3.1 Linked Entities for a Contract

This topic describes the linked the entities for a contract.

While capturing the details for a contract, user can select any number of customers as Linked Entities for the contract. These are the parties that play different roles during the life cycle processing of the contract. These parties can be,

- the Actual customer with whom the contract was agreed, if the party selected as counterparty in the contract details is different for any specific reason

- a Trading or Execution Venue, in which the contract was executed

- a Clearing House, CCP or a Clearing broker, through whom the contract is cleared for the bank

- any Intermediary who is involved in the arrangement, execution or clearing of the contract

- any Intermediary who is involved in reporting or recording the contract for regulatory purposes

If Linked Entities for an existing contract are amended, the new value for the field amended is used only for the subsequent operations and events on this contract and will not be applied on the past events automatically. Any adjustments to the past events should be operationally handled.

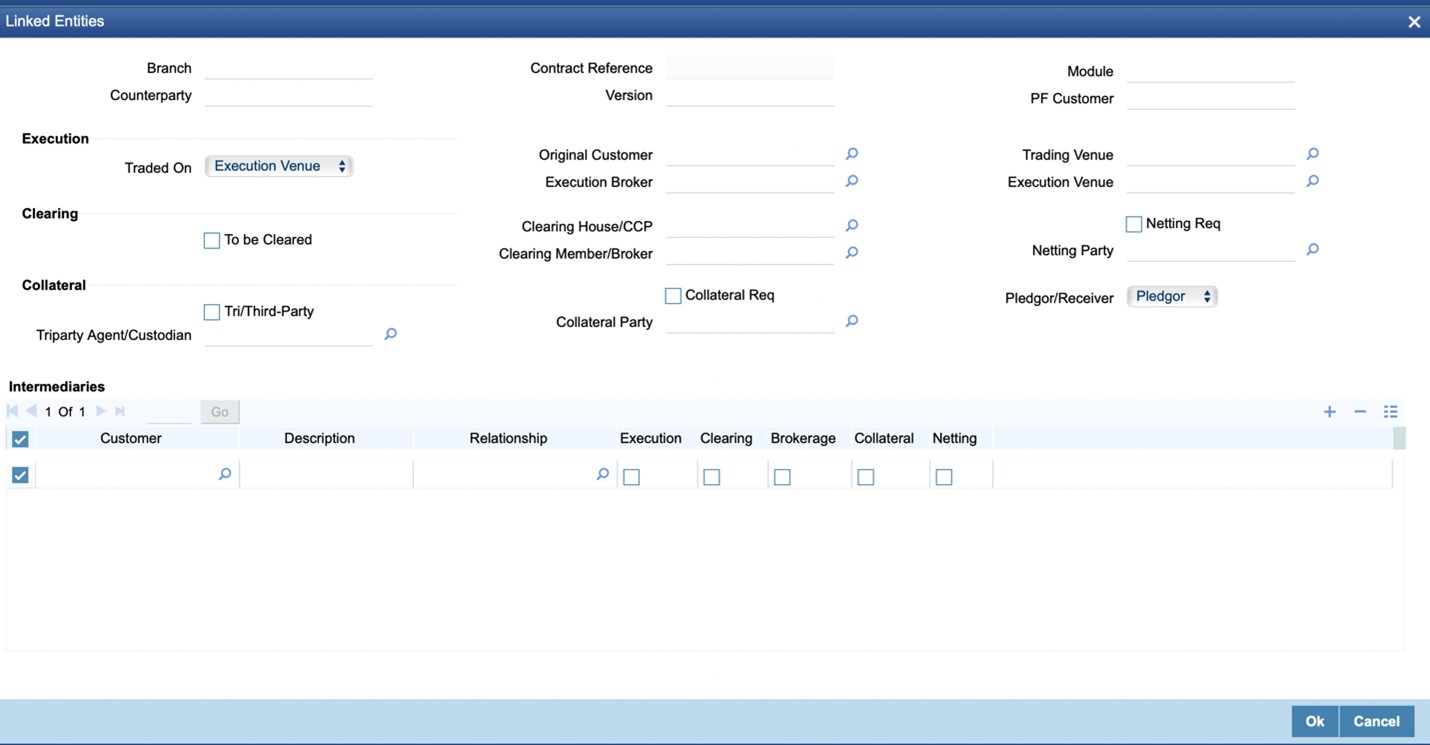

Click the Linked Entities button at the bottom of the contract screen to open this screen.

The following table describes the fields captured for Linked Entities for a Contract.

* Indicates mandatory fields.

Table 3-1 Linked Entities

| Field | Description |

|---|---|

|

Branch |

Displays the Branch in which contract is booked. |

|

Counterparty |

Displays Counterparty selected for the contract, in the main contract details.

|

|

User Reference |

Displays User Reference number of the Contract for which the Linked Entities are being captured. |

|

Version |

Displays current Version of the contract. |

|

Module |

Displays Treasury Module of the contract. |

|

Portfolio Customer |

Displays Customer of the Portfolio selected for the contract, if applicable.

|

|

Execution |

Group of fields to capture the main parties involved in the execution of the contract. |

|

Traded On |

Select the type of the contract, based on where the contract is traded.

|

|

Original Customer |

Select the actual customer for the contract, for/with whom this contract was executed.

|

|

Execution Broker |

Select the broker, who executes the contract on behalf of the Bank, if applicable.

|

|

Trading Venue |

Select the venue through which the contract was executed, if applicable.

|

|

Execution Venue |

Select the Regulated Exchange in which the contract was finally executed, if applicable

|

|

Clearing |

Group of fields to capture the main parties involved in the clearing of the contract. |

|

To be Cleared |

Indicate whether the contract is cleared through a Third party, if applicable.

|

|

Clearing House/CCP |

Select the Clearing House/CCP through which the contract is cleared, if applicable.

|

|

Clearing Member/Broker |

Select the broker, who clears the contract on behalf of the Bank, if applicable.

|

|

Netting Required |

Indicate whether any components of the contract is Net settled with other contracts, if applicable.

|

|

Netting Party |

Select the party with whom the main components of the contract is net settled.

|

|

Collateral |

Group of fields to capture the main parties involved in exchanging collateral for the contract. |

|

Tri/Third-Party |

Indicate whether a Triparty Agent or a Third-Party is used for holding the collateral for the contract. |

|

Triparty Agent/Custodian |

Select the Triparty Agent or Third-Party custodian, if applicable, who is holding the collateral for the contract.

|

|

Collateral Required |

Indicate whether collateral is exchanged for this contract, if applicable.

|

|

Collateral Party |

Select the Party with whom the collateral is exchanged for the contract.

|

|

Pledgor / Receiver |

Indicate whether the Bank is the Collateral Provider (Pledgor) or Receiver for the contract.

|

|

Intermediaries |

Group of fields to capture the other intermediaries involved in processing the contract.

|

|

Customer |

Select any other Intermediary linked to the contract.

|

|

Description |

Displays description of the Customer selected. |

|

Relationship |

Select the role played by this Intermediary for the contract.

|

|

Execution |

Indicate whether this Intermediary is involved in the execution of the contract.

|

|

Clearing |

Indicate whether this Intermediary is involved in the clearing the contract.

|

|

Brokerage / Charge |

Indicate whether Brokerage or any other Charges are to be paid to this Intermediary.

|

|

Collateral |

Indicate whether collateral is exchanged with this Intermediary for this contract.

|

|

Netting |

Indicate whether netting is applicable for the components to be settled with this intermediary.

|

Parent topic: Collateral and Netting Preferences for the Contract