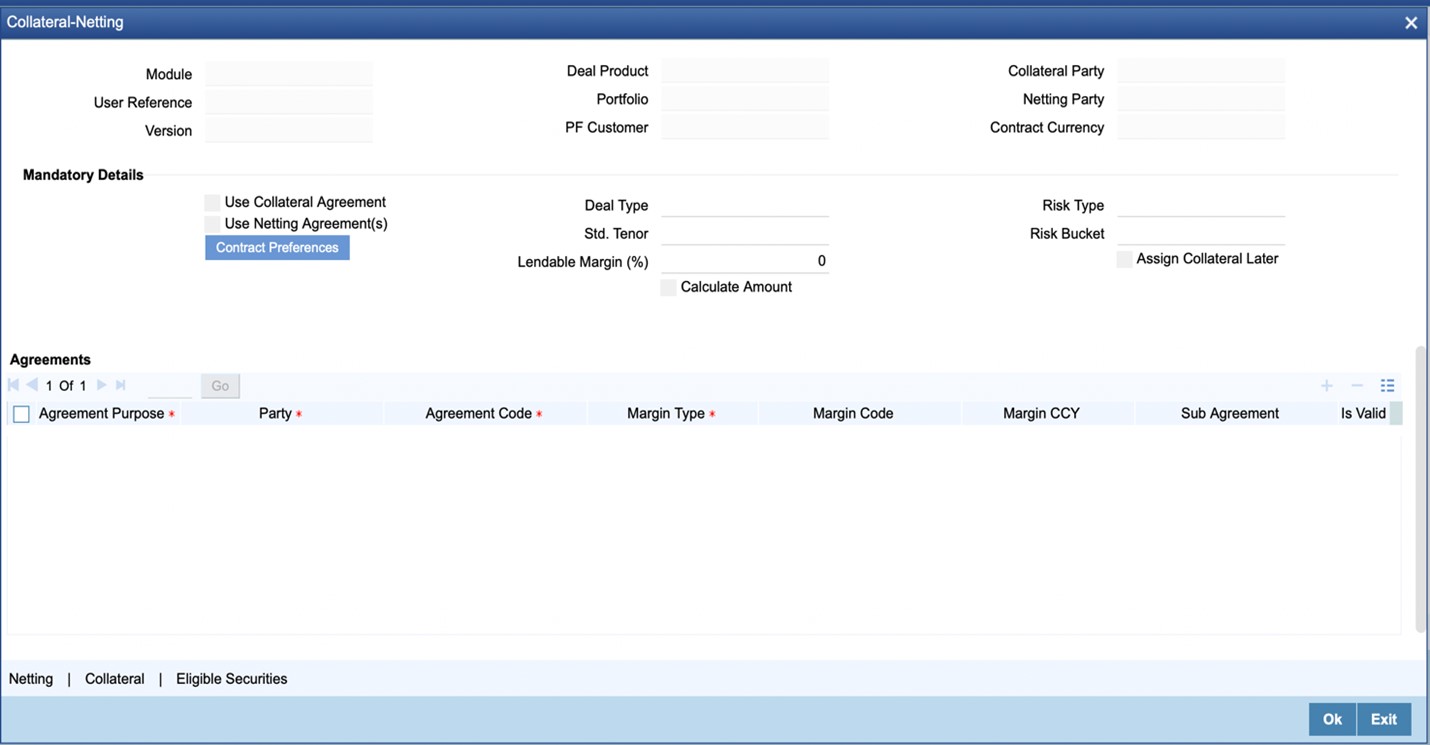

3.2 Collateral-Netting details for a Contract

This topic describes the collateral-netting details for a contract such as agreement applicable for the contract, netting agreement preferences, collateral agreement preferences, contract collateral and netting preferences, and collateral eligible securities for the contract.

While capturing the details for a contract, user can additionally capture the preferences for Collateral Margining and/or Settlement Netting, if applicable for the contract. These preferences can be captured individually for the contract if there are no existing agreements with the contract parties and the preferences are negotiated at the time of booking. Otherwise, agreements applicable for the contract are selected and only specific preferences were captured as override at the contract level.

The details that can be captured for Collateral-Netting include,

- Collateral and/or Netting Agreements applicable for the Contract

- Contract specific preferences for the Netting Agreement(s) selected

- Contract specific preferences for the Collateral Agreement selected

- Contract preferences for Collateral and Netting if there are no existing agreements

- List of securities eligible as collateral for the contract, if collateral is applicable and there are no existing agreements

Click the Collateral-Netting button at the bottom of the contract screen to open this screen.

The following table describes the fields captured for Collateral-Netting preferences for a Contract.

* Indicates mandatory fields.

Table 3-2 Collateral-Netting

| Field | Description |

|---|---|

|

Module |

Displays Treasury Module of the contract. |

|

User Reference |

Displays User Reference number of the Contract for which the Collateral-Netting preferences are being captured. |

|

Version |

Displays current Version of the contract. |

|

Deal Product |

Displays the Product selected for the contract. |

|

Portfolio |

Displays the Portfolio selected for the contract.

|

|

Portfolio Customer |

Displays Customer of the Portfolio selected for the contract, if applicable.

|

|

Collateral Party |

Displays the Party with whom the collateral is exchanged for the contract, as selected in the Linked Entities sub system. |

|

Netting Party |

Displays the Party with whom the main components of the contract is net settled, as selected in the Linked Entities sub system. |

|

Contract Currency |

Displays the Currency selected for the contract.

|

|

Use Collateral Agreement |

Indicate whether the contract use an existing agreement with the collateral party, for Collateral Margining. |

|

Use Netting Agreement(s) |

Indicate whether the contract use an existing agreements with the contract parties, for Settlement Netting. |

|

Deal Type |

Select the standard Deal Type applicable for the contract

|

|

Std. Tenor |

Select the Standard Tenor applicable for the contract

|

|

Lendable Margin (%) |

Enter the% of margin applicable for the contract.

|

|

Calculate Amount |

Indicate whether Contract Amount (borrowed/lent) is calculated based on the value of the collateral provided by applying the margin% entered.

|

|

Risk Type |

Select the Risk Type for the contract, if applicable

|

|

Risk Bucket |

Select the Risk Bucket for the contract, if applicable

|

|

Assign Collateral Later |

Indicate whether collateral details is captured during deal booking or later.

|