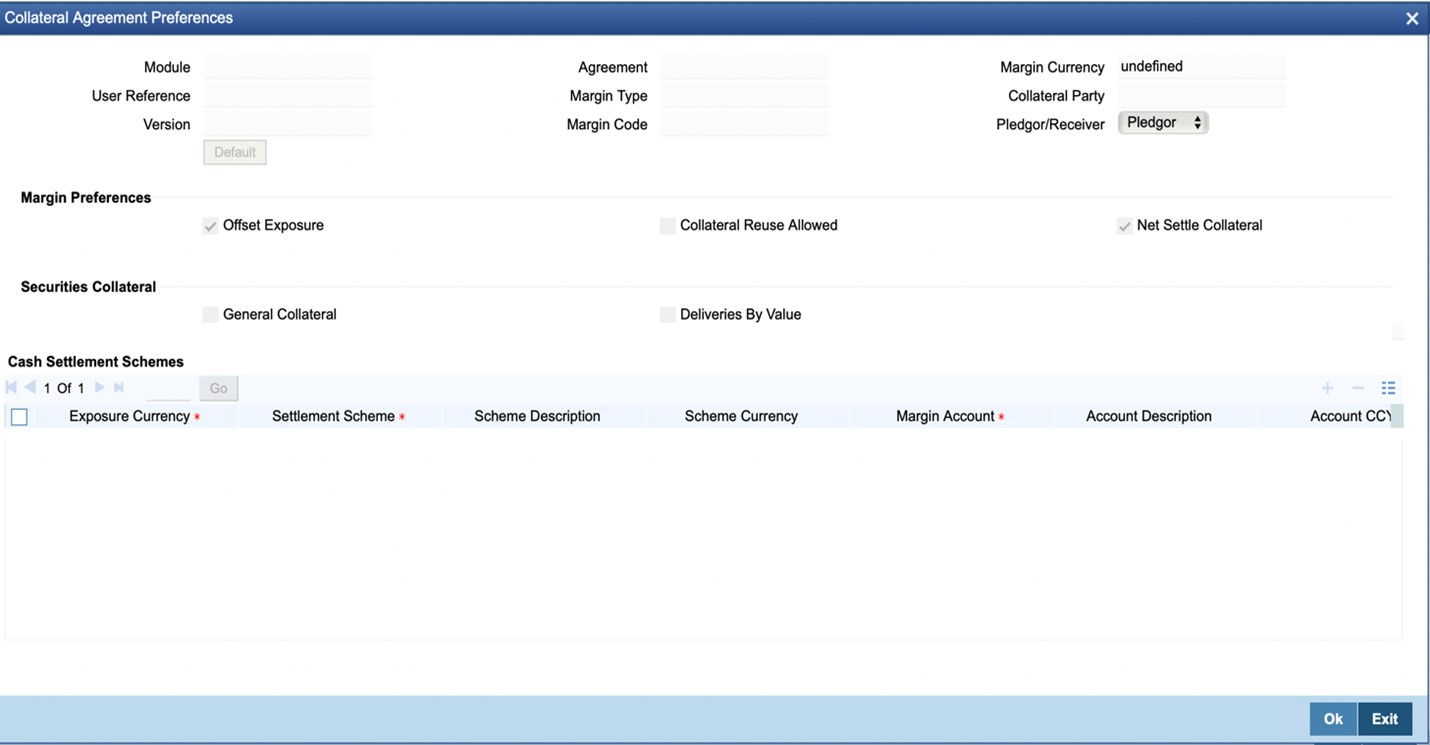

Figure 3-4 Collateral Agreement preferences

Description of "Figure 3-4 Collateral Agreement preferences"

The following table describes the fields captured for Collateral agreement preferences for a Contract.

* Indicates mandatory fields.

Table 3-5 Collateral Agreement preferences

| Field | Description |

|---|---|

|

Module |

Displays Treasury Module of the contract. |

|

User Reference |

Displays User Reference number of the Contract for which the Collateral-Netting preferences are being captured. |

|

Version |

Displays current Version of the contract. |

|

Agreement |

Displays the selected Agreement. |

|

Margin Type |

Displays the Margin type selected. |

|

Margin Code |

Displays the Margin code selected. |

|

Margin Currency |

Displays the margin currency selected. |

|

Collateral Party |

Displays the contract party of the agreement. |

|

Pledgor/Receiver |

Displays Pledgor/Receiver as selected in Linked Entities sub system for this contract. |

|

Margin Preferences |

Group of fields to capture the contract level overrides for the preferences to be used for collateral margining. |

|

Offset Exposure |

Indicate whether exposure of this contract can be offset against exposure of other transactions linked to the same agreement, to arrive at the net exposure for margin calculation purposes for this margin code.

|

|

Collateral Reuse Allowed |

Indicate whether the collateral exchanged for this contract can be reused for settling or repledging for other contracts booked by the receiver.

|

|

Net Settle Collateral |

Indicate whether the collateral exchanged for the contract is net settled with other components or with other contracts. |

|

Securities Collateral |

Group of fields to capture the contract level overrides for the preferences to be used for securities collateral provided. |

|

General Collateral |

Indicate whether the securities can be assigned from a general collateral pool of eligible securities provided by the pledgor, for this margin code

|

|

Deliveries By Value |

Indicate whether the securities can be assigned by the Triparty Agent/Third party from a general collateral pool of eligible securities provided by the pledgor, for this margin code

|

|

Cash Settlement Schemes |

Select the list of settlement schemes to be used for transferring cash collateral, for this margin code.

|

|

Exposure Currency |

Select the currency in which exposure is calculated for the contract for this margin code.

|

|

Settlement Scheme |

Select the settlement scheme through which the cash collateral is exchanged for the exposure in the selected exposure currency, for this margin code.

|

|

Scheme Description |

Displays the description of the Settlement scheme. |

|

Scheme Currency |

Displays the currency of the settlement scheme, in which the settlement happens.

|

|

Margin Account |

Select the cash margin account, linked to the selected settlement scheme, in which the cash collateral is tracked for the margin calculated in the account currency, for the exposure in the selected exposure currency, for this margin code

|

|

Account Description |

Displays the description of the cash margin account. |

|

Account Currency |

Displays the currency of the cash margin account, in which cash margin is tracked.

|

|

Account Type |

Displays the type of the cash margin account.

|

|

Default |

Indicate the default settlement scheme and margin account to be used, for the exposure calculated in currencies not setup separately. |

Click the Default button to populate the Cash Settlement Schemes in the selected agreement for the exposure currencies of this contract

Parent topic: Collateral-Netting details for a Contract